- United States

- /

- Wireless Telecom

- /

- NasdaqGS:TMUS

T-Mobile US (TMUS) Secures Multi-Year MVNO Deal With Charter And Comcast

Reviewed by Simply Wall St

The recent development involving Charter and Comcast entering a multi-year exclusive agreement with T-Mobile US (TMUS) forms a long-term MVNO partnership, strengthening TMUS's network leverage and may have had a positive impact on the stock price. Alongside, the MLB All-Star Week promotion and Samsung device rollout could have further influenced sentiment. The company's stock rose by 5% over the past month, a movement aligned with broader market trends, as the S&P 500 hit new highs. These factors potentially added weight to T-Mobile's upward momentum during a period marked by trade deal optimism and robust earnings expectations.

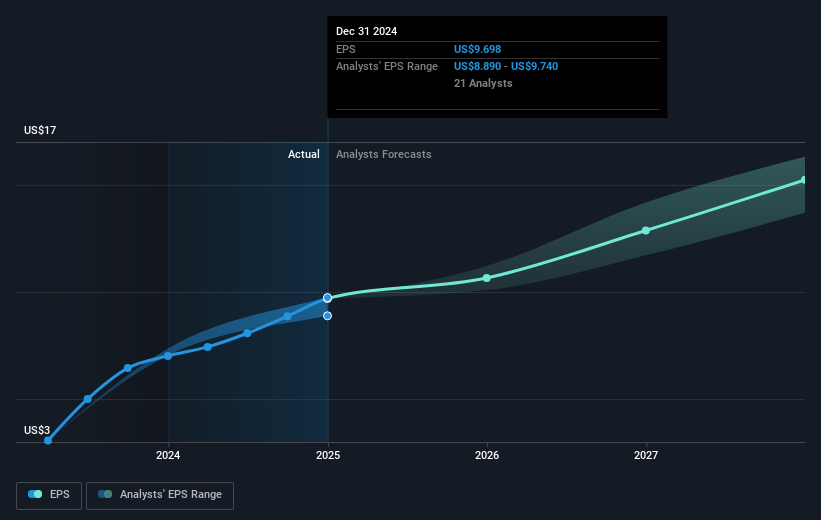

The recent multi-year agreement between Charter, Comcast, and T-Mobile US is likely to enhance T-Mobile's network leverage, potentially influencing its long-term revenue and earnings positively. This development, coupled with the recent promotional activities, strengthens T-Mobile's position, aligning with its narrative of expansion through 5G and fiber growth. Over the past five years, T-Mobile's total shareholder return, including both share price appreciation and dividends, reached 129.05%, demonstrating robust performance compared to a 14.6% increase in the U.S. market over the past year. Despite this longer-term strength, the company underperformed the U.S. Wireless Telecom industry in the last year, which saw a 33.8% increase.

The introduction of new agreements and product rollouts may push projections for future earnings and revenues upwards, but potential risks from tariffs or competitor strategies remain. The current share price of $233.25 is below the consensus analysts' price target of $266.08, reflecting a discount of approximately 14%. This suggests that there might be room for upward adjustment in line with analysts' expectations if growth catalysts are realized successfully. Investors are encouraged to consider these forecasts in the context of T-Mobile’s ongoing strategic initiatives and market conditions.

Learn about T-Mobile US' future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if T-Mobile US might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TMUS

T-Mobile US

Provides wireless communications services in the United States, Puerto Rico, and the United States Virgin Islands.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives