- United States

- /

- Wireless Telecom

- /

- NasdaqGS:TMUS

T-Mobile (TMUS): Fresh Satellite Expansion and CEO Transition—How Is the Stock Valued Now?

Reviewed by Kshitija Bhandaru

T-Mobile US is stepping up its game in wireless connectivity with the expansion of its T-Satellite service, powered by Starlink. The service now supports app-based satellite data on smartphones. This move arrives as Verizon pursues its own satellite network development.

See our latest analysis for T-Mobile US.

T-Mobile’s rollout of app-based satellite connectivity comes as the company’s year-to-date share price return sits at 4.2%, while its one-year total shareholder return is a solid 7.5%. Recent headlines include both major fixed-income offerings and a leadership transition, as Srini Gopalan prepares to take over as CEO. Investors will note the long-term momentum, with a three-year total shareholder return above 76%, which suggests confidence in the company’s growth prospects as it continues to invest in next-generation wireless services.

If these advances in connectivity have you wondering which other innovators are worth a look, now is an ideal moment to discover fast growing stocks with high insider ownership.

Given the company’s strong performance and ongoing investments in cutting-edge connectivity, is T-Mobile’s stock flying under the radar, or have shares already reflected the next wave of growth in their price?

Most Popular Narrative: 16.8% Undervalued

T-Mobile US recently closed at $228.79. The most widely followed narrative assigns a fair value nearly 17% higher. This significant difference reflects a belief that the company's current momentum and investment strategy could support even greater market upside, depending on how various factors develop.

The analysts have a consensus price target of $272.299 for T-Mobile US based on their expectations of its future earnings growth, profit margins, and other risk factors. However, there is a degree of disagreement among analysts, with the most bullish reporting a price target of $309.0, and the most bearish reporting a price target of just $200.0.

What exactly goes into this bullish price prediction? The narrative’s rationale is built on aggressive margin expansion, a step-change in future profitability, and ambitious assumptions for customer growth. Wondering which specific financial factors tip the scales? Uncover the quantitative drivers behind T-Mobile’s fair value and see the full story for yourself.

Result: Fair Value of $274.85 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, factors such as rising competition or a slowdown in postpaid subscriber growth could threaten T-Mobile’s bullish outlook and challenge future earnings momentum.

Find out about the key risks to this T-Mobile US narrative.

Another View: What Do Valuation Ratios Say?

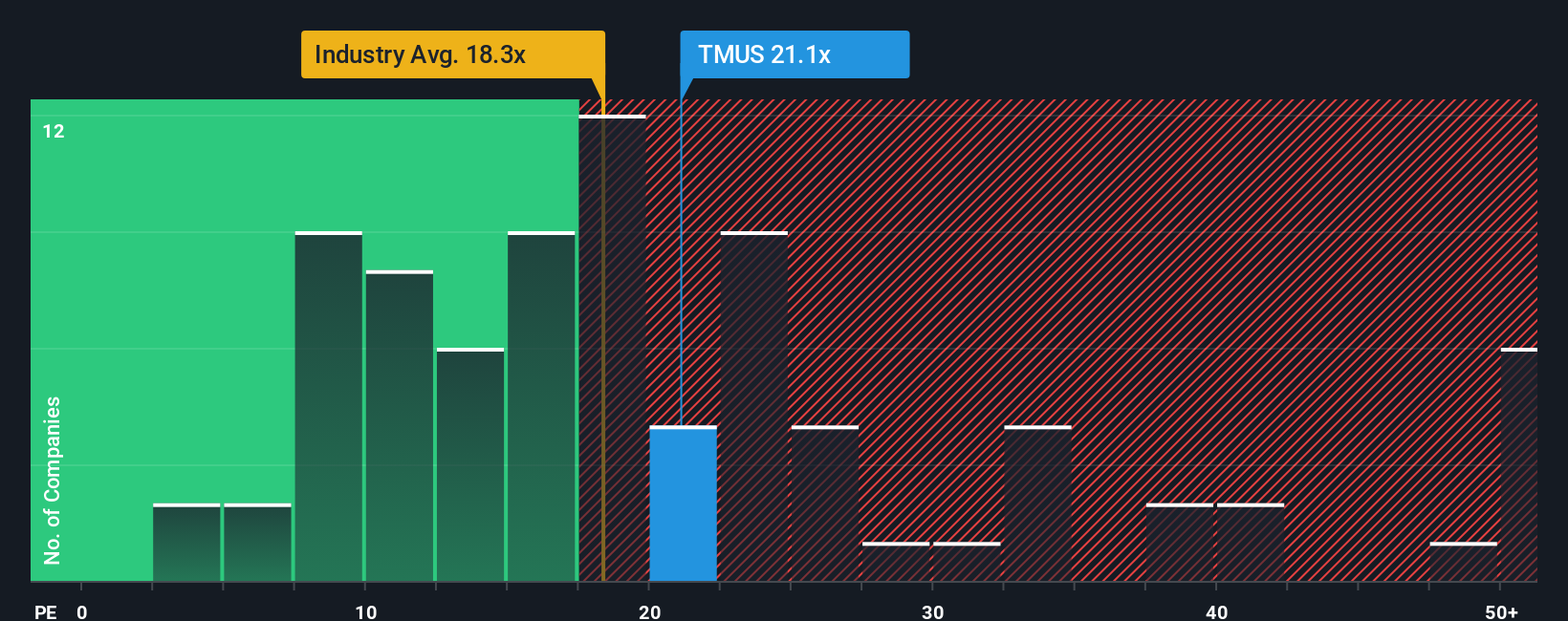

Looking beyond forecasts, T-Mobile is trading at a price-to-earnings ratio of 21.1x, which is noticeably higher than both its peer group (8.9x) and the global wireless telecom average (18.3x). The fair ratio for T-Mobile, based on our analysis, is 17.6x. This signals a potential valuation risk if market sentiment were to adjust.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own T-Mobile US Narrative

If you would rather look under the hood yourself or shape your own conclusion, you have all the tools to build your own take in just minutes. Do it your way.

A great starting point for your T-Mobile US research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't miss out on fresh investing opportunities that could transform your portfolio. Simply Wall St’s Screeners help you spot quality stocks others overlook before the crowd catches on.

- Supercharge your passive income with market leaders offering yields of more than 3% when you check out these 19 dividend stocks with yields > 3%.

- Join the AI boom and catch early movers who are shaping tomorrow’s technology sector through these 25 AI penny stocks.

- Find exceptional value by tapping into these 897 undervalued stocks based on cash flows, which shows strong fundamentals the market may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if T-Mobile US might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TMUS

T-Mobile US

Provides wireless communications services in the United States, Puerto Rico, and the United States Virgin Islands.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives