- United States

- /

- Wireless Telecom

- /

- NasdaqCM:FNGR

FingerMotion (FNGR): Losses Widen 5.1% Annually, Testing Bullish Turnaround Hopes

Reviewed by Simply Wall St

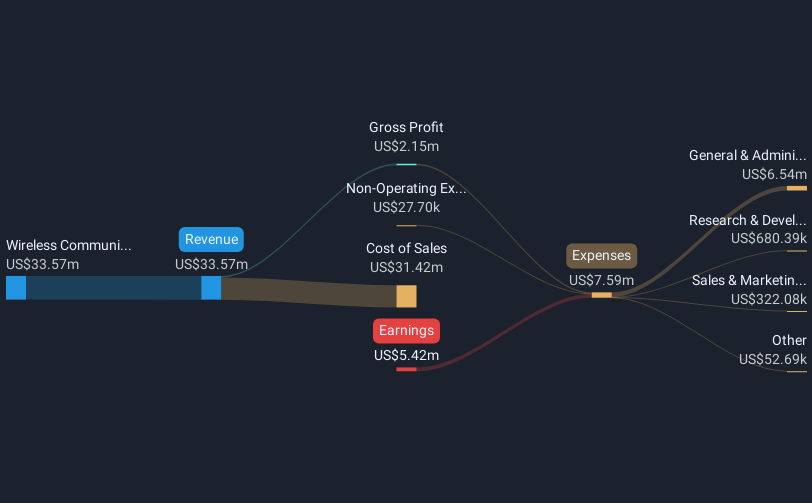

FingerMotion (NasdaqCM:FNGR) continues to face mounting losses, with annual losses increasing at a rate of 5.1% over the past five years. The company’s Price-To-Sales Ratio stands at 2.9x, which is considerably higher than both the global wireless telecom industry average of 1.5x and a peer average of 1.2x. Despite these premium valuation multiples, FingerMotion’s net profit margin remains negative and there is not enough data to determine the company’s expected earnings or revenue growth relative to the broader market. This persistent unprofitability, alongside the absence of profit momentum, sets a challenging backdrop for current and prospective investors.

See our full analysis for FingerMotion.Next, we will see how these numbers measure up against the most-discussed narratives and market expectations. It is time to see whether the community consensus holds up to FingerMotion’s latest performance.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Momentum Fails to Materialize

- Losses have continued to rise, with annual losses increasing at a rate of 5.1% per year over the past five years. This highlights persistent unprofitability.

- Prevailing market view suggests hopes for a turnaround remain unfulfilled, as the company's weak earnings quality and lack of improving profit margins weigh heavily on investor sentiment.

- Net profit margin is still negative and there is no evidence from filings that signals a shift toward profitability anytime soon.

- Bulls looking for operational inflection continue to face disappointment, as none of the reported figures point to meaningful earnings progress.

Valuation Premium Stands Out

- FingerMotion’s Price-To-Sales Ratio of 2.9x is nearly double the global wireless telecom industry average of 1.5x and more than double the peer group average of 1.2x. This marks it out as a premium-priced outlier.

- Prevailing market view contends that such premium valuation multiples set a high bar for future performance and add risk for new investors.

- Without tangible evidence of revenue or earnings growth in the filings, paying up for FNGR largely reflects speculation rather than proven business momentum.

- This lofty valuation is harder to justify given the ongoing net losses and lack of profit momentum documented in the filings.

Financial Stability Flags Grow

- Risk indicators highlight that the company is not in a strong financial position, and its share price has not maintained stability over the past three months.

- Prevailing market view emphasizes that lack of financial resilience adds to investor risk and overshadows any positive market sentiment toward sector opportunities.

- Filings indicate no offsetting rewards or upside catalysts, so maintaining confidence in the stock has become increasingly difficult for both current and prospective shareholders.

- Sector optimism is present in some narratives, but with no improvement in the company’s core financials, these themes do little to offset present risks.

For a deeper look at what’s driving the numbers and why the latest results matter, check the latest company analysis.

See our latest analysis for FingerMotion.Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on FingerMotion's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

FingerMotion faces steep ongoing losses, high valuations compared to industry averages, and clear concerns about financial resilience and stability.

If you want to focus on companies with lower debt, better balance sheets, and proven financial strength, check out solid balance sheet and fundamentals stocks screener (1978 results) to discover more reliable investment options now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:FNGR

FingerMotion

A mobile data specialist company, provides mobile payment and recharge platform system in China.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)