- United States

- /

- Wireless Telecom

- /

- NasdaqCM:VEON

Will VEON (VEON) Team Consolidation in Almaty Boost Its Digital Transformation Ambitions?

Reviewed by Simply Wall St

- Earlier this week, VEON Ltd. inaugurated Beeline Kazakhstan's new headquarters in Almaty, bringing together 500 professionals across telecom, AI, and digital services under one roof to strengthen collaboration and innovation efforts.

- This consolidation of VEON and QazCode talent is intended to accelerate Kazakhstan's digital transformation and support the national Digital Kazakhstan strategy through the integrated delivery of new products and customer experiences.

- We’ll explore how the unification of VEON’s teams in Almaty could influence its future growth prospects and digital transformation ambitions.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

VEON Investment Narrative Recap

To invest in VEON, you have to believe in its ability to expand digital services in high-growth emerging markets while managing significant geopolitical and operational risks, especially in regions like Kazakhstan and Ukraine. The consolidation of VEON and QazCode teams in Almaty is a visible step toward accelerating digital transformation in Kazakhstan, but this news does not appear to materially impact the biggest near-term catalyst, growth in digital revenues, or the most pressing risk, which remains exposure to macroeconomic instability in several operating regions.

The introduction of the AI Tutor by Beeline Kazakhstan and QazCode earlier this year directly connects to the push for digital innovation, reflecting VEON’s intention to boost digital product development in Kazakhstan, an area that investors are watching as a key source of future revenue growth.

Yet, despite these advances in Kazakhstan, investors should be acutely aware of the contrasting macro risks faced elsewhere, particularly relating to...

Read the full narrative on VEON (it's free!)

VEON's narrative projects $4.9 billion in revenue and $631.7 million in earnings by 2028. This requires 6.2% yearly revenue growth and a $174.7 million increase in earnings from $457.0 million today.

Uncover how VEON's forecasts yield a $64.70 fair value, a 16% upside to its current price.

Exploring Other Perspectives

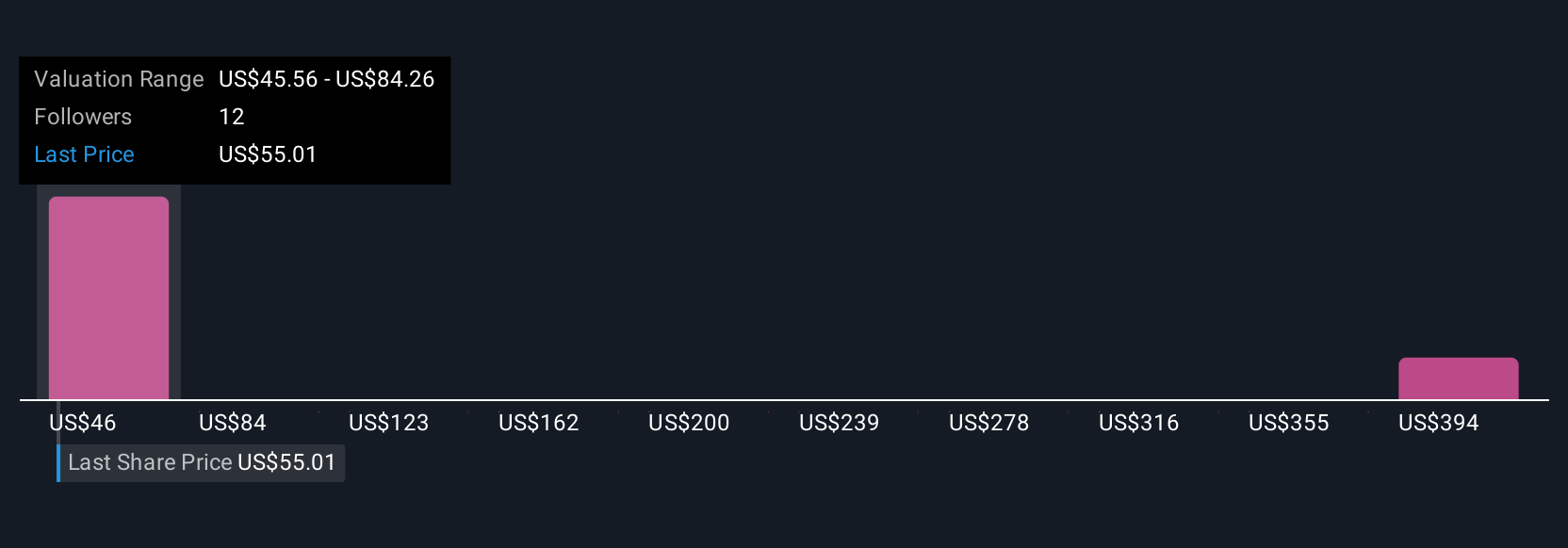

Simply Wall St Community members provided four unique fair value estimates for VEON, from US$45.56 to US$443.73 per share. Although optimism around digital revenue growth remains a central catalyst, sharply differing opinions reveal just how much investor perspectives on future performance can vary.

Explore 4 other fair value estimates on VEON - why the stock might be worth 19% less than the current price!

Build Your Own VEON Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your VEON research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free VEON research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate VEON's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:VEON

VEON

A digital operator, provides telecommunications and digital services to corporate and individual customers in Pakistan, Ukraine, Kazakhstan, Uzbekistan, and Bangladesh.

Very undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives