TE Connectivity (TEL) Net Profit Margin Decline Challenges Bull Case on Premium Valuation

Reviewed by Simply Wall St

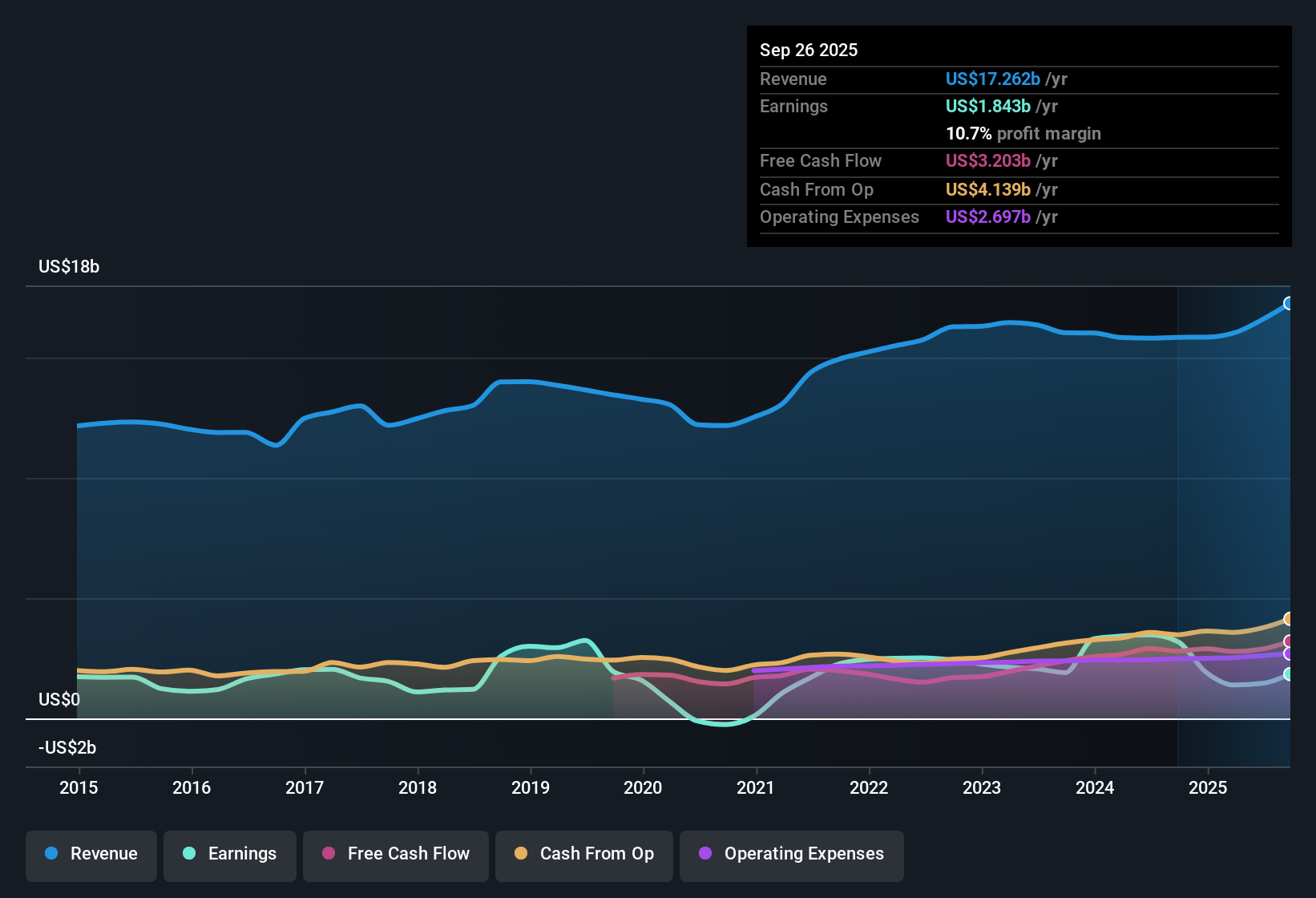

TE Connectivity (TEL) posted a net profit margin of 10.7%, down from 20.2% the previous year, signaling a noticeable decline in profitability. While the company’s earnings are forecast to grow at 15.59% per year and revenue is expected to rise 7.5% annually, both growth rates come in just below broader US market forecasts. Despite profit margins facing pressure, the company’s consistent annualized earnings growth of 13.3% over the past five years demonstrates resilient performance, even as investors weigh premium valuation concerns.

See our full analysis for TE Connectivity.Now, it's time to see how the latest results align with the current market narratives. Some expectations may hold up, while others could be upended.

See what the community is saying about TE Connectivity

AI-Driven Segments Propel Top-Line

- TE Connectivity’s revenue from AI-related products is projected to surge from $300 million to over $800 million in fiscal 2025, nearly tripling in a short span and underscoring the scale of the company’s pivot toward high-growth tech verticals.

- Analysts' consensus view highlights how the company is harnessing rapid growth in AI-driven data centers and electrified vehicles to unlock above-segment margins and a pipeline of high-quality projects.

- TE’s strong momentum in industrial and energy markets is reinforced by recent acquisitions and operational shifts, supporting durable double-digit earnings per share growth and robust free cash flow conversion.

- Notably, manufacturing localization, now at over 70%, and operational footprint optimization have contributed to a nearly 400 basis point margin uplift in the Industrial segment year-over-year, signaling deeper profitability levers beyond pure sales expansion.

- Consensus expectations see these catalysts creating a durable advantage, but investors should keep watch on whether performance in these new verticals can be maintained as opportunities scale. See how analysts weigh these strengths and uncertainties in the full Consensus Narrative. 📊 Read the full TE Connectivity Consensus Narrative.

Margin Pressures and Growth Risks Remain

- Net profit margin dropped to 10.7%, a notable decline from last year's 20.2%, highlighting that despite growing end-markets, underlying profitability is more vulnerable than topline momentum suggests.

- Consensus narrative urges caution, noting that heavy reliance on AI, Energy, and Asian mobility growth exposes TE Connectivity to customer concentration and integration risks as well as margin volatility.

- Manufacturing expansion and recent acquisitions open up new addressable markets but also bring the risk of cost overruns, regional market disruptions, or weaker-than-expected synergies that could cap future earnings.

- Bears argue that if demand in these core segments slows or competitive dynamics shift, revenue instability and compressed free cash flow could result, particularly given geographic concentration and shifting regulatory environments.

Premium Valuation Versus Industry and Peers

- At 39x price-to-earnings, TE Connectivity trades well above both the US electronic industry average of 25.7x and its peer group at 34.6x. The current share price of $243.45 also sits above its DCF fair value of $136.85 and just below the analyst price target of $262.56, suggesting limited near-term upside.

- According to the consensus narrative, this premium price hinges on sustained double-digit earnings growth and successful margin expansion outpacing the underlying market.

- For this valuation to hold, TE would need to reach revenues of $20.3 billion and earnings of $3.1 billion by 2028, with profit margins expanding to 15.1% and a PE ratio coming down to 26.2x. These conditions assume both operational and market execution continue without major disruption.

- With the share price already pricing in much of the expected growth, the balance of risks and rewards looks finely split, making it important for investors to sense-check analyst projections before buying into the story.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for TE Connectivity on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures? Share your perspective and craft a unique narrative in just a few minutes. Do it your way

A great starting point for your TE Connectivity research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

TE Connectivity’s premium valuation means much of its growth is already priced in. Any slip in margins or execution could quickly pressure the stock.

If you want to find better value, check out these 850 undervalued stocks based on cash flows to discover companies trading at more attractive levels with upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TE Connectivity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TEL

TE Connectivity

Manufactures and sells connectivity and sensor solutions in Europe, the Middle East, Africa, the Asia–Pacific, and the Americas.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)