- United States

- /

- Tech Hardware

- /

- NYSE:IONQ

IonQ (NYSE:IONQ) Partners With Einride To Revolutionize Fleet Optimization With Quantum Technology

Reviewed by Simply Wall St

IonQ (NYSE:IONQ) recently announced a strategic investment partnership with Einride, highlighting its commitment to leveraging quantum computing in logistics and fleet optimization. This, coupled with new global partnerships and the development of a quantum innovation center, aligns with IonQ's aggressive expansion strategy, potentially contributing to its 37% price increase over the past month. Despite the market being relatively flat and uncertain around tax policies and rising Treasury yields, IonQ's specific advancements in quantum applications may have provided confidence to investors, differentiating its performance amidst broader market concerns. These developments could have countered any market headwinds.

We've identified 4 weaknesses for IonQ (1 is potentially serious) that you should be aware of.

Outshine the giants: these 28 early-stage AI stocks could fund your retirement.

Over a period of three years, IonQ's total return, including share price movements and dividends, has been very large, demonstrating its capacity to generate significant shareholder value. In contrast, its performance over the past year was more modest compared to the US Tech industry, which returned 6%. These metrics highlight the substantial impact of IonQ’s advancements and partnerships on its stock's longer-term trajectory.

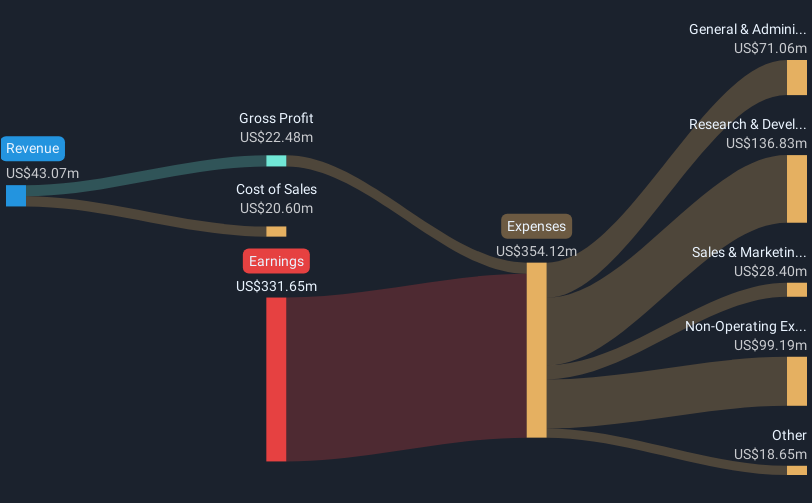

The recent strategic developments and announcements potentially position IonQ to drive future revenue growth, with forecasts showing an anticipated rise of 40.98% per year. Despite the company's current unprofitability, these initiatives may bolster future earnings, although they are expected to decline by an average of 2.2% per year. The recent price surge aligns closely with the consensus analyst price target of US$40.0, indicating a market valuation reflective of anticipated strong growth and strategic accomplishments.

Click here to discover the nuances of IonQ with our detailed analytical financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade IonQ, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IONQ

Flawless balance sheet slight.

Similar Companies

Market Insights

Community Narratives