- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:GSAT

There's Reason For Concern Over Globalstar, Inc.'s (NASDAQ:GSAT) Massive 48% Price Jump

Despite an already strong run, Globalstar, Inc. (NASDAQ:GSAT) shares have been powering on, with a gain of 48% in the last thirty days. The annual gain comes to 148% following the latest surge, making investors sit up and take notice.

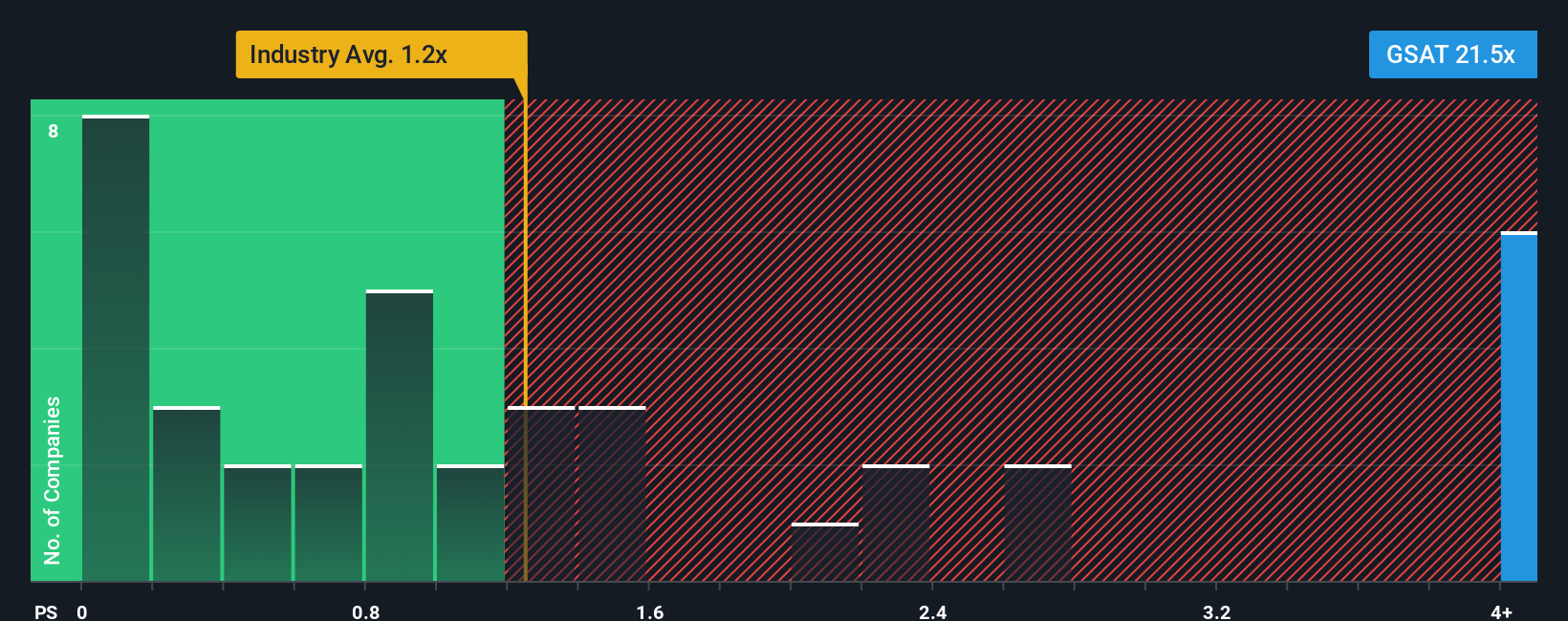

Following the firm bounce in price, given around half the companies in the United States' Telecom industry have price-to-sales ratios (or "P/S") below 1.2x, you may consider Globalstar as a stock to avoid entirely with its 21.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Globalstar

What Does Globalstar's Recent Performance Look Like?

Recent times haven't been great for Globalstar as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Globalstar.How Is Globalstar's Revenue Growth Trending?

In order to justify its P/S ratio, Globalstar would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 15%. Pleasingly, revenue has also lifted 91% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 7.3% over the next year. With the industry predicted to deliver 223% growth, the company is positioned for a weaker revenue result.

With this information, we find it concerning that Globalstar is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What We Can Learn From Globalstar's P/S?

Globalstar's P/S has grown nicely over the last month thanks to a handy boost in the share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've concluded that Globalstar currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Plus, you should also learn about this 1 warning sign we've spotted with Globalstar.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:GSAT

Globalstar

Provides mobile satellite services in the United States, Canada, Europe, Central and South America, and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026