Jabil (JBL) Valuation Recheck After AI Rotation, Cooling Constraints and New Growth Investments

Reviewed by Simply Wall St

Jabil (JBL) just got caught in the latest market rotation, sliding after investors stepped back from AI exposed manufacturers. But that pullback is colliding with a busy stretch of operational and governance developments.

See our latest analysis for Jabil.

Despite the latest 5.1% one day share price drop to about $222, Jabil still shows strong momentum, with a roughly mid 50s year to date share price return and a powerful multi year total shareholder return above 400%. This suggests investors are reassessing timing rather than abandoning the long term story.

If you are weighing Jabil’s AI exposed upside against broader tech opportunities, this is a good moment to scan other high growth tech and AI names with high growth tech and AI stocks.

So with shares still up strongly this year, a modest discount to price targets, and big 2026 to 2027 projects in the pipeline, is Jabil quietly undervalued, or is the market already pricing in that next leg of growth?

Most Popular Narrative Narrative: 9.5% Undervalued

Jabil's most followed narrative pegs fair value modestly above the recent 222 dollars close, framing upside around multi year growth and capital returns.

The analysts have a consensus price target of $227.5 for Jabil based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $256.0, and the most bearish reporting a price target of just $176.0.

Curious what kind of earnings ramp, margin rebuild, and share count shrink could justify that valuation path? Want to see the specific levers and timing?

Result: Fair Value of $245.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering weakness in EV and renewable demand, combined with elevated inventory days, could cap margins and slow the expected earnings ramp.

Find out about the key risks to this Jabil narrative.

Another View Through Market Multiples

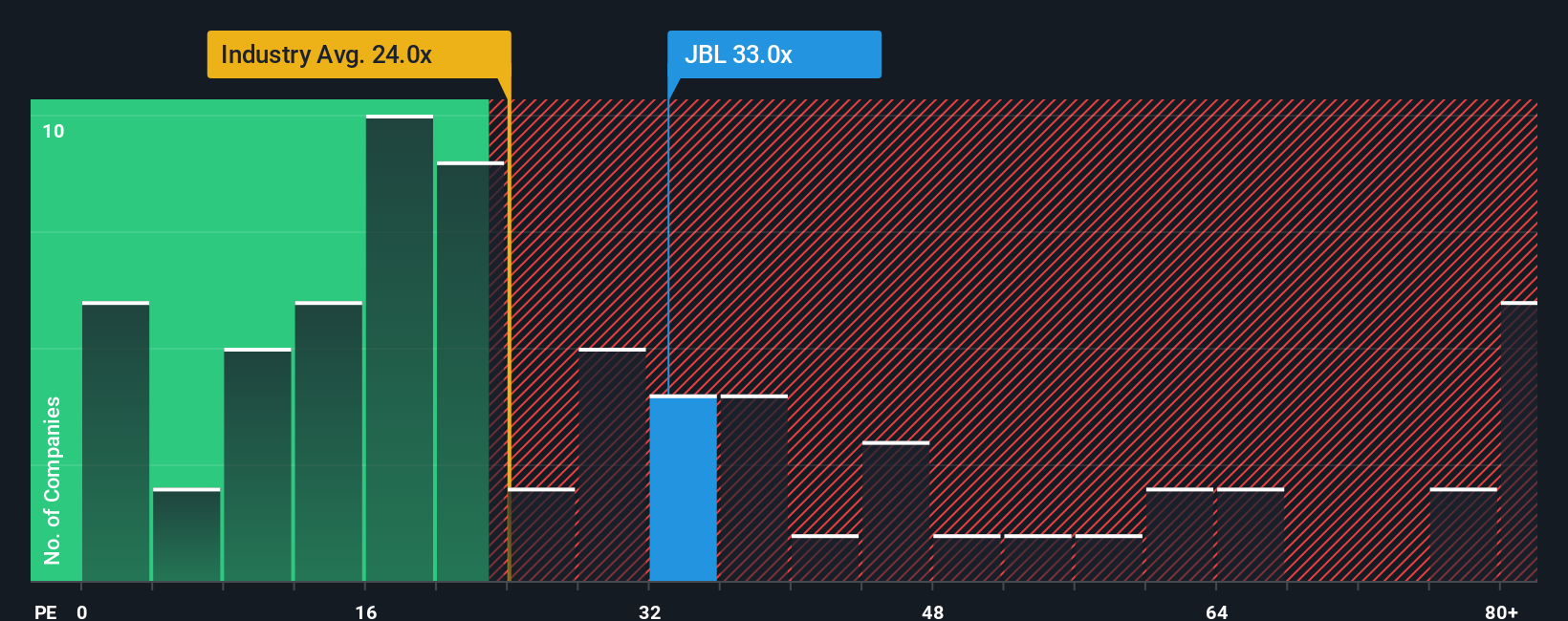

Step away from intrinsic models and Jabil looks a lot richer. Its price to earnings ratio sits at 36.2 times, above both the Electronic industry’s 25.8 times and our fair ratio estimate of 31.5 times. This hints the market may already be baking in a lot of good news. Is this premium really worth paying at this stage of the cycle?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Jabil Narrative

If our angle does not quite fit your view and you prefer hands on research, you can build a tailored narrative yourself in just minutes: Do it your way.

A great starting point for your Jabil research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at one opportunity when a whole universe of stocks is within reach. Use the Simply Wall Street Screener to explore a wider range of possibilities.

- Capture growth early by scanning these 3609 penny stocks with strong financials that pair low share prices with relatively strong balance sheets and fundamentals.

- Tap into emerging innovations with these 27 quantum computing stocks that are advancing computing power and real world problem solving.

- Seek steadier income streams by targeting these 13 dividend stocks with yields > 3% that may help support total returns across different market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JBL

Jabil

Provides engineering, manufacturing, and supply chain solutions worldwide.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)