- United States

- /

- Tech Hardware

- /

- NYSE:IONQ

IonQ (NYSE:IONQ) Sees 21% Drop Following CEO Change And Board Shakeup

Reviewed by Simply Wall St

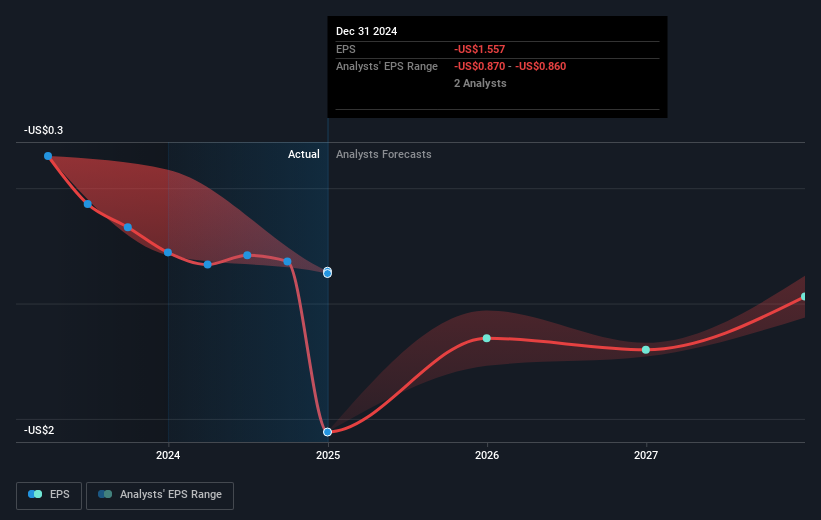

Last week, IonQ (NYSE: IONQ) faced significant changes, including the appointment of Niccolo de Masi as CEO and Gabrielle Toledano to the Board, while Harry You stepped down. Against a backdrop of economic concern, the company's stock saw a 21% decline, possibly influenced by the $500M equity offering filing and the announcement of widened net losses of $332M for 2024. These financial results, coupled with IonQ's revenue projections for 2025 and its talks to acquire ID Quantique, reflect a period of transformation. Meanwhile, broader market trends featured a 1.3% market drop and investor caution amid persistent economic worries, contributing to a climate of uncertainty. The company's stock performance paralleled a tech sector downturn, with Nvidia and other tech frontrunners seeing losses amidst tariff announcements and weak manufacturing data. The combination of company-specific events and macroeconomic conditions likely led to IonQ's noticeable stock price movement during the week.

Take a closer look at IonQ's potential here.

Over the past year, IonQ, Inc. has demonstrated a total shareholder return of 143.51%, marking significant progress in the quantum computing sector. This impressive gain surpasses the US Market's return of 15.3% and the broader US Tech industry's 31.8% return for the same period. IonQ's achievements are underscored by successful client agreements, such as the $54.5 million contract with the U.S. Air Force Research Lab for quantum technology, and a renewed partnership with Abu Dhabi’s Quantum Research Center. These initiatives highlight IonQ’s commitment to advancing quantum technology.

IonQ's forward-looking revenue guidance, projecting between $75 million and $95 million for 2025, alongside a strategic follow-on equity offering of $500 million in common stock, further emphasizes its growth trajectory. Product innovation has also been strong, evidenced by delivering the IonQ Forte Enterprise to Switzerland’s QuantumBasel and launching the IonQ Quantum OS. Together, these elements reinforce IonQ’s place within the technological frontier, despite the challenges of unprofitability and a highly volatile share price.

- Discover whether IonQ is fairly priced, undervalued, or overvalued in our comprehensive valuation breakdown.

- Uncover the uncertainties that could impact IonQ's future growth—read our risk evaluation here.

- Got skin in the game with IonQ? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IONQ

IonQ

Engages in the development of general-purpose quantum computing systems in the United States.

Excellent balance sheet low.

Similar Companies

Market Insights

Community Narratives