- United States

- /

- Tech Hardware

- /

- NYSE:IONQ

IonQ (IONQ) Rallies 11.4% After Raising $2 Billion for Quantum Technology Expansion Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- IonQ has completed a follow-on equity offering, raising approximately US$2 billion through the sale of 16,500,000 common shares and multiple warrant classes to support its technology expansion and R&D initiatives.

- This major capital injection follows a series of rapid advancements by IonQ in quantum networking and sensing, as well as the recent appointment of former U.S. Space Force Chief General John Raymond to its board, highlighting its strong momentum in both technology and leadership.

- We'll explore how this substantial capital raise strengthens IonQ’s investment narrative as the company accelerates growth in cutting-edge quantum technologies.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is IonQ's Investment Narrative?

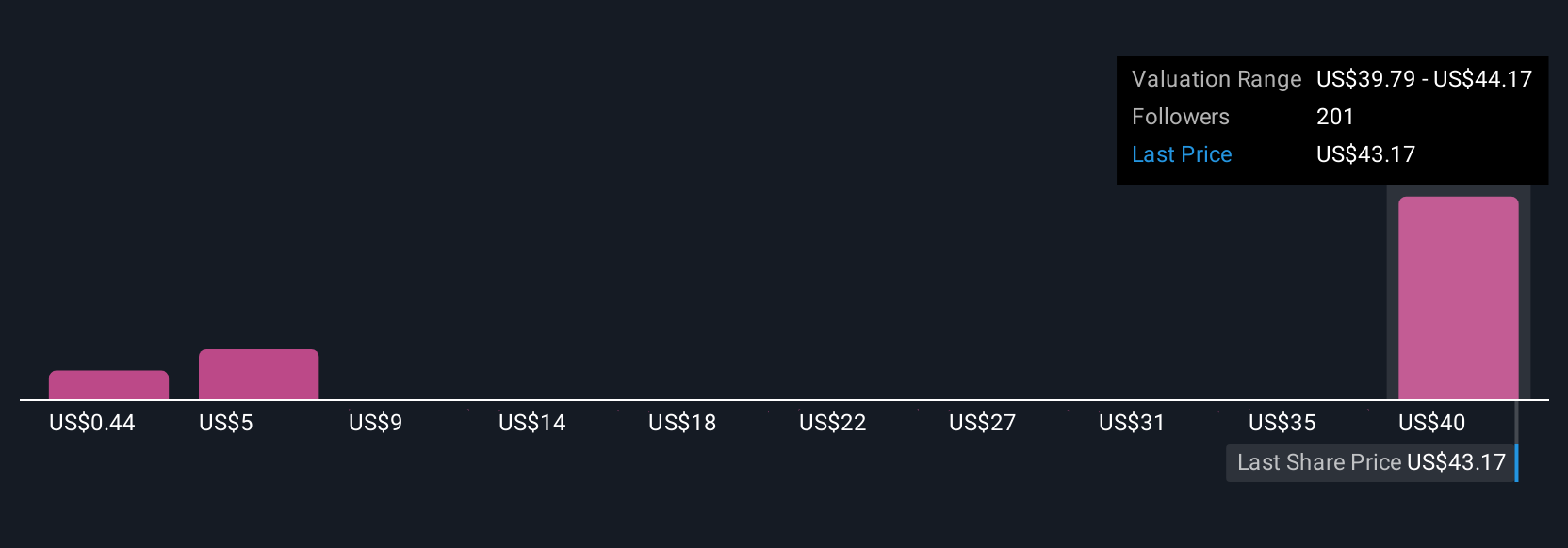

For shareholders, the core question is whether IonQ can leverage quantum technology breakthroughs into lasting commercial dominance before competitors or capital constraints intervene. The recent US$2 billion equity offering is a significant moment. On the one hand, this strengthens the company’s ability to accelerate research, forge partnerships, and scale its quantum platform, directly supporting growth catalysts like its push into quantum networking, government projects, and emerging defense and aerospace opportunities. It also sends a strong signal amid a period of rapid revenue growth and headline-grabbing board appointments, even as the business continues to operate at a loss. However, this capital raise brings fresh risks into focus: meaningful shareholder dilution and amplified scrutiny of IonQ’s high valuation and cash burn, especially since analyst and community price targets signal only a modest upside from current levels. Recent share price volatility suggests that while the capital infusion addresses funding risk, concern remains around profitability timelines and whether expectations have run ahead of execution.

But not all investors will appreciate the potential for further dilution in the months ahead. Our expertly prepared valuation report on IonQ implies its share price may be too high.Exploring Other Perspectives

Explore 62 other fair value estimates on IonQ - why the stock might be worth less than half the current price!

Build Your Own IonQ Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IonQ research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free IonQ research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IonQ's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IONQ

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives