- United States

- /

- Wireless Telecom

- /

- NasdaqGS:TIGO

Assessing Millicom (NasdaqGS:TIGO): Is the Recent Rally Reflected in Its Current Valuation?

Reviewed by Simply Wall St

Most Popular Narrative: 6% Overvalued

According to the most widely followed narrative, Millicom International Cellular may be trading above its intrinsic fair value, with risks to future growth coming into focus.

Investors seem to be underestimating the risk posed by accelerating digital disruption from global tech players entering connectivity and digital financial services markets. This competition may erode Millicom's future market share and growth in its mobile and fintech platforms, pressuring revenue and limiting sustainable long-term earnings expansion.

Want to know what is holding this valuation up and why it could be stretched? The main driver here is a set of financial projections that challenge the company’s recent momentum with forecasts for tighter margins and cautious growth rates. Curious which one factor could swing the fair value in a big way? Keep reading to uncover the key assumptions at the heart of this widely watched narrative.

Result: Fair Value of $44.06 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing organic growth in core markets or a meaningful improvement in operational efficiency could quickly shift the balance in Millicom's favor.

Find out about the key risks to this Millicom International Cellular narrative.Another View: What Do Multiples Suggest?

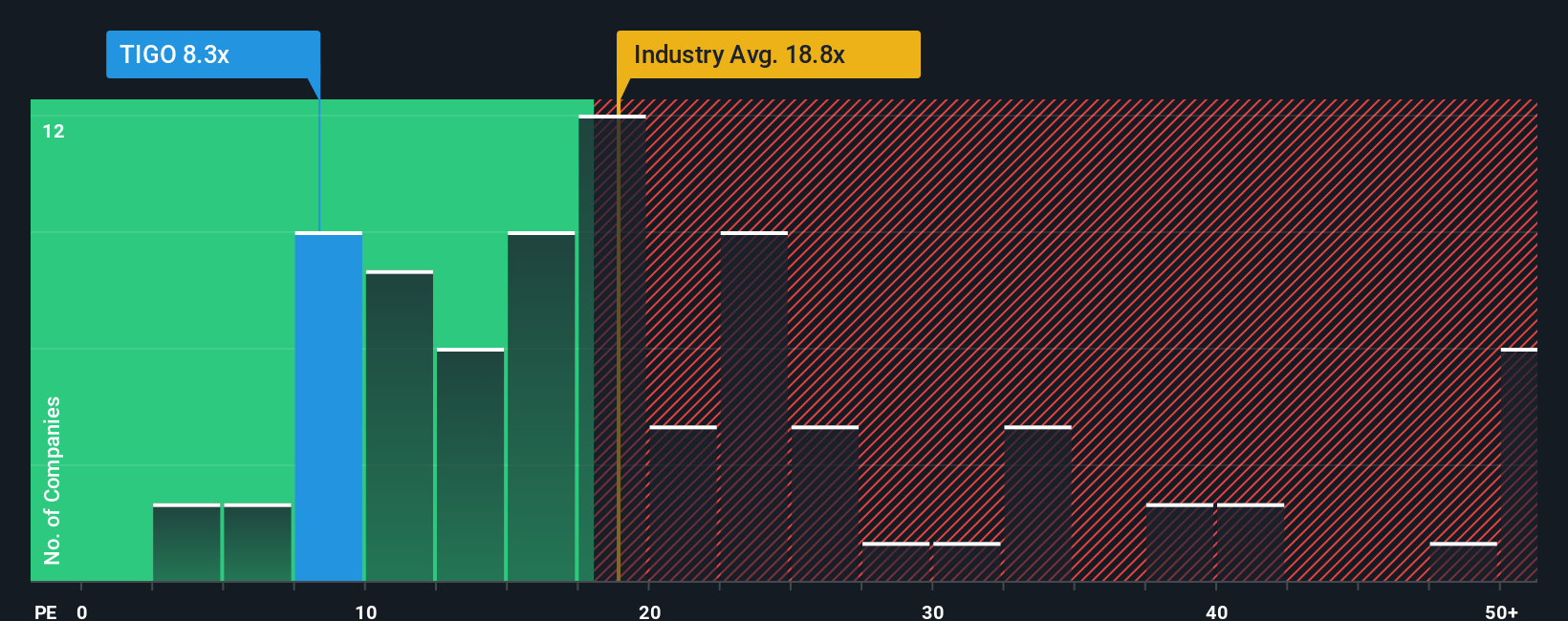

While some analysts see the stock as overvalued using discounted cash flow, another method that compares Millicom's earnings multiplier to industry averages places it firmly in the good value camp. Which reality reflects true value?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Millicom International Cellular to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Millicom International Cellular Narrative

If you see things differently or want to dig into the details yourself, you can create your own narrative in just a few minutes. Do it your way

A great starting point for your Millicom International Cellular research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Turn momentum into opportunity by using the Simply Wall Street Screener to find your next investment. Uncover standout stocks that fit your approach and seize the advantage before the crowd catches up.

- Target companies shaking up healthcare with smart technology and access the latest high-potential picks with healthcare AI stocks.

- Tap into the power of undervalued businesses and position yourself for growth with undervalued stocks based on cash flows.

- Secure steady passive income by scanning for shares offering impressive yields with dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:TIGO

Millicom International Cellular

Provides cable and mobile services in Latin America.

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)