- United States

- /

- Wireless Telecom

- /

- NasdaqCM:VEON

How Kyivstar’s Special Update Call Is Shaping the VEON (VEON) Investment Narrative

Reviewed by Simply Wall St

- On August 28, 2025, VEON announced a special call to provide updates on Kyivstar’s strategic initiatives, financial performance, and market outlook for investors and stakeholders.

- This announcement suggests heightened attention on Kyivstar’s role within VEON, underscoring its significance as a growth and value driver for the wider group.

- We'll examine how investor anticipation around Kyivstar’s financial outlook and strategy may influence VEON’s overall investment case.

AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

VEON Investment Narrative Recap

VEON’s investment case hinges on the ability to deliver sustainable growth in emerging markets, driven by digital transformation and the performance of core assets like Kyivstar. The August 28 special call signals renewed focus on Kyivstar, giving investors added insight into this major revenue driver, but current information suggests the event does not materially alter the near-term catalyst, digital service growth, or the biggest risk, which remains exposure to macroeconomic and currency volatility.

Recent progress in Kyivstar’s satellite integration with Starlink (announced August 12) is highly relevant, as it could support user acquisition and ARPU uplift in Ukraine, benefiting VEON’s digital and connectivity ambitions. This expansion aligns with the key catalyst of leveraging advanced technology to improve ARPU and diversify revenue, especially as Kyivstar’s performance becomes increasingly central to group-level growth narratives.

By contrast, ongoing macroeconomic and currency risks in core markets present issues investors should be aware of, especially if...

Read the full narrative on VEON (it's free!)

VEON's outlook projects $5.0 billion in revenue and $688.2 million in earnings by 2028. This is based on a 6.7% annual revenue growth rate and a $295.8 million decrease in earnings from the current level of $984.0 million.

Uncover how VEON's forecasts yield a $69.64 fair value, a 26% upside to its current price.

Exploring Other Perspectives

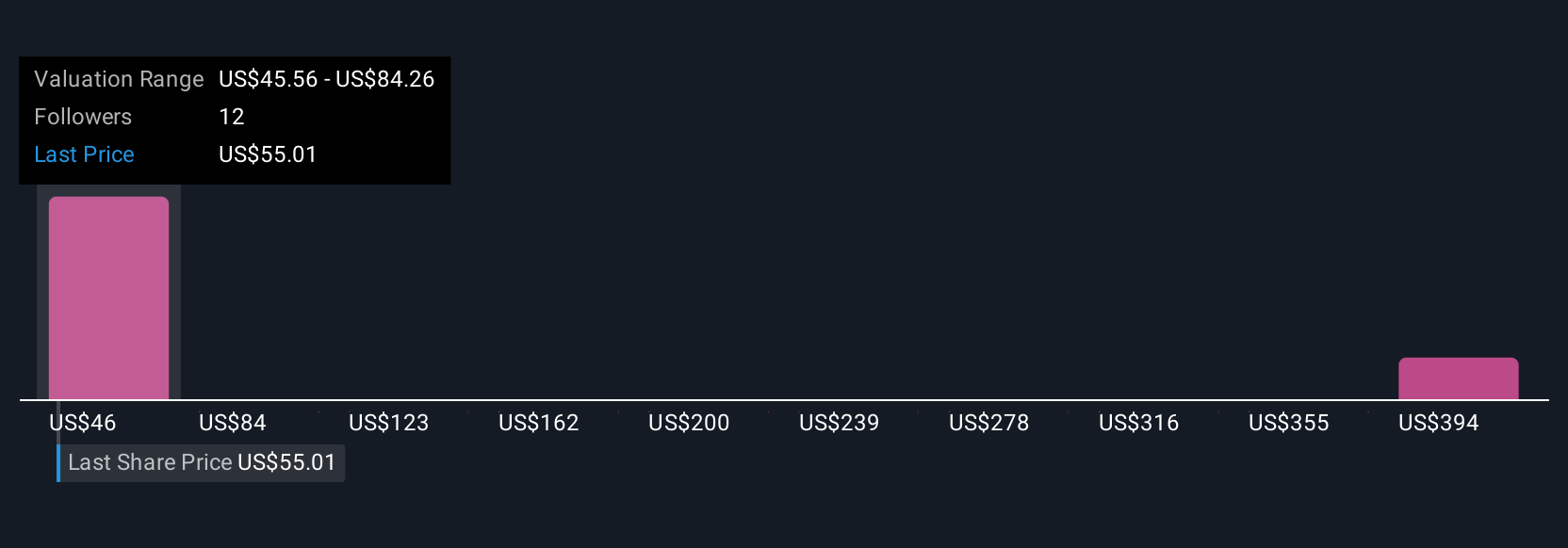

Simply Wall St Community members estimate VEON’s fair value between US$45.56 and US$438.55, with four diverse viewpoints. While digital service expansion stands out as a possible catalyst, be aware that macroeconomic and currency swings may still influence broader business outcomes.

Explore 4 other fair value estimates on VEON - why the stock might be worth over 7x more than the current price!

Build Your Own VEON Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your VEON research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

- Our free VEON research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate VEON's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:VEON

VEON

A digital operator, provides telecommunications and digital services to corporate and individual customers in Pakistan, Ukraine, Kazakhstan, Uzbekistan, and Bangladesh.

Very undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives