Teledyne Technologies (TDY) Announces New US$2 Billion Buyback and Raises 2025 Earnings Guidance

Reviewed by Simply Wall St

Teledyne Technologies (TDY) recently raised its full-year guidance and announced a new share repurchase program, reflecting strong financial results for the second quarter, with sales rising to $1,514 million and net income reaching $210 million. These strategic moves have likely reinforced shareholder confidence, contributing to a 24% stock price increase over the last quarter. The market, enhancing this momentum, saw the S&P 500 reaching new highs, buoyed by optimism from trade deals and encouraging earnings from other companies, aligning with Teledyne's positive trajectory.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Teledyne Technologies' recent developments, including a raised full-year guidance and a new share repurchase program, seem to bolster the company's narrative of focusing on strategic acquisitions and space programs. The Qioptiq acquisition and alignment with growing global defense budgets indicate potential for sustained revenue streams and margin improvements. Over the last five years, investors have seen a total return of 83.00%, reflecting the company's broader growth trajectory and strategic positioning in both commercial and governmental markets.

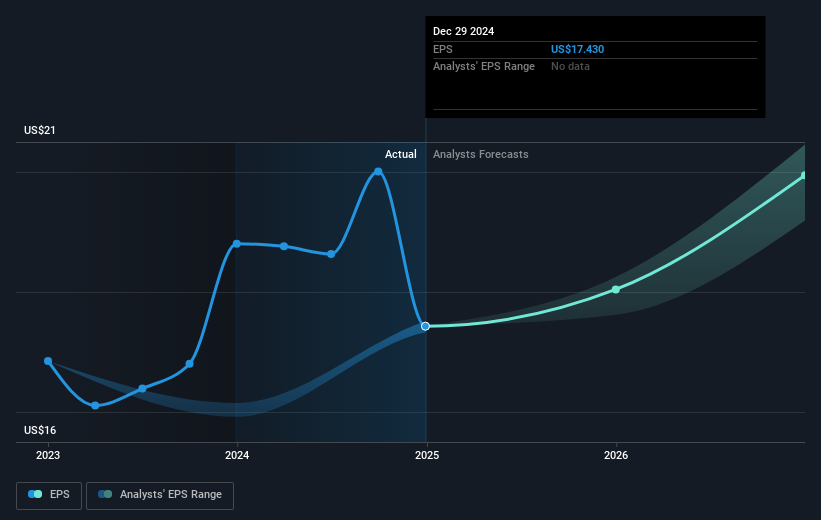

In the past year, Teledyne's performance outpaced both the US Electronic industry, which returned 23.9%, and the broader US Market, which returned 13.7%. Analysts' projections suggest a price target of approximately US$573.41, slightly above the current share price of US$555.95, indicating a consistent belief in continued growth, although trading presently above their fair value estimate of US$533.73. This signals expectations of future earnings and revenue expansion, with fair value factors in future potential challenges such as tariff costs and market volatility.

Take a closer look at Teledyne Technologies' potential here in our financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Teledyne Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TDY

Teledyne Technologies

Provides enabling technologies for industrial growth markets in the United States, Europe, Asia, and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)