- United States

- /

- Diversified Financial

- /

- NasdaqCM:COOP

3 US Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

As the U.S. stock market experiences mixed signals with the S&P 500 inching higher amid a soft Producer Price Index report and tech stocks facing volatility, investors are keenly observing opportunities that may arise from these fluctuations. In such an environment, identifying stocks that might be trading below their estimated value can offer potential advantages, especially when market conditions create discrepancies between a company's intrinsic worth and its current market price.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Dime Community Bancshares (NasdaqGS:DCOM) | $31.25 | $61.63 | 49.3% |

| Burke & Herbert Financial Services (NasdaqCM:BHRB) | $60.55 | $117.78 | 48.6% |

| German American Bancorp (NasdaqGS:GABC) | $39.26 | $78.06 | 49.7% |

| Afya (NasdaqGS:AFYA) | $15.21 | $29.63 | 48.7% |

| Ally Financial (NYSE:ALLY) | $35.32 | $68.95 | 48.8% |

| Mr. Cooper Group (NasdaqCM:COOP) | $96.54 | $188.33 | 48.7% |

| Bilibili (NasdaqGS:BILI) | $16.65 | $32.75 | 49.2% |

| Ubiquiti (NYSE:UI) | $393.63 | $771.91 | 49% |

| Coeur Mining (NYSE:CDE) | $6.35 | $12.63 | 49.7% |

| Zillow Group (NasdaqGS:ZG) | $68.92 | $136.88 | 49.7% |

Here we highlight a subset of our preferred stocks from the screener.

Mr. Cooper Group (NasdaqCM:COOP)

Overview: Mr. Cooper Group Inc. operates as a non-bank servicer of residential mortgage loans in the United States and has a market cap of approximately $6.18 billion.

Operations: The company's revenue segments include Servicing at $1.48 billion and Originations at $416 million.

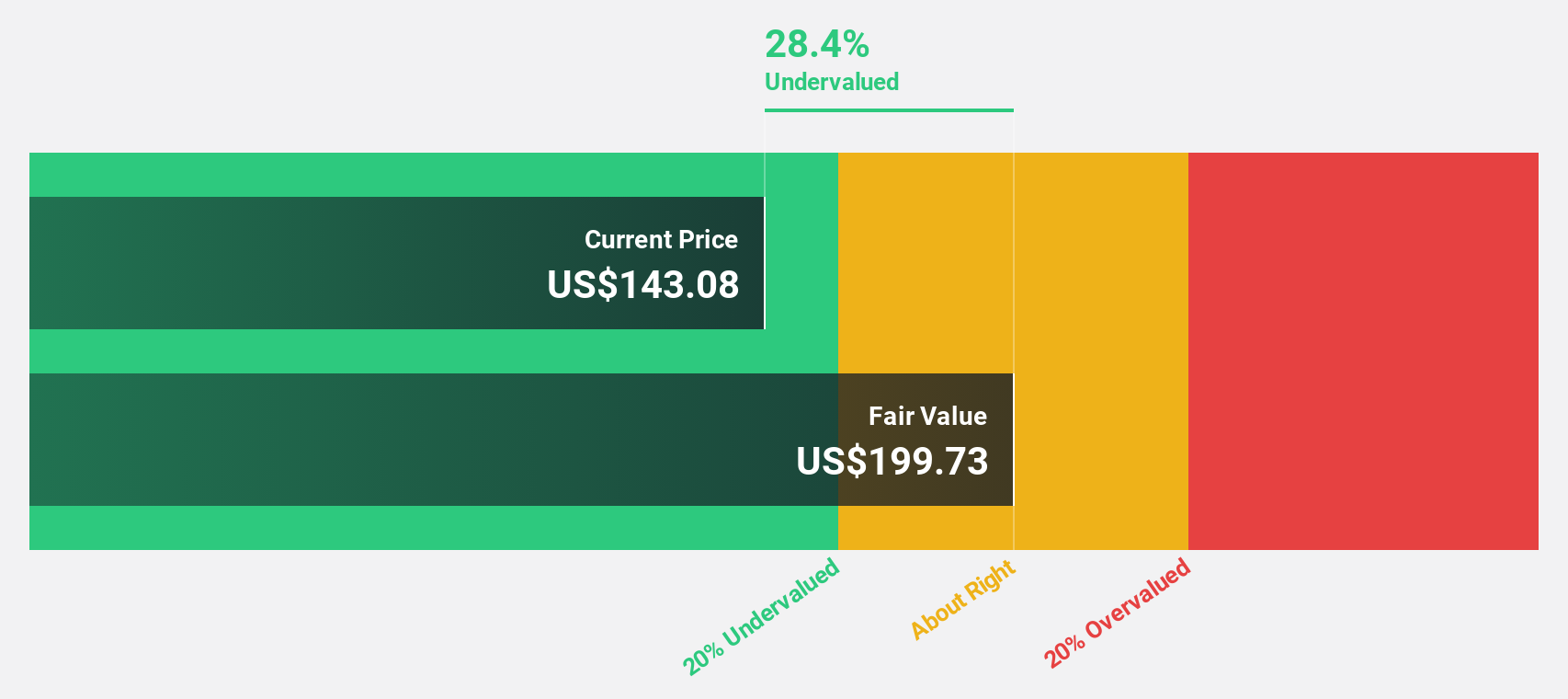

Estimated Discount To Fair Value: 48.7%

Mr. Cooper Group is trading at US$96.54, significantly below its estimated fair value of US$188.33, indicating it may be undervalued based on cash flows. The company's earnings are projected to grow at 21.7% annually, outpacing the broader market's growth rate of 14.9%. However, recent earnings showed a decline in quarterly revenue and net income compared to last year, though nine-month figures improved slightly year-over-year amidst ongoing executive transitions and share buybacks totaling US$344 million.

- The analysis detailed in our Mr. Cooper Group growth report hints at robust future financial performance.

- Take a closer look at Mr. Cooper Group's balance sheet health here in our report.

GE Vernova (NYSE:GEV)

Overview: GE Vernova Inc. is an energy company that provides products and services for generating, transferring, orchestrating, converting, and storing electricity across multiple regions worldwide, with a market cap of approximately $105.37 billion.

Operations: The company's revenue segments consist of Wind at $9.18 billion, Power at $18.29 billion, and Electrification at $7.34 billion.

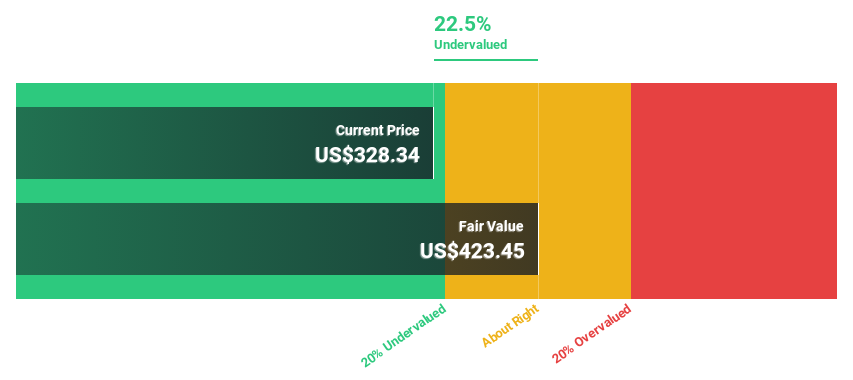

Estimated Discount To Fair Value: 10.5%

GE Vernova, trading at US$382.26, is priced below its estimated fair value of US$427.33, reflecting potential undervaluation based on cash flows. The company recently became profitable and forecasts a robust 24.6% annual earnings growth over the next three years, surpassing the broader U.S. market's growth expectations. Recent strategic initiatives include a US$6 billion share repurchase program and significant involvement in innovative energy projects like carbon capture and hydrogen power stations.

- The growth report we've compiled suggests that GE Vernova's future prospects could be on the up.

- Click here to discover the nuances of GE Vernova with our detailed financial health report.

Ubiquiti (NYSE:UI)

Overview: Ubiquiti Inc. develops networking technology for service providers, enterprises, and consumers, with a market cap of approximately $23.80 billion.

Operations: The company generates revenue primarily from its Wireless Communications Equipment segment, which reported $2.02 billion.

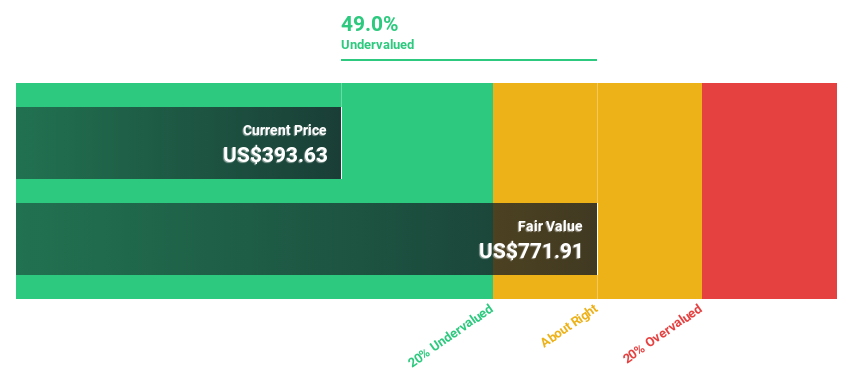

Estimated Discount To Fair Value: 49%

Ubiquiti, currently trading at US$393.63, is significantly undervalued compared to its estimated fair value of US$771.91, suggesting strong potential based on cash flows. Despite a high debt level, the company reported robust earnings for Q1 2024 with net income rising to US$127.99 million from US$87.75 million year-over-year and declared a $0.60 per share dividend in November 2024, highlighting solid financial performance and shareholder returns amidst forecasted annual earnings growth of 29%.

- Our comprehensive growth report raises the possibility that Ubiquiti is poised for substantial financial growth.

- Dive into the specifics of Ubiquiti here with our thorough financial health report.

Next Steps

- Reveal the 170 hidden gems among our Undervalued US Stocks Based On Cash Flows screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:COOP

Mr. Cooper Group

Operates as a non-bank servicer of residential mortgage loans in the United States.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives