- United States

- /

- Software

- /

- NYSE:QBTS

Investors ignore increasing losses at D-Wave Quantum (NYSE:QBTS) as stock jumps 37% this past week

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). For example, the D-Wave Quantum Inc. (NYSE:QBTS) share price is up 22% in the last 1 year, clearly besting the market decline of around 12% (not including dividends). If it can keep that out-performance up over the long term, investors will do very well! Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

View our latest analysis for D-Wave Quantum

D-Wave Quantum wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

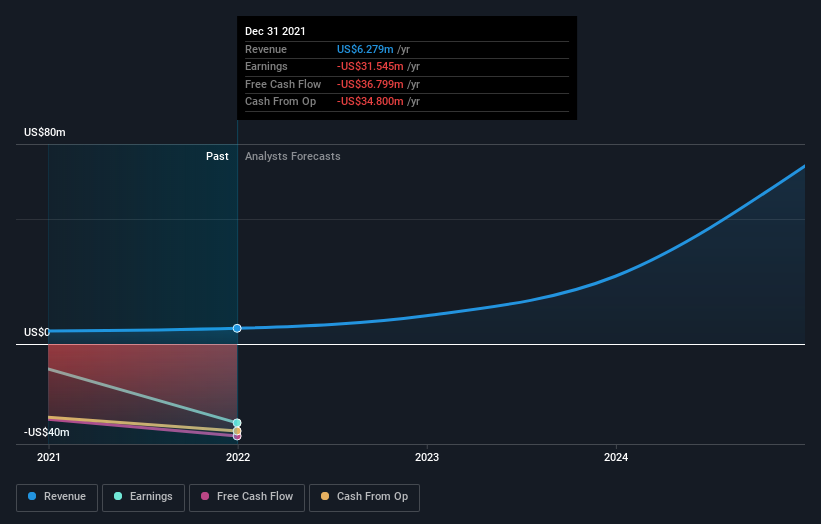

In the last year D-Wave Quantum saw its revenue grow by 22%. We respect that sort of growth, no doubt. Buyers pushed the share price 22% in response, which isn't unreasonable. If the company can maintain the revenue growth, the share price could go higher still. But before deciding this growth stock is underappreciated, you might want to check out profitability trends (and cash flow)

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. If you are thinking of buying or selling D-Wave Quantum stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

D-Wave Quantum boasts a total shareholder return of 22% for the last year. A substantial portion of that gain has come in the last three months, with the stock up 20% in that time. This suggests the company is continuing to win over new investors. It's always interesting to track share price performance over the longer term. But to understand D-Wave Quantum better, we need to consider many other factors. Even so, be aware that D-Wave Quantum is showing 2 warning signs in our investment analysis , and 1 of those is significant...

Of course D-Wave Quantum may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:QBTS

D-Wave Quantum

Develops and delivers quantum computing systems, software, and services worldwide.

Slight with limited growth.

Similar Companies

Market Insights

Community Narratives