Will IHS's (IHS) Expanded TIM S.A. Partnership Reshape Its Telecom Infrastructure Growth Story?

Reviewed by Sasha Jovanovic

- IHS Brazil recently announced it has signed a new site agreement with TIM S.A., aiming to build up to 3,000 telecom sites across multiple Brazilian regions, with an initial deployment of 500 sites, further extending their partnership first established in 2020.

- This collaboration highlights IHS's role in Brazil's communications infrastructure expansion, emphasizing the importance of partnerships for scaling connectivity in fast-growing markets.

- We'll explore how the expanded TIM S.A. partnership could accelerate IHS's infrastructure rollout and influence its long-term growth prospects.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

IHS Holding Investment Narrative Recap

Shareholders in IHS Holding need to believe that fast-growing demand for mobile data and network densification, especially in emerging markets like Brazil, will continue to drive tower deployments and long-term organic revenue growth. The newly expanded agreement with TIM S.A. in Brazil may help power near-term infrastructure rollouts, but it doesn't fundamentally change the biggest short-term catalyst, carrier investment in next-gen wireless networks, or reduce the major risk of elevated customer concentration.

Among recent announcements, IHS's upgraded 2025 earnings guidance, following improved profitability in Q2 and a return to net income, stands out as especially relevant. While this improved outlook aligns with ongoing infrastructure agreements, it remains sensitive to any revenue disruptions from major customers, underscoring the catalyzing effect of carrier investment while highlighting the concentration risk investors track closely.

However, for all the promise of expansion, investors should be aware that heavy reliance on a few telecom operators leaves IHS exposed if...

Read the full narrative on IHS Holding (it's free!)

IHS Holding's outlook anticipates $2.0 billion in revenue and $268.3 million in earnings by 2028. This projection is based on a 4.1% annual revenue growth rate and a $157.4 million increase in earnings from the current $110.9 million level.

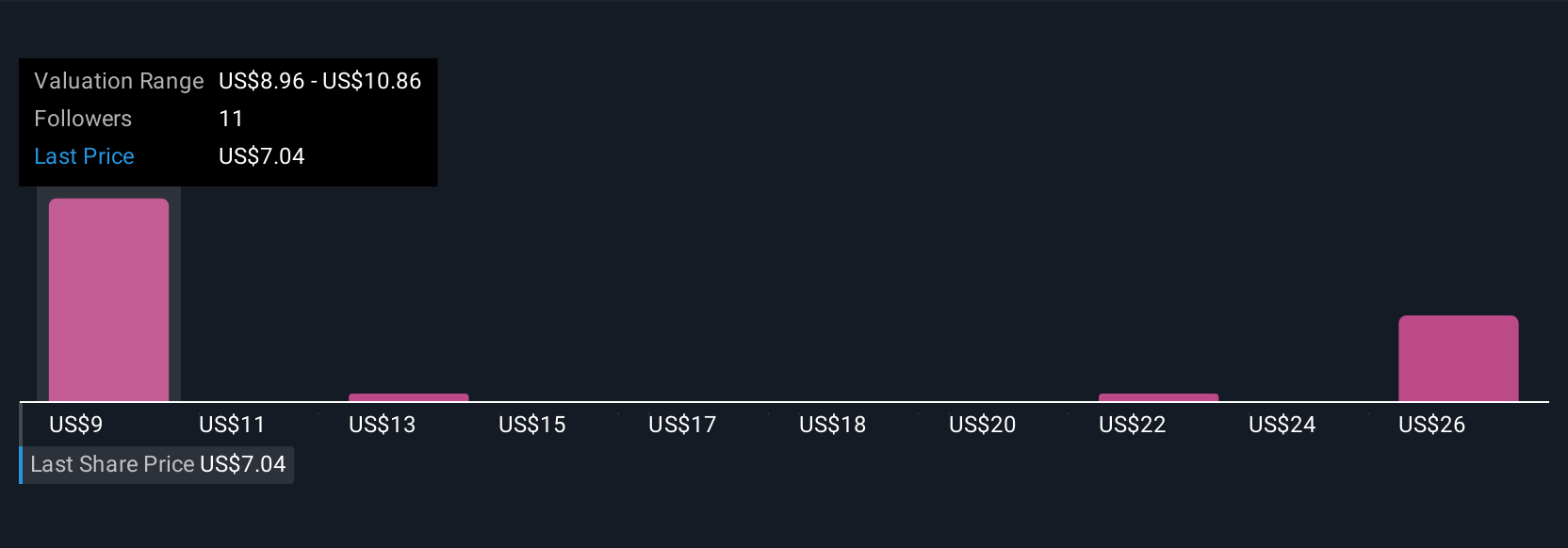

Uncover how IHS Holding's forecasts yield a $9.66 fair value, a 41% upside to its current price.

Exploring Other Perspectives

Six different Simply Wall St Community fair value estimates for IHS range from US$9.66 to US$25.73 per share. With carrier investment in advanced networks as a key catalyst, consider multiple viewpoints before forming your outlook.

Explore 6 other fair value estimates on IHS Holding - why the stock might be worth just $9.66!

Build Your Own IHS Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IHS Holding research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free IHS Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IHS Holding's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IHS

IHS Holding

Develops, owns, and operates shared communications infrastructure in Nigeria, Sub-Saharan Africa, the Middle East and North Africa, and Latin America.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives