- United States

- /

- Communications

- /

- NYSEAM:NTIP

Discover Immix Biopharma And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

As the U.S. stock market experiences a rise, buoyed by recent labor market data and anticipation of the August jobs report, investors are keenly observing potential shifts in monetary policy. Amidst this backdrop, penny stocks continue to intrigue those looking for opportunities beyond the mainstream indices. Although often associated with smaller or newer companies, these stocks can offer significant growth potential when supported by strong financials and robust fundamentals. In this article, we explore three penny stocks that stand out as promising candidates for investors seeking under-the-radar opportunities with solid balance sheets and growth prospects.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.07 | $454.33M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.78 | $636.53M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $1.14 | $194.96M | ✅ 4 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $1.84 | $22.75M | ✅ 4 ⚠️ 2 View Analysis > |

| Table Trac (TBTC) | $4.95 | $22.7M | ✅ 2 ⚠️ 2 View Analysis > |

| Riverview Bancorp (RVSB) | $4.83 | $103.28M | ✅ 2 ⚠️ 1 View Analysis > |

| BAB (BABB) | $0.9101 | $6.97M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.10 | $95.16M | ✅ 3 ⚠️ 3 View Analysis > |

| North European Oil Royalty Trust (NRT) | $5.00 | $46.78M | ✅ 2 ⚠️ 2 View Analysis > |

| TETRA Technologies (TTI) | $4.72 | $634.41M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 378 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Immix Biopharma (IMMX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Immix Biopharma, Inc. is a clinical-stage biopharmaceutical company focused on developing chimeric antigen receptor cell therapy for light chain amyloidosis and immune-mediated diseases, with a market cap of $65.74 million.

Operations: Immix Biopharma, Inc. has not reported any revenue segments.

Market Cap: $65.74M

Immix Biopharma, Inc., a clinical-stage biopharmaceutical company, remains pre-revenue with no significant income streams. Recent updates highlight promising developments in its CAR-T cell therapy NXC-201, showcasing a strong safety profile and absence of neurotoxicity. Despite these advancements, the company faces financial challenges with less than a year of cash runway and increasing losses over recent years. The stock has experienced high volatility, typical for penny stocks, though shareholders have not faced dilution recently. Immix's management and board are considered experienced but profitability is not anticipated in the near term.

- Get an in-depth perspective on Immix Biopharma's performance by reading our balance sheet health report here.

- Gain insights into Immix Biopharma's outlook and expected performance with our report on the company's earnings estimates.

Network-1 Technologies (NTIP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Network-1 Technologies, Inc. focuses on developing, licensing, and protecting intellectual property assets with a market cap of $34.65 million.

Operations: The company generates revenue of $0.15 million from the development, licensing, and protection of its intellectual property assets.

Market Cap: $34.65M

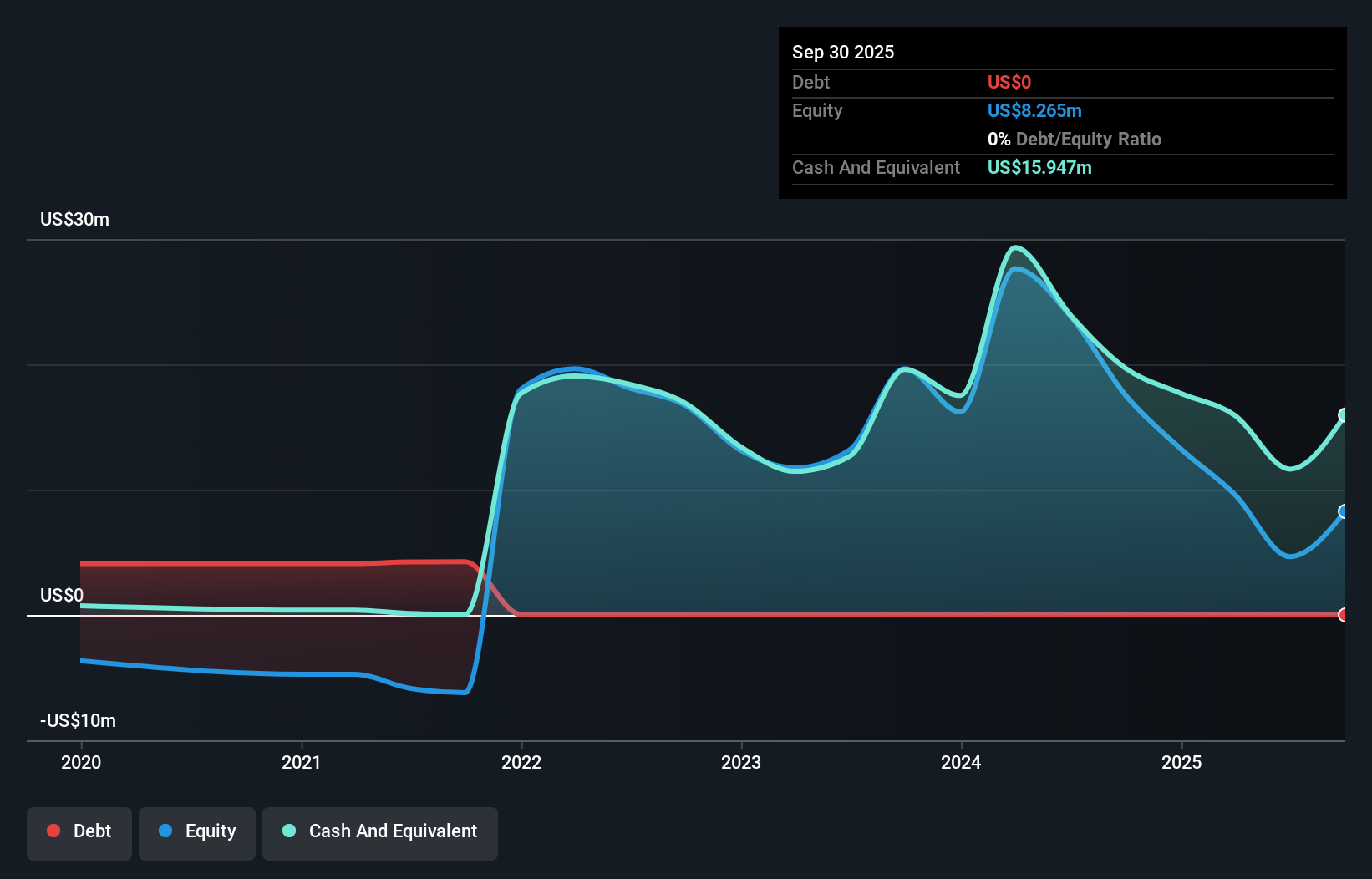

Network-1 Technologies, Inc. is a pre-revenue company focused on intellectual property assets, generating US$0.15 million in revenue with a market cap of US$34.65 million. The company reported a net loss of US$0.826 million for the first half of 2025 but has no debt obligations, mitigating interest payment concerns. Despite its unprofitability and declining earnings over five years, Network-1's short-term assets significantly exceed liabilities, providing financial stability. The firm has been actively repurchasing shares and recently increased its buyback authorization by US$5 million to bolster shareholder value amidst ongoing losses and dividend sustainability challenges.

- Navigate through the intricacies of Network-1 Technologies with our comprehensive balance sheet health report here.

- Assess Network-1 Technologies' previous results with our detailed historical performance reports.

Eventbrite (EB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Eventbrite, Inc. operates a two-sided marketplace offering self-service ticketing and marketing tools for event creators globally, with a market cap of approximately $259.59 million.

Operations: The company generates revenue primarily from its Internet Software & Services segment, totaling $300.86 million.

Market Cap: $259.59M

Eventbrite, Inc., with a market cap of approximately US$259.59 million, has faced challenges with declining sales and profitability, reporting a net loss of US$8.72 million for the first half of 2025. Despite these setbacks, the company maintains a strong financial position with short-term assets exceeding liabilities and more cash than total debt. Eventbrite recently secured a US$60 million term loan to manage convertible note obligations and support general corporate purposes. The company's strategic focus includes enhancing product features to boost ticket sales in the competitive event space while managing its leverage ratios under new credit agreements.

- Click here and access our complete financial health analysis report to understand the dynamics of Eventbrite.

- Gain insights into Eventbrite's future direction by reviewing our growth report.

Taking Advantage

- Investigate our full lineup of 378 US Penny Stocks right here.

- Interested In Other Possibilities? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Network-1 Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:NTIP

Network-1 Technologies

Engages in the development, licensing, and protection of intellectual property assets.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)