- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:OUST

Ouster, Inc.'s (NYSE:OUST) Stock Retreats 54% But Revenues Haven't Escaped The Attention Of Investors

Unfortunately for some shareholders, the Ouster, Inc. (NYSE:OUST) share price has dived 54% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 89% loss during that time.

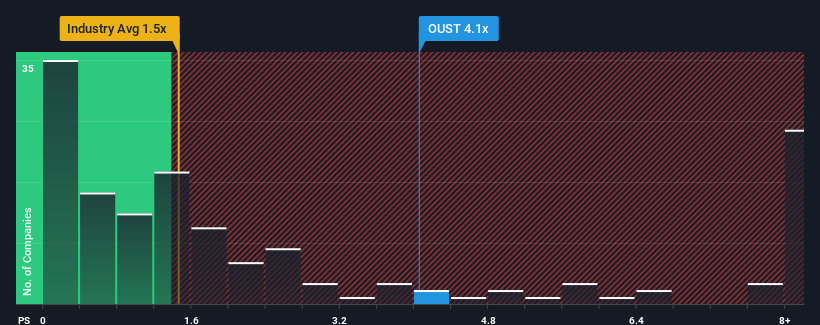

Although its price has dipped substantially, given around half the companies in the United States' Electronic industry have price-to-sales ratios (or "P/S") below 1.5x, you may still consider Ouster as a stock to avoid entirely with its 4.1x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Ouster

What Does Ouster's P/S Mean For Shareholders?

Recent times have been advantageous for Ouster as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying to much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Ouster will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as Ouster's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an exceptional 22% gain to the company's top line. The latest three year period has also seen an excellent 259% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 101% each year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 31% each year, which is noticeably less attractive.

With this information, we can see why Ouster is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Even after such a strong price drop, Ouster's P/S still exceeds the industry median significantly. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Ouster shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 5 warning signs for Ouster (of which 3 make us uncomfortable!) you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:OUST

Ouster

Provides lidar sensors for the automotive, industrial, robotics, and smart infrastructure industries in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet slight.

Similar Companies

Market Insights

Community Narratives