- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:ASTS

AST SpaceMobile (NasdaqGS:ASTS) Partners With Vodafone for Satellite Services Across Europe

Reviewed by Simply Wall St

AST SpaceMobile (NasdaqGS:ASTS) saw a significant 34% increase in its share price over the last month, coinciding with its partnership with Vodafone Group Plc to launch a new satellite service company, SatCo, aimed at providing European mobile network operators with comprehensive geographic coverage and secure space-based broadband. As AST SpaceMobile expands operations with a new facility in Barcelona, it fortifies its role in satellite telecommunications. This period also saw the stock benefiting from a new $43 million contract with the U.S. Space Development Agency, potentially enhancing its financial outlook. Interestingly, the broader market dipped due to economic concerns, as seen by a 1.3% decline over the past week in major indices such as the Nasdaq. However, AST SpaceMobile's strategic initiatives have seemingly countered these broader market pressures, reflecting investor optimism despite the prevailing economic unease and fluctuating U.S. stock index performance.

See the full analysis report here for a deeper understanding of AST SpaceMobile.

AST SpaceMobile's remarkable total return over the last year, exceeding 768%, offers insight into its enduring appeal among investors, far surpassing both the US Telecom industry's 29.5% return and the broader US market's 15.3%. Key developments bolstering this growth include its acquisition of 45 MHz spectrum for satellite applications in January 2025, and the successful deployment of its initial five BlueBird satellites in October 2024, which featured advanced phased array technology. The firm's March 2025 partnership with Vodafone to create SatCo also signals a transformation in providing exhaustive geographic connectivity through innovative satellite technologies.

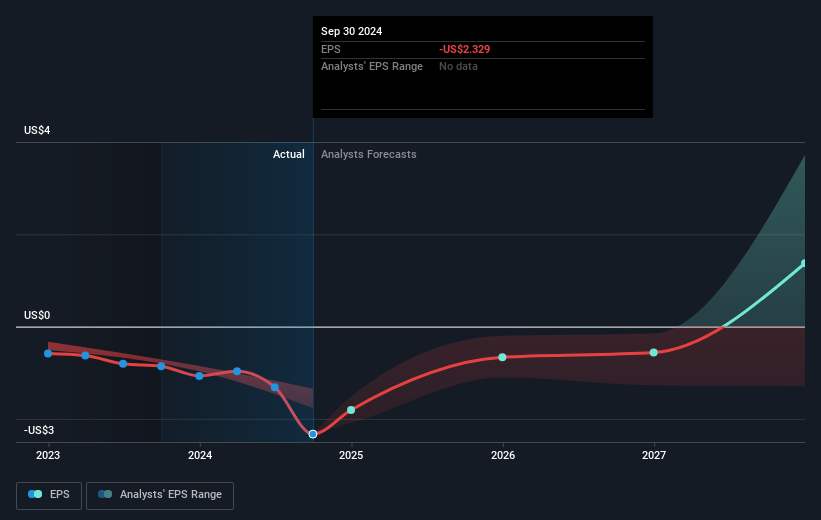

Alongside these ventures, AST SpaceMobile secured a significant US$43 million contract with the U.S. Space Development Agency in February 2025, enhancing its financial position and expanding military satellite capabilities. Despite a challenging financial landscape marked by quarterly losses, these strategic enhancements in satellite infrastructure and promising partnerships have clearly driven substantial shareholder confidence and market performance over the period.

- See whether AST SpaceMobile's current market price aligns with its intrinsic value in our detailed report

- Understand the uncertainties surrounding AST SpaceMobile's market positioning with our detailed risk analysis report.

- Are you invested in AST SpaceMobile already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ASTS

AST SpaceMobile

Develops and provides access to a space-based cellular broadband network for smartphones in the United States.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives