- United States

- /

- Telecom Services and Carriers

- /

- NasdaqCM:ATEX

Anterix (NASDAQ:ATEX) adds US$57m to market cap in the past 7 days, though investors from three years ago are still down 38%

This week we saw the Anterix Inc. (NASDAQ:ATEX) share price climb by 11%. But that cannot eclipse the less-than-impressive returns over the last three years. Truth be told the share price declined 38% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

While the stock has risen 11% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

Check out our latest analysis for Anterix

Anterix isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years, Anterix saw its revenue grow by 64% per year, compound. That's well above most other pre-profit companies. While its revenue increased, the share price dropped at a rate of 11% per year. That seems like an unlucky result for holders. It seems likely that actual growth fell short of shareholders' expectations. Still, with high hopes now tempered, now might prove to be an opportunity to buy.

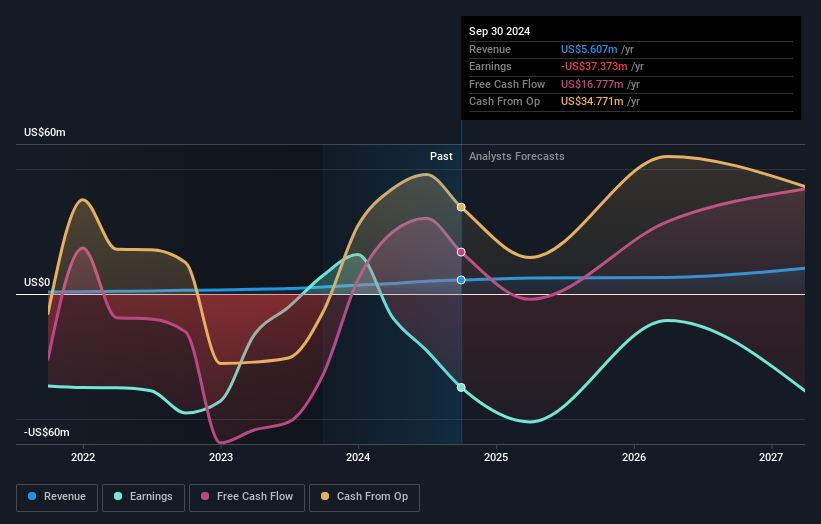

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. If you are thinking of buying or selling Anterix stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

Anterix shareholders gained a total return of 2.6% during the year. Unfortunately this falls short of the market return. But at least that's still a gain! Over five years the TSR has been a reduction of 6% per year, over five years. It could well be that the business is stabilizing. It's always interesting to track share price performance over the longer term. But to understand Anterix better, we need to consider many other factors. Even so, be aware that Anterix is showing 2 warning signs in our investment analysis , you should know about...

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of undervalued small cap companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

If you're looking to trade Anterix, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ATEX

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives