- United States

- /

- Communications

- /

- NYSE:MSI

A Fresh Look at Motorola Solutions (MSI) Valuation After Record Q2 Results and Upgraded Outlook

Reviewed by Simply Wall St

Most Popular Narrative: 6.1% Undervalued

According to community narrative, analysts currently view Motorola Solutions as undervalued by just over 6% based on its future earnings potential and sector dynamics.

The accelerating focus on public safety and security, fueled by heightened geopolitical instability, border security needs, and new government funding programs such as the "One Big Beautiful Bill", is driving strong, sustained customer demand for advanced, integrated communication solutions. This expanding long-term tailwind is evident in Motorola's record Q2 orders, growing backlog, and consistent multi-year contract wins, which support above-trend revenue growth and durability.

Wondering why this valuation is drawing attention? Here’s a hint: the community narrative centers on a profit trajectory that is rarely seen in the sector, supported by above-trend growth assumptions and bold margin forecasts. Interested in which numbers underpin this optimistic price target or what would need to happen for these projections to become reality? Explore the remarkable financial blueprint at the heart of this valuation story.

Result: Fair Value of $500.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, there are still potential obstacles, such as slower adoption of new software solutions or increased competition, that could disrupt Motorola Solutions' projected growth story.

Find out about the key risks to this Motorola Solutions narrative.Another View: What Does Our DCF Model Indicate?

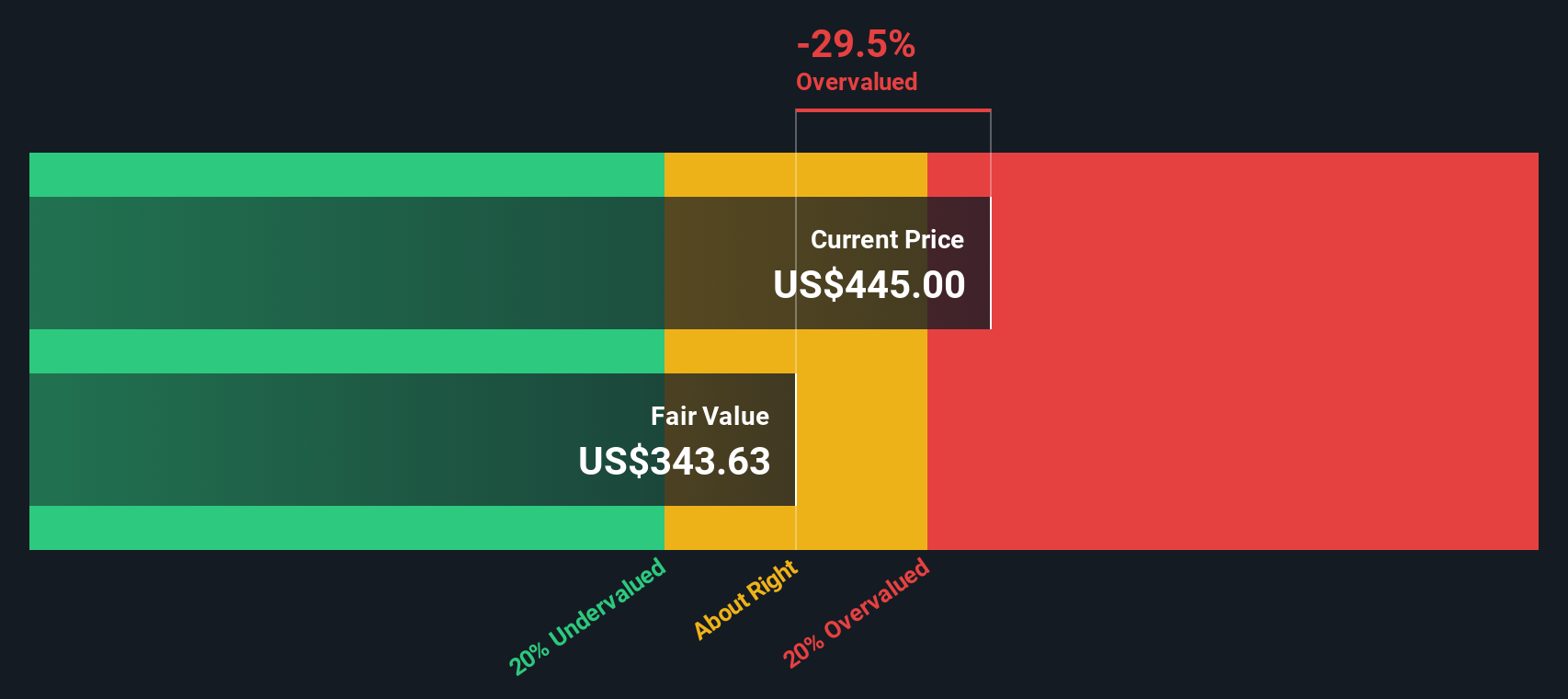

Taking a different perspective, the SWS DCF model suggests a less optimistic picture compared to the market-based narrative. This analysis indicates that Motorola Solutions may actually be overvalued at current levels. Which approach will prove more accurate in the long run?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Motorola Solutions Narrative

If you have a different take or want to dig into the numbers on your own, the tools are here to help shape your own perspective in just minutes. Do it your way.

A great starting point for your Motorola Solutions research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Picks?

Why stop at one opportunity? Genuine growth often starts with fresh research and a willingness to seize what others overlook. Make your next move count and stay ahead of the crowd by checking out these hand-picked stock ideas that could reshape your portfolio:

- Get ahead of the curve with stocks benefiting from the artificial intelligence surge by using AI penny stocks, which is designed for investors interested in powerful new technology trends.

- Tap into real value by identifying companies trading below their true worth with our resource for undervalued stocks based on cash flows, and find bargains before the rest of the market takes notice.

- Boost your income potential by focusing on companies that offer attractive yields by scanning dividend stocks with yields > 3% and secure compelling cash returns for your future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:MSI

Motorola Solutions

Provides public safety and enterprise security solutions in the United States, the United Kingdom, Canada, and internationally.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)