- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:ASTS

Assessing AST SpaceMobile (ASTS) Valuation After New Telecom Deals and Orbital AI Infrastructure Speculation

Reviewed by Simply Wall St

AST SpaceMobile (ASTS) is back in the spotlight as fresh telecom partnerships and chatter about its role in future orbital AI data centers intersect with high profile commentary on the stock’s speculative upside and risks.

See our latest analysis for AST SpaceMobile.

Those AT&T and Verizon wins, plus the buzz around orbital AI infrastructure, help explain why AST SpaceMobile has a 30 day share price return of 24.92 percent and a three year total shareholder return of 1887.05 percent, even after a recent pullback.

If this kind of space telecom story has caught your attention, it is a good time to explore other ambitious aerospace and defense stocks that could be building similar long term momentum.

With shares trading above Wall Street targets despite minimal revenue and mounting losses, AST SpaceMobile looks priced for perfection rather than execution hiccups. This raises the question: is there still a buying opportunity here, or is future growth already baked in?

Price to Book of 17.4x: Is it justified?

On a price to book basis, AST SpaceMobile looks richly valued at the last close of $76.70 compared with both peers and the wider telecom industry.

The price to book ratio compares the company’s market value to its accounting book value, making it a common yardstick for asset heavy, capital intensive businesses like space telecom infrastructure.

AST SpaceMobile trades at a price to book of 17.4 times, which means investors are paying a steep premium over its current net assets for future growth and profitability that is still several years away.

That premium stands out sharply against both the peer average of 7.3 times and the US telecom industry average of just 1.2 times, suggesting the market is assigning AST SpaceMobile a venture like valuation multiple rather than a traditional carrier style one.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to Book of 17.4x (OVERVALUED)

However, persistent losses and a share price that is already above analyst targets mean that any launch delay or technical setback could quickly puncture today’s optimism.

Find out about the key risks to this AST SpaceMobile narrative.

Another View: DCF Points the Other Way

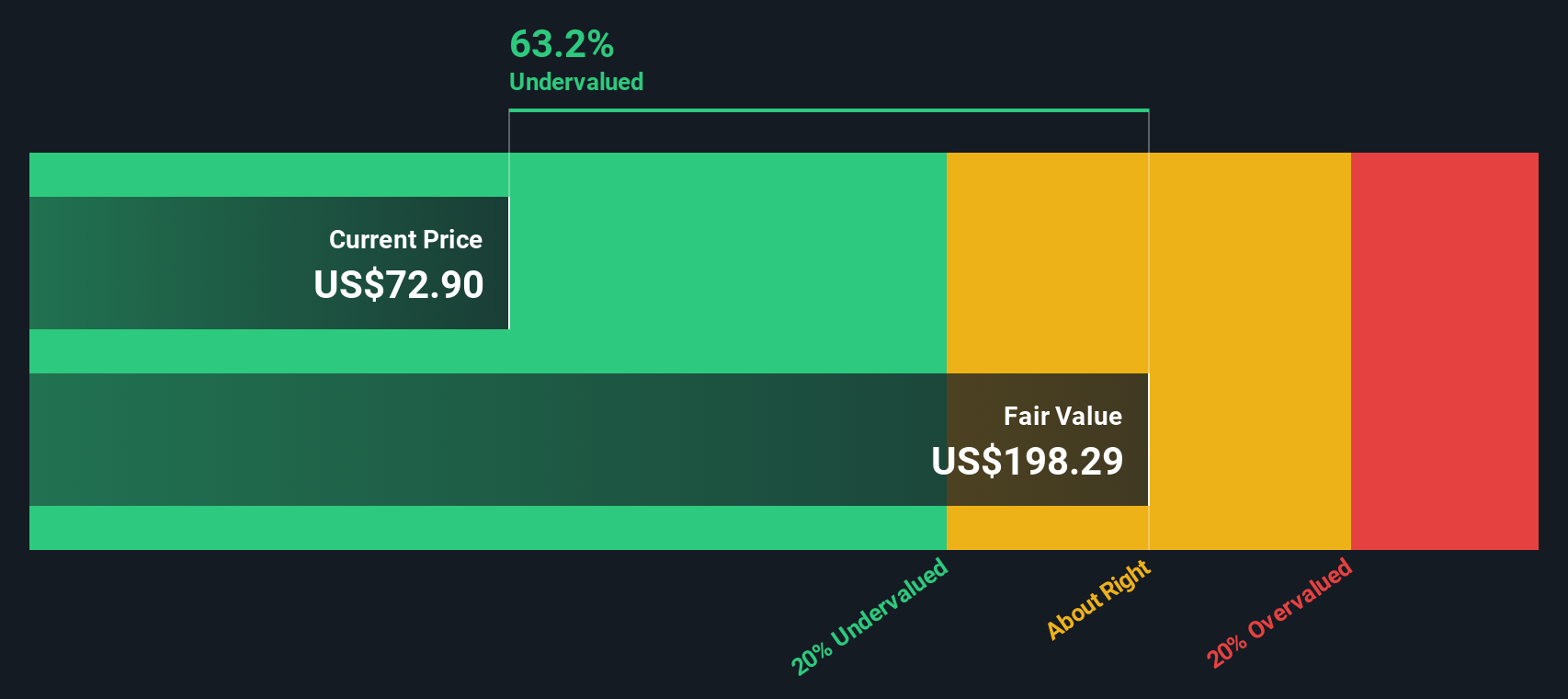

While the lofty price to book suggests AST SpaceMobile is overvalued, our DCF model paints a different picture. It estimates fair value at about $194 per share, implying the stock is around 61 percent undervalued. Is the market underestimating long term cash flows, or is the model too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out AST SpaceMobile for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own AST SpaceMobile Narrative

If you see the numbers differently or want to stress test your own thesis, you can build a personalized take in minutes: Do it your way

A great starting point for your AST SpaceMobile research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more high conviction opportunities?

Before you move on, lock in a shortlist of fresh, data backed ideas from our screeners so you are not leaving better risk reward setups on the table.

- Capture early stage growth potential by targeting these 3612 penny stocks with strong financials that already show signs of solid execution and improving fundamentals.

- Position yourself at the heart of the next productivity boom by zeroing in on these 26 AI penny stocks transforming entire industries with real world AI adoption.

- Identify potentially attractive entry points by focusing on these 908 undervalued stocks based on cash flows where current prices sit below estimates of intrinsic value based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ASTS

AST SpaceMobile

Designs and develops the constellation of BlueBird satellites in the United States.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion