Ingram Micro Holding (INGM): Valuation Check After Dual 2025 AWS Global Distributor Partner Awards

Reviewed by Simply Wall St

Ingram Micro Holding (INGM) just picked up two major 2025 AWS Partner Awards, including Global Distributor Partner of the Year, putting a fresh spotlight on how its cloud ecosystem clout might influence its future growth.

See our latest analysis for Ingram Micro Holding.

Despite a recent downgrade driven dip, Ingram Micro Holding's $21.84 share price sits on a solid footing, with a 9.42 percent 1 month share price return and 5.91 percent 1 year total shareholder return suggesting momentum is gently rebuilding as its AWS awards and new partnerships reinforce the growth narrative.

If the AWS accolades have you rethinking cloud infrastructure plays, it could be worth scanning other high growth tech and AI names using high growth tech and AI stocks to explore what the market might be pricing next.

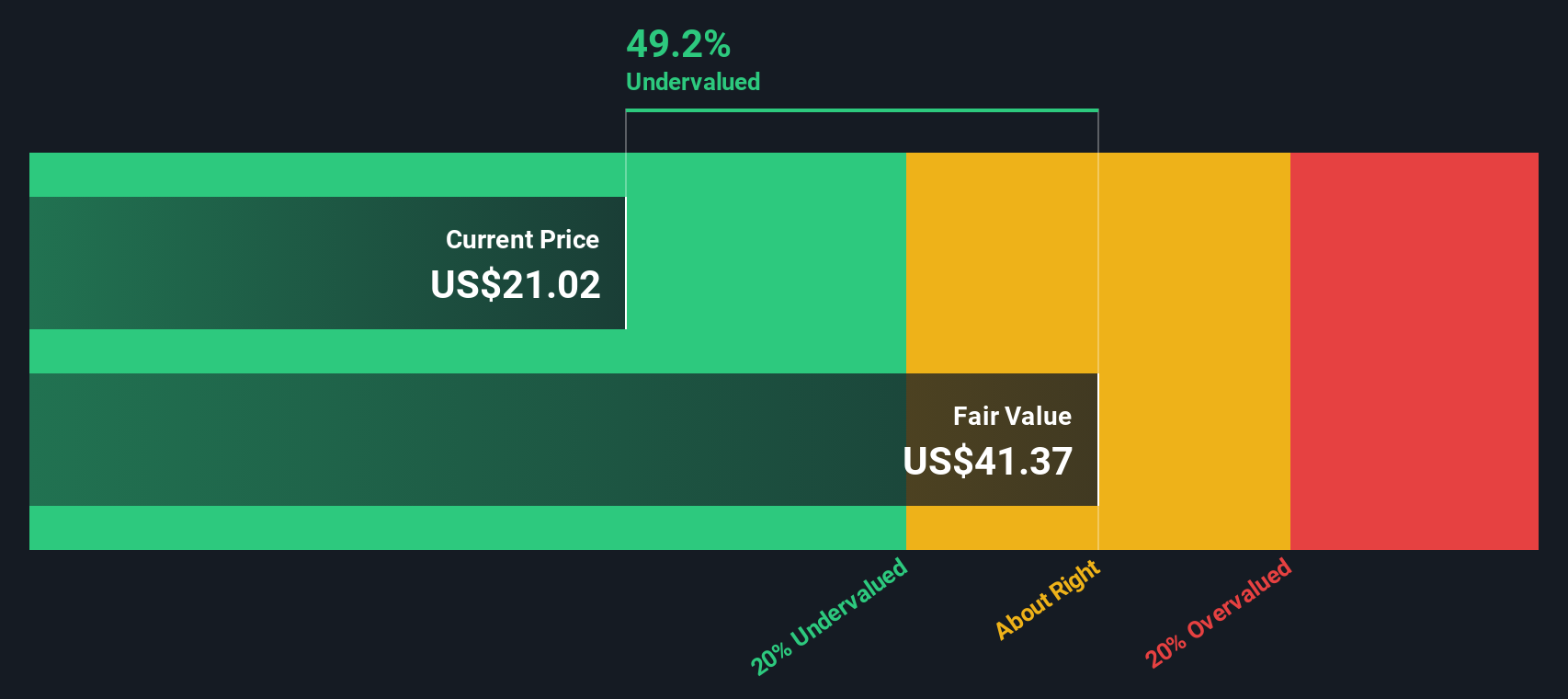

With analysts still seeing upside to fair value and AWS momentum driving fresh optimism, the key question now is whether Ingram Micro shares remain undervalued or if the market is already pricing in the next leg of growth.

Price to Earnings of 17.7x: Is It Justified?

On a price to earnings ratio of 17.7 times and a last close of $21.84, Ingram Micro Holding appears attractively valued versus its implied earnings power and peers.

The price to earnings ratio compares the company share price with its per share earnings. It is a straightforward way to gauge how much investors are paying for each dollar of profit in a hardware, distribution and cloud services business like Ingram Micro.

Ingram Micro is judged to be good value versus its own earnings potential, with the SWS fair price to earnings ratio estimated at 30.6 times. This implies the current multiple could rise meaningfully if forecast profit growth materialises.

Against the broader US Electronic industry, where the average price to earnings multiple sits at 24.7 times, Ingram Micro trades at a marked discount. It is, however, seen as slightly more expensive than a narrower peer set on 16 times.

Explore the SWS fair ratio for Ingram Micro Holding

Result: Price to Earnings of 17.7x (UNDERVALUED)

However, softer global IT spending or a slowdown in AWS related demand could quickly test whether recent optimism and valuation support are truly durable.

Find out about the key risks to this Ingram Micro Holding narrative.

Another Angle on Value

Our DCF model paints a much stronger upside story, suggesting Ingram Micro Holding is trading about 41.6 percent below its estimated fair value of $37.42 per share. If both earnings multiples and long term cash flows point to value, is the market still underestimating this AWS fueled pivot?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ingram Micro Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ingram Micro Holding Narrative

If you would rather dive into the numbers yourself and shape your own view of Ingram Micro Holding, you can build a custom narrative in just a few minutes, Do it your way.

A great starting point for your Ingram Micro Holding research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at one opportunity; use the Simply Wall Street Screener to uncover fresh, data driven ideas before the market fully catches on.

- Capture potential price rebounds early by scanning these 3625 penny stocks with strong financials that already show solid financial underpinnings and room for sentiment to turn.

- Position ahead of the next tech wave by targeting these 25 AI penny stocks shaping automation, data intelligence and the next generation of productivity gains.

- Lock in value while it lasts by filtering for these 908 undervalued stocks based on cash flows where cash flows hint that the current market price underestimates future strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:INGM

Ingram Micro Holding

Through its subsidiaries, distributes information technology products, cloud, and other services in North America, Europe, the Middle East, Africa, the Asia-Pacific, Latin America, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)