- United States

- /

- Telecom Services and Carriers

- /

- NYSE:LUMN

Lumen Technologies (LUMN): Assessing Valuation After Consumer Fiber Sale and Shift Toward Enterprise AI Services

Reviewed by Kshitija Bhandaru

Lumen Technologies (LUMN) has announced the sale of its remaining consumer fiber network to AT&T, highlighting a shift to enterprise-focused services. At the same time, the company is expanding its fiber network and incorporating artificial intelligence capabilities.

See our latest analysis for Lumen Technologies.

This strategic pivot has played out alongside steady market moves, as Lumen's 1-year total shareholder return has been essentially flat. This reflects both the challenges of its transition and investor caution. The latest news signals momentum is building around enterprise growth as the company modernizes its network and streamlines operations.

If you're on the lookout for fresh growth stories in tech and AI, now is the perfect time to explore See the full list for free.

With Lumen Technologies streamlining its business and investing in next-generation networks, the question now is whether the stock is actually undervalued or if the market has already priced in these growth prospects. Could this present a true buying opportunity?

Most Popular Narrative: 37.7% Overvalued

Against the last close price of $7.16, the most followed narrative sets Lumen Technologies' fair value much lower. This highlights a wide gap between current trading levels and the narrative's calculated intrinsic worth, setting the scene for a perspective that sees market optimism outpacing near-term fundamentals.

Strategic refinancing, deleveraging, and the pending sale of the consumer fiber-to-the-home business to AT&T will materially strengthen Lumen's balance sheet, reduce interest expense by $300 to $400 million annually, and free up capital for enterprise-focused growth initiatives, directly impacting future net earnings and free cash flow.

Want to know what bold assumptions get baked into this pessimistic calculation? The narrative leans heavily on big shifts in profit margins and future revenue. Which financial levers push the fair value this far from the market price? Find out what’s really driving this valuation; the details may surprise you.

Result: Fair Value of $5.20 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent declines in legacy revenues and heavy dependence on a small number of enterprise clients could challenge Lumen's long-term turnaround story.

Find out about the key risks to this Lumen Technologies narrative.

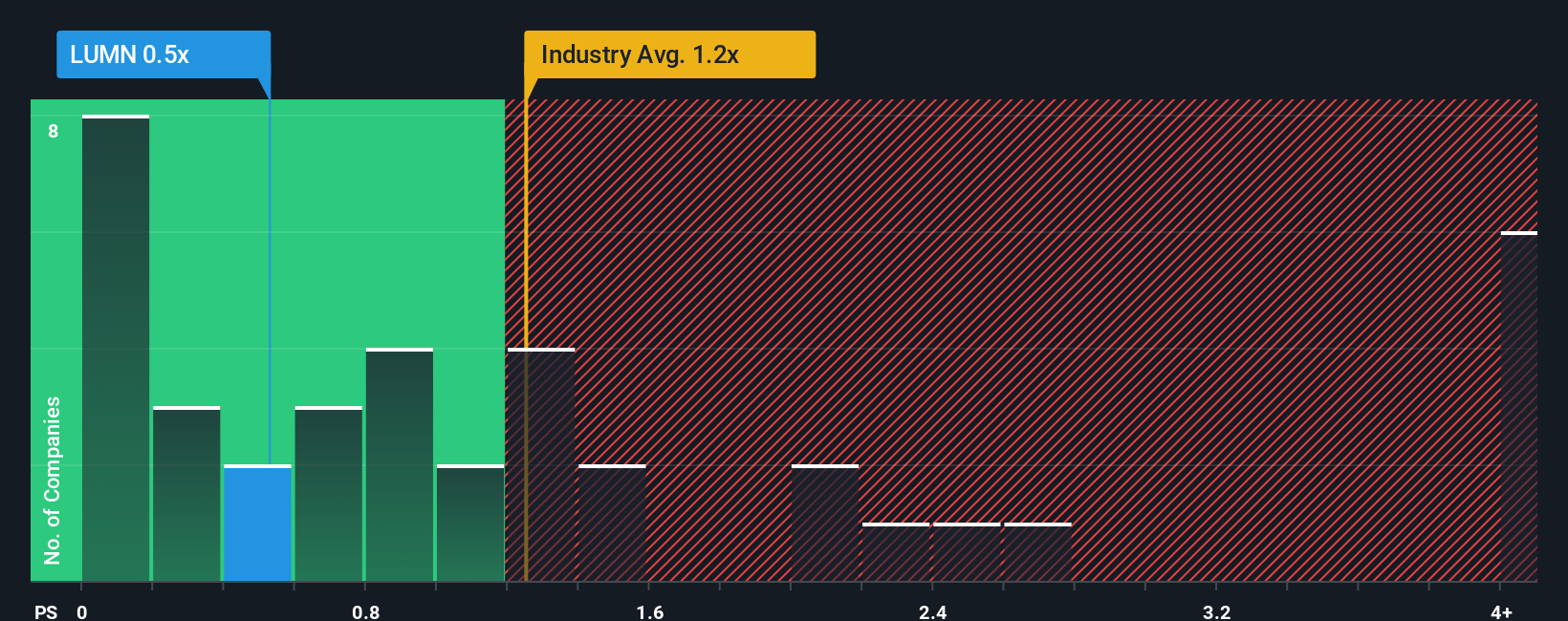

Another View: Peer and Industry Value Signals

Looking from a different perspective, Lumen Technologies’ price-to-sales ratio of 0.6x is considerably lower than both the US Telecom industry average (1.3x) and the peer group average (6.1x). This wide discount suggests investors see extra risk, but it may also hint at overlooked value. If the market re-rates Lumen closer to the sector’s fair ratio of 1x, there could be more upside than the pessimistic narrative suggests. Could Lumen’s strategic pivots lead to a revaluation, or are the market’s reservations justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lumen Technologies Narrative

If you think there's another angle to Lumen Technologies’ story or you’d rather dig into the numbers firsthand, crafting your own outlook takes just a few minutes. Do it your way

A great starting point for your Lumen Technologies research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Seize the chance to boost your portfolio by checking out stocks that could outperform, offer diversification, or align with next-big-thing trends investors are talking about.

- Unlock growth with these 25 AI penny stocks, making headlines for advancements in smart automation, predictive analytics, and future-ready digital infrastructure.

- Capture potential income streams by targeting market leaders highlighted in these 19 dividend stocks with yields > 3%, ensuring your investments can work harder for you with high-yield returns.

- Ride the innovation wave by investing in these 26 quantum computing stocks, where breakthroughs in computation and security are set to transform entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LUMN

Lumen Technologies

A networking company, provides integrated products and services to business and mass customers in the United States and internationally.

Fair value with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives