Loss-making IHS Holding (NYSE:IHS) has seen earnings and shareholder returns follow the same downward trajectory over past -17%

Over the last month the IHS Holding Limited (NYSE:IHS) has been much stronger than before, rebounding by 32%. But that doesn't change the reality of under-performance over the last twelve months. In fact, the price has declined 17% in a year, falling short of the returns you could get by investing in an index fund.

Although the past week has been more reassuring for shareholders, they're still in the red over the last year, so let's see if the underlying business has been responsible for the decline.

Check out our latest analysis for IHS Holding

SWOT Analysis for IHS Holding

- Debt is well covered by cash flow.

- Interest payments on debt are not well covered.

- Expected to breakeven next year.

- Has sufficient cash runway for more than 3 years based on current free cash flows.

- Trading below our estimate of fair value by more than 20%.

- No apparent threats visible for IHS.

Because IHS Holding made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last twelve months, IHS Holding increased its revenue by 24%. That's definitely a respectable growth rate. Unfortunately that wasn't good enough to stop the share price dropping 17%. This implies the market was expecting better growth. But if revenue keeps growing, then at a certain point the share price would likely follow.

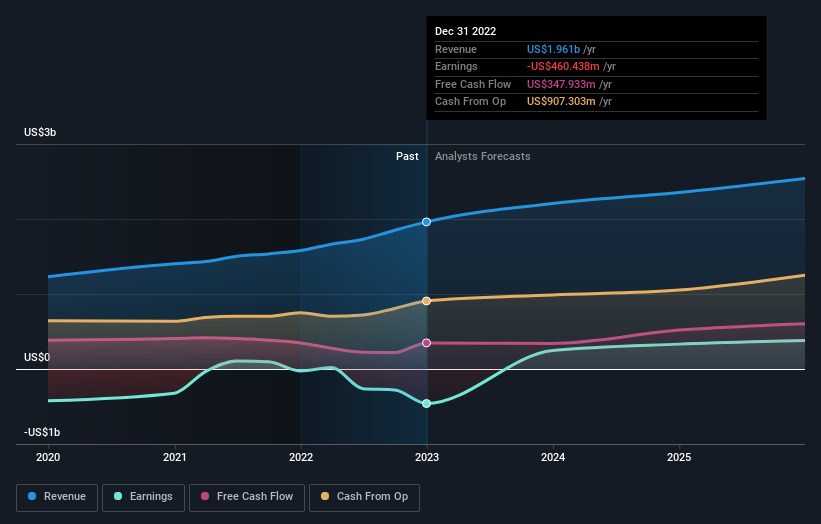

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on IHS Holding's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We doubt IHS Holding shareholders are happy with the loss of 17% over twelve months. That falls short of the market, which lost 3.6%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. It's great to see a nice little 20% rebound in the last three months. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). You could get a better understanding of IHS Holding's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

If you're looking to trade IHS Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:IHS

IHS Holding

Develops, owns, and operates shared communications infrastructure in Nigeria, Sub-Saharan Africa, the Middle East and North Africa, and Latin America.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives