- United States

- /

- Beverage

- /

- NasdaqCM:CELH

3 Intriguing US Stocks Estimated To Be Undervalued By Up To 46.6%

Reviewed by Simply Wall St

As U.S. stock markets hover near record highs, recent fluctuations in retail sales data and treasury yields have captured investor attention, highlighting the complex interplay of economic indicators influencing market dynamics. In this environment, identifying undervalued stocks can be particularly appealing to investors seeking opportunities that may offer potential value relative to current market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | $18.93 | $37.03 | 48.9% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | $29.57 | $58.94 | 49.8% |

| Old National Bancorp (NasdaqGS:ONB) | $23.86 | $45.68 | 47.8% |

| Incyte (NasdaqGS:INCY) | $70.01 | $135.22 | 48.2% |

| DiDi Global (OTCPK:DIDI.Y) | $4.97 | $9.60 | 48.2% |

| Advanced Micro Devices (NasdaqGS:AMD) | $111.81 | $214.70 | 47.9% |

| Constellium (NYSE:CSTM) | $9.53 | $18.34 | 48% |

| First Advantage (NasdaqGS:FA) | $20.01 | $38.21 | 47.6% |

| Marcus & Millichap (NYSE:MMI) | $37.27 | $73.76 | 49.5% |

| Kyndryl Holdings (NYSE:KD) | $41.54 | $82.14 | 49.4% |

We'll examine a selection from our screener results.

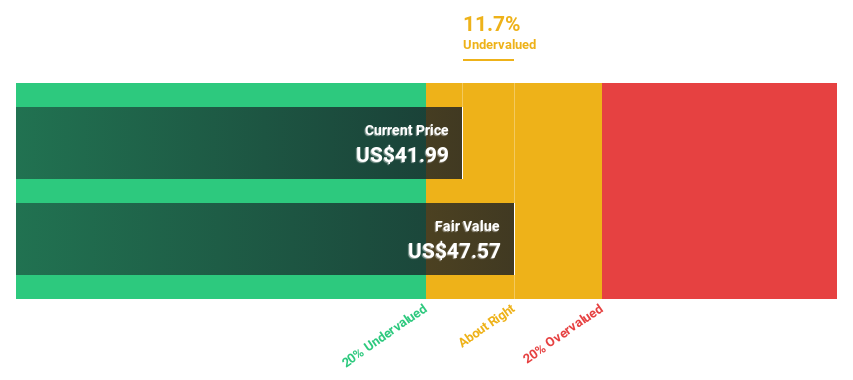

Anterix (NasdaqCM:ATEX)

Overview: Anterix Inc. is a wireless communications company with a market cap of $667.45 million.

Operations: The company generates revenue primarily from its Wireless Communications Services segment, totaling $5.90 million.

Estimated Discount To Fair Value: 13.8%

Anterix's recent earnings report shows improved net income, indicating potential undervaluation based on cash flows. With sales of US$1.57 million in Q3 2024 and strategic interest from investors, the company is exploring options with Morgan Stanley to capitalize on its position in private wireless broadband for utilities. The stock trades at US$40.52, below its estimated fair value of US$47.01, suggesting it may be undervalued despite a limited cash runway and projected revenue growth above market rates.

- Our growth report here indicates Anterix may be poised for an improving outlook.

- Click here to discover the nuances of Anterix with our detailed financial health report.

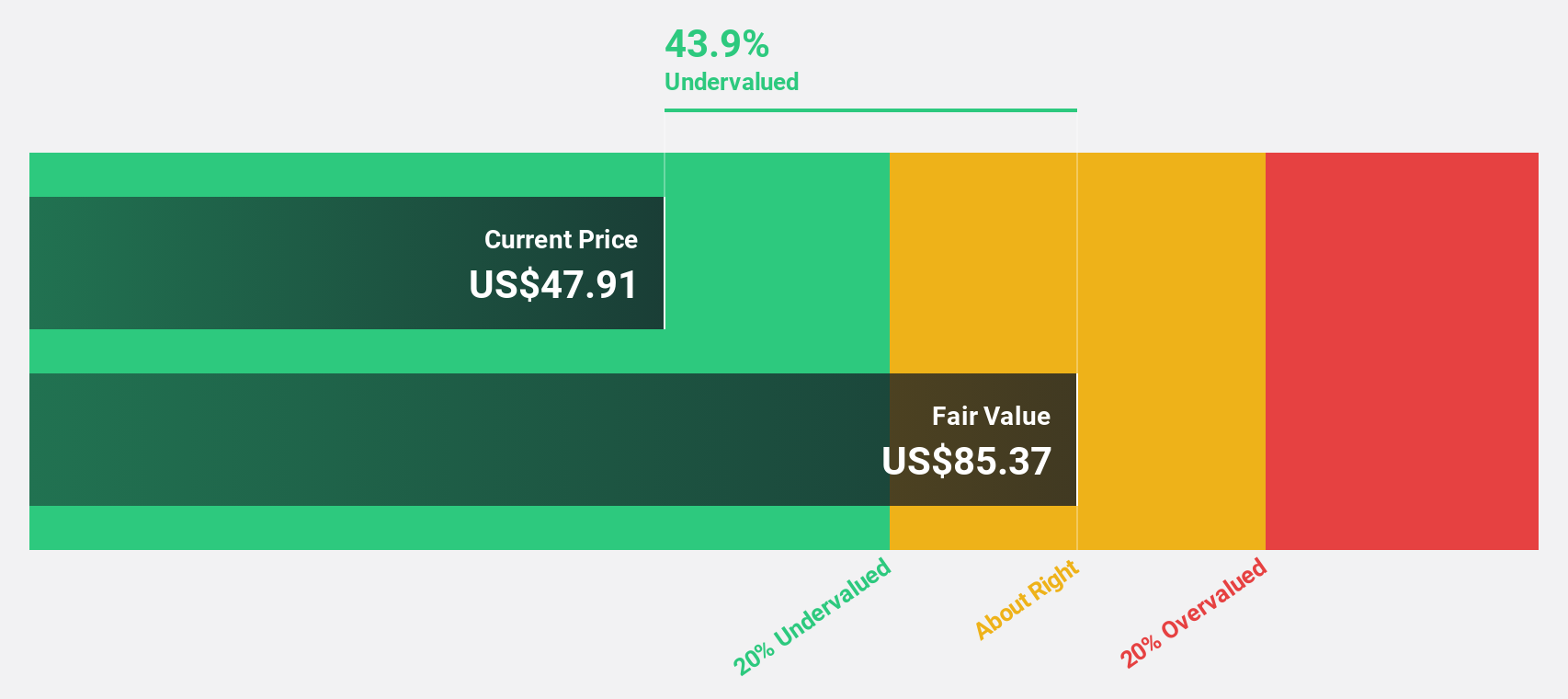

Celsius Holdings (NasdaqCM:CELH)

Overview: Celsius Holdings, Inc. is engaged in the development, processing, marketing, distribution, and sale of functional energy drinks and liquid supplements across various international markets with a market cap of approximately $5 billion.

Operations: The company's revenue is primarily derived from its non-alcoholic beverages segment, totaling $1.37 billion.

Estimated Discount To Fair Value: 46.6%

Celsius Holdings, trading at US$22.66, is considered undervalued with a fair value estimate of US$42.43, reflecting a 46.6% discount. Despite recent legal challenges related to inventory overselling to Pepsi and potential sales declines, Celsius anticipates robust revenue growth of 11.4% annually, outpacing the US market average. The introduction of CELSIUS HYDRATION expands its product line in the growing hydration powder market, potentially enhancing cash flow prospects amid ongoing litigation concerns.

- Our earnings growth report unveils the potential for significant increases in Celsius Holdings' future results.

- Click to explore a detailed breakdown of our findings in Celsius Holdings' balance sheet health report.

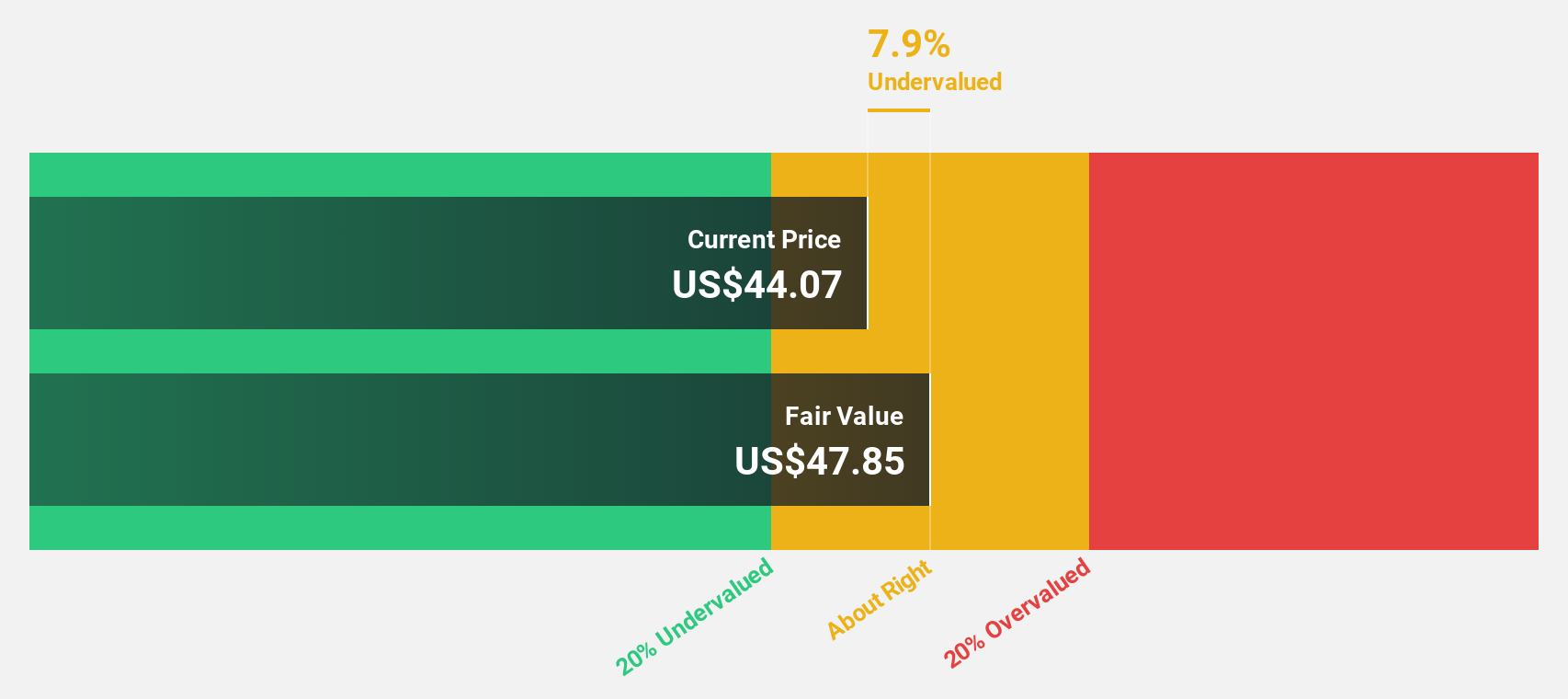

Symbotic (NasdaqGM:SYM)

Overview: Symbotic Inc. is an automation technology company that develops technologies to enhance operating efficiencies in modern warehouses, with a market cap of approximately $17.13 billion.

Operations: The company generates revenue of approximately $1.91 billion from its Industrial Automation & Controls segment.

Estimated Discount To Fair Value: 29.6%

Symbotic, trading at US$27.72, is undervalued with a fair value estimate of US$39.36. Despite a recent net loss of US$3.48 million for Q1 2025, revenue increased to US$486.69 million from the previous year and is projected to grow significantly above market averages. The company anticipates profitability within three years and has strengthened its leadership with Dr. James Kuffner as CTO, enhancing its strategic growth potential amid ongoing legal challenges regarding revenue recognition practices.

- The growth report we've compiled suggests that Symbotic's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Symbotic stock in this financial health report.

Seize The Opportunity

- Gain an insight into the universe of 164 Undervalued US Stocks Based On Cash Flows by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CELH

Celsius Holdings

Develops, processes, markets, distributes, and sells functional energy drinks and liquid supplements in the United States, Australia, New Zealand, Canadian, European, Middle Eastern, Asia-Pacific, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives