- United States

- /

- Telecom Services and Carriers

- /

- NYSE:LUMN

Lumen Technologies (NYSE:LUMN) Is Due To Pay A Dividend Of US$0.25

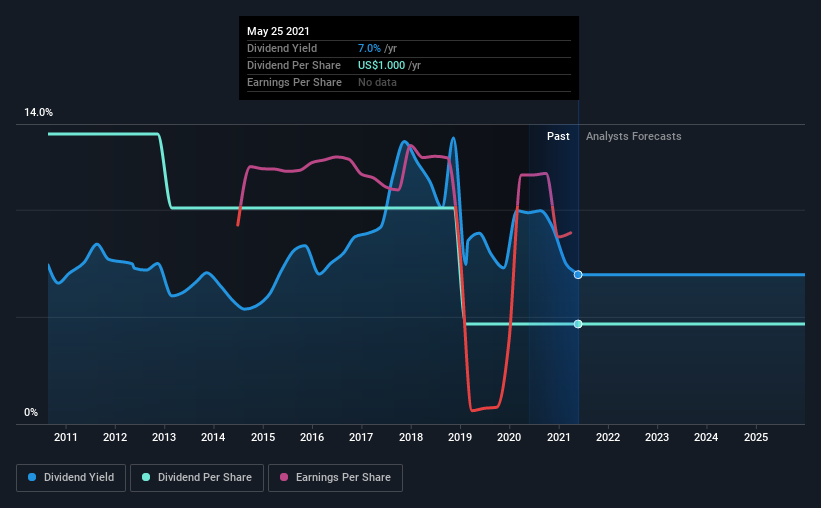

Lumen Technologies, Inc. (NYSE:LUMN) will pay a dividend of US$0.25 on the 11th of June. This means the annual payment is 7.0% of the current stock price, which is above the average for the industry.

View our latest analysis for Lumen Technologies

Lumen Technologies' Distributions May Be Difficult To Sustain

If the payments aren't sustainable, a high yield for a few years won't matter that much. Even though Lumen Technologies isn't generating a profit, it is generating healthy free cash flows that easily cover the dividend. This gives us some comfort about the level of the dividend payments.

Recent, EPS has fallen by 36.1%, so this could continue over the next year. This means that the company won't turn a profit over the next year, but with healthy cash flows at the moment the dividend could still be okay to continue.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. The dividend has gone from US$2.90 in 2011 to the most recent annual payment of US$1.00. The dividend has fallen 66% over that period. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

Dividend Growth Potential Is Shaky

Dividends have been going in the wrong direction, so we definitely want to see a different trend in the earnings per share. Lumen Technologies' earnings per share has shrunk at 36% a year over the past five years. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough.

Lumen Technologies' Dividend Doesn't Look Sustainable

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Lumen Technologies' payments, as there could be some issues with sustaining them into the future. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. This company is not in the top tier of income providing stocks.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. For example, we've identified 3 warning signs for Lumen Technologies (1 is concerning!) that you should be aware of before investing. We have also put together a list of global stocks with a solid dividend.

If you’re looking to trade Lumen Technologies, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:LUMN

Lumen Technologies

A facilities-based technology and communications company, provides various integrated products and services to business and residential customers in the United States and internationally.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives