- United States

- /

- Telecom Services and Carriers

- /

- NasdaqCM:SIFY

Further Upside For Sify Technologies Limited (NASDAQ:SIFY) Shares Could Introduce Price Risks After 28% Bounce

Sify Technologies Limited (NASDAQ:SIFY) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 52% share price drop in the last twelve months.

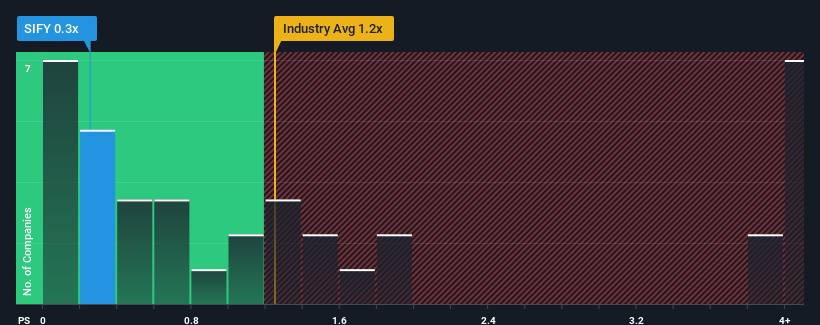

In spite of the firm bounce in price, Sify Technologies' price-to-sales (or "P/S") ratio of 0.3x might still make it look like a buy right now compared to the Telecom industry in the United States, where around half of the companies have P/S ratios above 1.2x and even P/S above 4x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Sify Technologies

How Has Sify Technologies Performed Recently?

With revenue growth that's superior to most other companies of late, Sify Technologies has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Sify Technologies will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Sify Technologies' is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 14%. Pleasingly, revenue has also lifted 47% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 52% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 42%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Sify Technologies' P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does Sify Technologies' P/S Mean For Investors?

Despite Sify Technologies' share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A look at Sify Technologies' revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

It is also worth noting that we have found 1 warning sign for Sify Technologies that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SIFY

Sify Technologies

Offers information and communication technology solutions and services in India and internationally.

High growth potential with very low risk.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Unique One, Retail Sector, but Short Time Investmentnya Almost 2,5 kali Persediaan

OPAP S.A.: Merger Momentum and Greek Gaming Resilience

A Global Powerhouse in the Making

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Undervalued Key Player in Magnets/Rare Earth

Trending Discussion