- United States

- /

- Tech Hardware

- /

- NYSE:PSTG

Is Pure Storage’s Impressive 67.9% Rally Justified After New Cloud Partnerships?

Reviewed by Bailey Pemberton

- Ever wondered if Pure Storage is actually a bargain or just another hyped-up tech stock? Here is a closer look at what its current price might really mean for long-term investors.

- After a 13.5% increase this week and a 42.4% jump year-to-date, Pure Storage has delivered 67.9% gains over the last year and 323.6% over five years to patient holders.

- Momentum has been fueled by notable partnerships and industry recognition for the company’s flash storage solutions, as well as broad optimism over cloud infrastructure investments. Recent news about its expanding cloud alliances and its standing as a leader in enterprise data storage has attracted increased market attention.

- Despite all the attention, Pure Storage scores just 2 out of 6 on key undervaluation checks. Do these returns reflect how the market is really valuing the stock? This article will walk through the main valuation approaches, and a different way to look at the situation is presented at the end.

Pure Storage scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Pure Storage Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's true value by projecting its future cash flows and discounting them back to today's dollars. This provides a forward-looking perspective on what the business could be worth beyond current market attention.

For Pure Storage, the latest trailing twelve months Free Cash Flow is $560.9 million. Analyst estimates suggest steady growth, projecting the company's annual Free Cash Flow to surpass $1.5 billion ($1,549.65 million) by 2030. While detailed analyst forecasts are available for the next five years, longer-term projections beyond 2029 are based on Simply Wall St’s extrapolations.

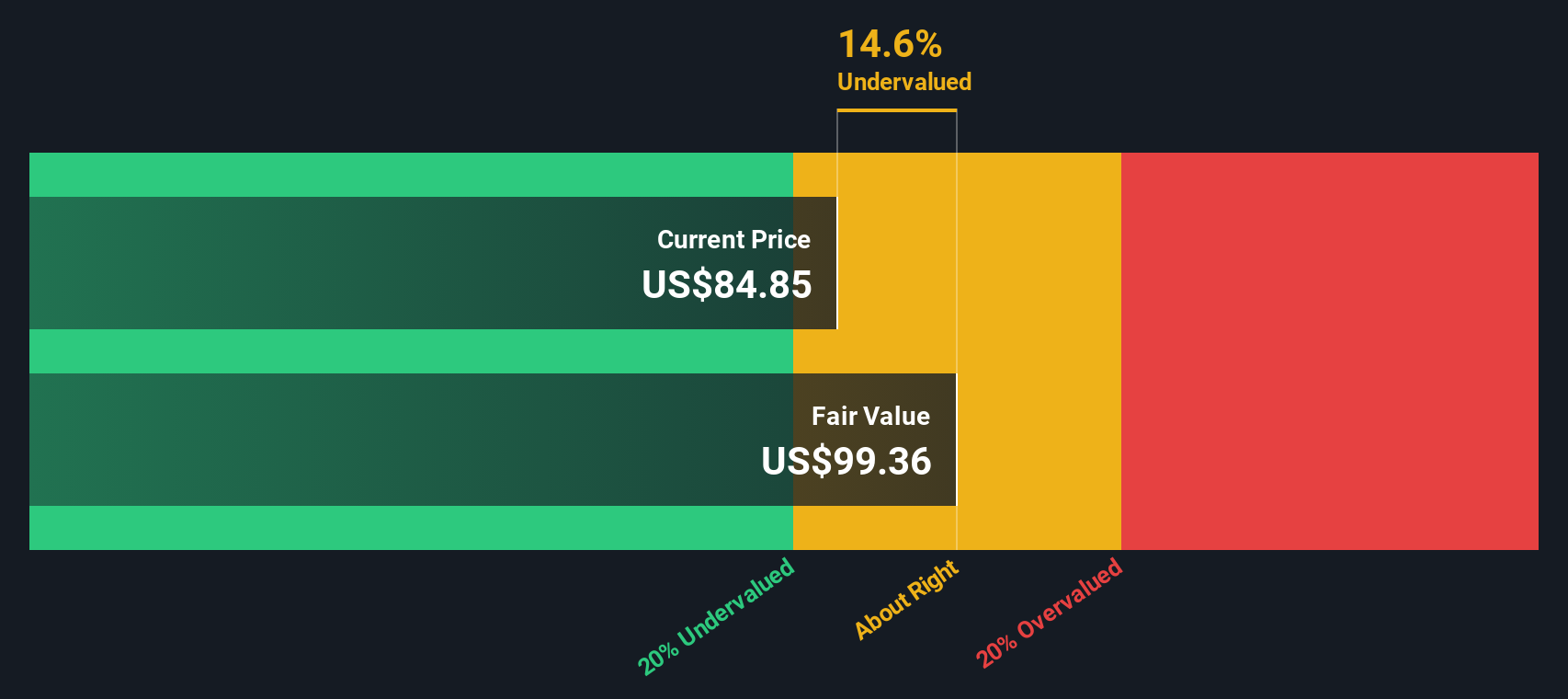

According to the 2 Stage Free Cash Flow to Equity model, the estimated intrinsic value of Pure Storage’s shares is $101.44. The DCF valuation indicates the stock is 12.3% undervalued at current prices, which highlights a difference between the calculated value and where the shares currently trade.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Pure Storage is undervalued by 12.3%. Track this in your watchlist or portfolio, or discover 914 more undervalued stocks based on cash flows.

Approach 2: Pure Storage Price vs Sales (P/S)

The Price-to-Sales (P/S) ratio is a popular metric for valuing tech companies and other high-growth businesses, especially when profits are modest or reinvested aggressively. It reflects how much investors are willing to pay for each dollar of a company's revenues. This is particularly useful for companies like Pure Storage with strong topline momentum but less emphasis on current earnings.

A company's P/S ratio will often be higher if the market expects fast future growth or sees lower risk versus competitors. Conversely, a lower ratio might suggest slower growth prospects or higher uncertainty. Investors commonly compare the current P/S ratio to the industry average and similar peers to gauge if the stock appears expensive or cheap by these standards.

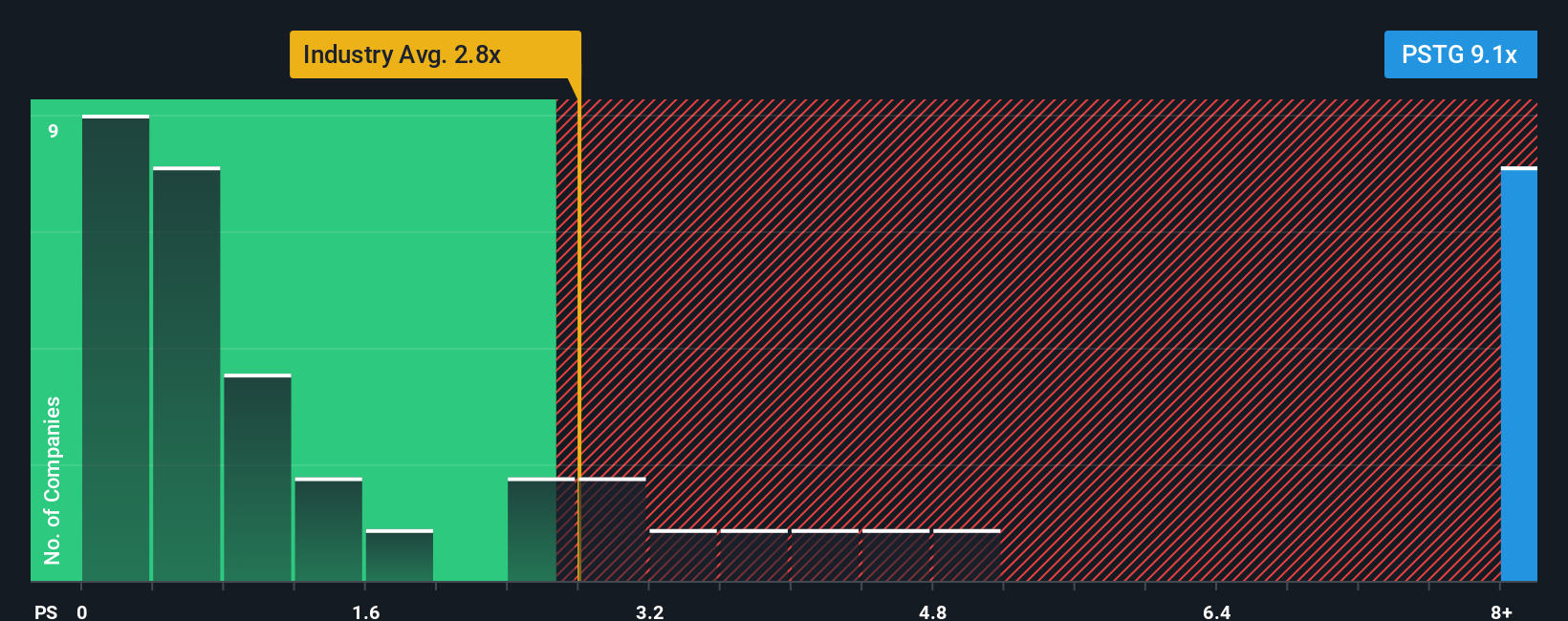

Pure Storage’s current P/S ratio stands at 8.73x. That is considerably above the Tech industry average of 1.60x and the peer group average of 2.21x. However, these simple comparisons can be misleading if the company's growth, margins, or risks differ materially from the average.

To get a more nuanced view, Simply Wall St provides a “Fair Ratio,” a metric designed to reflect what P/S multiple would be justified for Pure Storage based on its growth profile, profit margins, business risks, industry, and market cap. This proprietary approach goes beyond basic peer comparisons to give a fuller picture of value.

Pure Storage’s Fair Ratio is 13.63x, which is higher than its current P/S multiple. Since the stock trades below its Fair Ratio, this suggests the shares may be undervalued at today’s price according to this methodology.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1437 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Pure Storage Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. Narratives are a powerful and accessible tool that let investors describe their own story and outlook for a company by connecting their assumptions, such as future revenue growth, profit margins, and fair value targets, to a financial forecast and valuation.

Think of a Narrative as your unique investment thesis, capturing both the numbers and the reasons behind your expectations. By tying together what you believe about Pure Storage's business, industry trends, or potential risks, a Narrative bridges the company's story with clear, actionable financial projections.

On Simply Wall St's Community page, creating and adjusting a Narrative takes only a few clicks. You can use these dynamic forecasts not only to spot if the current share price offers a buying or selling opportunity, but also to see how shifts in news or earnings immediately update estimated fair value. This allows you to make timely and informed decisions.

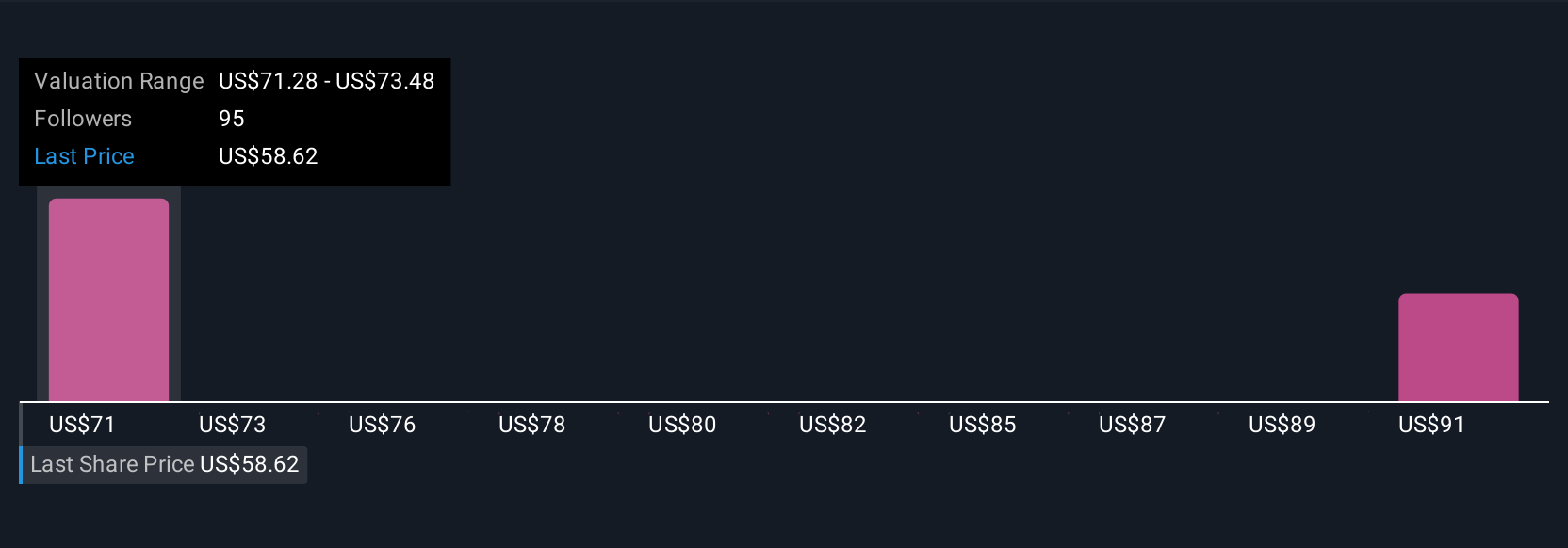

For example, the most bullish Pure Storage Narrative currently projects a fair value of $93.00 per share, based on rapid expansion with hyperscale partners and accelerating AI-driven demand. The most cautious Narrative estimates just $55.00, emphasizing margin uncertainty and cloud transition risks. Both are visible and openly compared in the platform's Community.

Do you think there's more to the story for Pure Storage? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSTG

Pure Storage

Provides data storage and management technologies, products, and services in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)