- United States

- /

- Tech Hardware

- /

- NYSE:IONQ

IonQ (IONQ) Appoints New CFO and Unveils Quantum Hardware Breakthrough

Reviewed by Simply Wall St

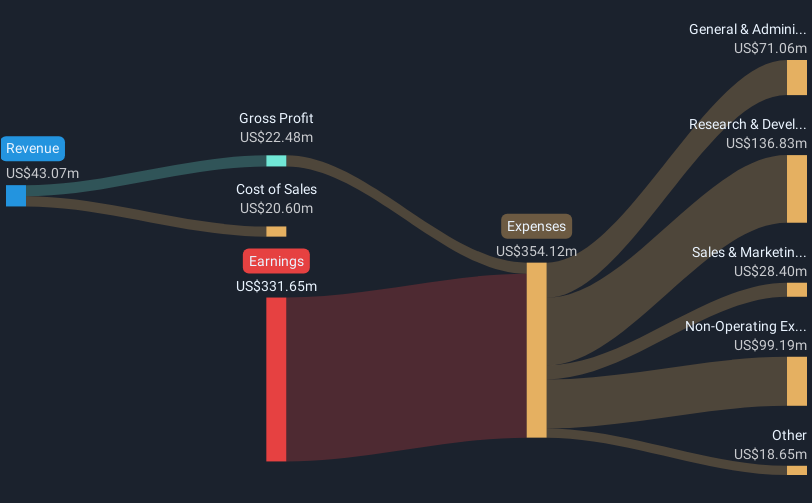

IonQ (IONQ) has witnessed a range of strategic developments in the last quarter, marked by the dual appointment of Inder M. Singh as both Chief Operating Officer and Chief Financial Officer. His leadership, alongside the breakthrough collaboration with Element Six to advance quantum technology, has added momentum to the company's position in its industry. Over this period, IonQ's stock price registered an 12% increase, which aligns with broader market growth supported by strong technology stock performances. These company-specific developments, while impactful, complemented the overall positive sentiment across tech sectors amid expectations of a potential Federal Reserve rate cut.

Over the past three years, IonQ's total shareholder return has been notably high at over 500%, showcasing a significant increase in investor value. Compared to the average 18.1% return of the US market and 8.8% return of the US Tech industry over the past year, IonQ has outperformed both by a considerable margin. This suggests robust investor confidence and growing interest in the company's potential within the quantum computing space.

The recent leadership appointments and strategic collaborations are expected to influence IonQ's revenue and earnings forecasts positively. The introduction of Inder M. Singh as COO and CFO, coupled with advancements in quantum technology, may enhance operational efficiency and drive future growth. Moreover, the stock's recent 12% price increase positions it closer to the US$51 consensus analyst price target, though still leaving room for potential upward movement. This target is significantly higher than the current share price, reflecting analysts' optimism about the company's growth trajectory despite its current lack of profitability.

Unlock comprehensive insights into our analysis of IonQ stock in this financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IONQ

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives