- United States

- /

- Telecom Services and Carriers

- /

- NasdaqCM:SIFY

Here's What's Concerning About Sify Technologies' (NASDAQ:SIFY) Returns On Capital

Finding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key financial metrics. Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. Having said that, from a first glance at Sify Technologies (NASDAQ:SIFY) we aren't jumping out of our chairs at how returns are trending, but let's have a deeper look.

Return On Capital Employed (ROCE): What Is It?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. The formula for this calculation on Sify Technologies is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

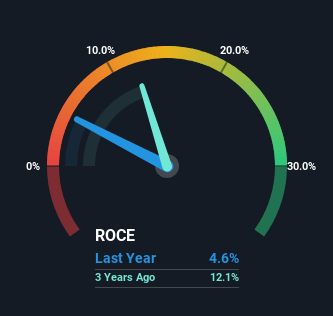

0.046 = ₹2.2b ÷ (₹71b - ₹23b) (Based on the trailing twelve months to March 2024).

Therefore, Sify Technologies has an ROCE of 4.6%. In absolute terms, that's a low return but it's around the Telecom industry average of 5.6%.

View our latest analysis for Sify Technologies

In the above chart we have measured Sify Technologies' prior ROCE against its prior performance, but the future is arguably more important. If you're interested, you can view the analysts predictions in our free analyst report for Sify Technologies .

The Trend Of ROCE

The trend of ROCE doesn't look fantastic because it's fallen from 11% five years ago, while the business's capital employed increased by 207%. However, some of the increase in capital employed could be attributed to the recent capital raising that's been completed prior to their latest reporting period, so keep that in mind when looking at the ROCE decrease. Sify Technologies probably hasn't received a full year of earnings yet from the new funds it raised, so these figures should be taken with a grain of salt.

On a side note, Sify Technologies has done well to pay down its current liabilities to 33% of total assets. So we could link some of this to the decrease in ROCE. Effectively this means their suppliers or short-term creditors are funding less of the business, which reduces some elements of risk. Since the business is basically funding more of its operations with it's own money, you could argue this has made the business less efficient at generating ROCE.

What We Can Learn From Sify Technologies' ROCE

In summary, Sify Technologies is reinvesting funds back into the business for growth but unfortunately it looks like sales haven't increased much just yet. Unsurprisingly, the stock has only gained 9.9% over the last five years, which potentially indicates that investors are accounting for this going forward. So if you're looking for a multi-bagger, the underlying trends indicate you may have better chances elsewhere.

One more thing: We've identified 2 warning signs with Sify Technologies (at least 1 which is significant) , and understanding these would certainly be useful.

While Sify Technologies may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SIFY

Sify Technologies

Offers information and communication technology solutions and services in India and internationally.

High growth potential with very low risk.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

West Africa's 20 Baggers Gold Play (Nigeria/Senegal)

Tesla’s Nvidia Moment – The AI & Robotics Inflection Point

Micron's New Supercycle: Riding the High-Bandwidth Memory Wave

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Early mover in a fast growing industry. Likely to experience share price volatility as they scale