TE Connectivity (NYSE:TEL) Projects Q3 Sales Growth Despite Q2 Earnings Drop

Reviewed by Simply Wall St

TE Connectivity (NYSE:TEL) announced its earning guidance and results, projecting an 8% rise in net sales for the next quarter. The company reported mixed Q2 results, with sales increasing to $4,143 million but net income dropping significantly to $13 million. Despite these internal challenges, TEL's stock price rose 7% over the past week, aligning with a market-wide surge supported by favorable earnings reports and tariff developments. The company's cautiously optimistic future outlook may have added weight to the stock's positive momentum, aligning its movements with broader market trends driven by investor reactions to earnings results and economic policy shifts.

Be aware that TE Connectivity is showing 1 weakness in our investment analysis.

The recent announcement of TE Connectivity’s earnings guidance, projecting an 8% rise in net sales, adds weight to the company's potential for aligning with its growth narratives, including localized manufacturing and AI-driven innovations in the auto and utility sectors. Despite mixed Q2 results, with net income dropping to US$13 million, the company's revenue increase to US$4.14 billion supports its growth trajectory. The stock's 7% rise over the past week, combined with a market surge driven by favorable earnings and tariff news, suggests a positive investor sentiment that could influence future revenue and earnings expectations.

Over the past five years, TE Connectivity has delivered a total shareholder return of 89.06%, reflecting a strong long-term investment performance. This contrasts with the company's underperformance relative to the broader US market and its match with the US Electronic industry over the past year. Such long-term growth provides context for current stock price movements and supports a broader view of the company's performance amid specific shorter-term fluctuations.

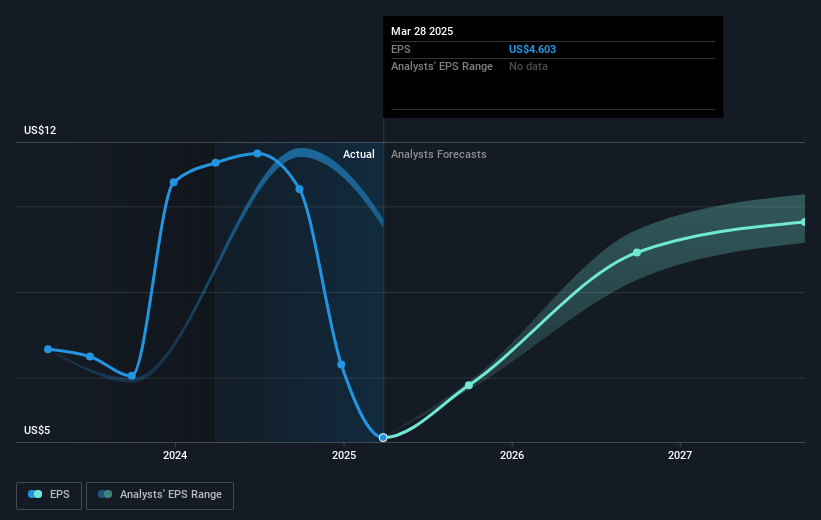

The recent earnings projections could boost investor confidence, particularly as they relate to TE Connectivity’s revenue and earnings forecasts. As analysts predict a 5.9% annual revenue growth over the next three years and a net profit margin expansion to 16.5%, these figures become crucial in assessing the company’s overall financial health. With the current share price at US$133.45 and a consensus price target of US$159.90, the stock's movement indicates a potential appreciation of 16.5%, offering a perspective on future valuation gains as the market assimilates these forecasts.

Explore TE Connectivity's analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TE Connectivity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TEL

TE Connectivity

Manufactures and sells connectivity and sensor solutions in Europe, the Middle East, Africa, the Asia–Pacific, and the Americas.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives