- United States

- /

- Tech Hardware

- /

- NYSE:HPQ

HP (NYSE:HPQ) Unveils AI-Powered PCs And Print Tools To Transform Work And Gaming Experiences

Reviewed by Simply Wall St

HP (NYSE:HPQ) experienced a modest price increase of 0.3% over the past week, amid a backdrop of significant product launches and technological advancements at its Annual Amplify Conference on March 18, 2025. The introduction of over 80 new products and AI-powered services, such as the redesign of the HP EliteBook 8 Series and innovative automation tools for SMBs, reflects HP's strategic focus on enhancing productivity and work experiences. These timely product enhancements align with the rising demand for improved work dynamics, as illustrated by the 2024 Work Relationship Index. This comes as broader market indices such as the Nasdaq Composite and S&P 500 also saw positive momentum, fueled by anticipation surrounding the Federal Reserve's policy statements. While HP's incremental price movement mirrors the market's cautious optimism, its dedication to AI and technological innovation might be positioning the company favorably amid fluctuating investor sentiments.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Over the last five years, HP's total shareholder return, including share price appreciation and dividends, was 118.54%. This impressive performance was shaped by several key factors. A substantial share buyback program, completed 57.12% of an $18.4 billion planned repurchase, significantly reduced the number of shares outstanding, potentially boosting returns. Earnings reports over the period revealed consistent revenue streams, with the most recent quarter showing US$13.50 billion in revenue. Product innovation played a role too. Initiatives like the HP Reverb G2 Omnicept VR headset and solutions for hybrid workplaces indicated HP's agility in adapting to market demands, driving engagement.

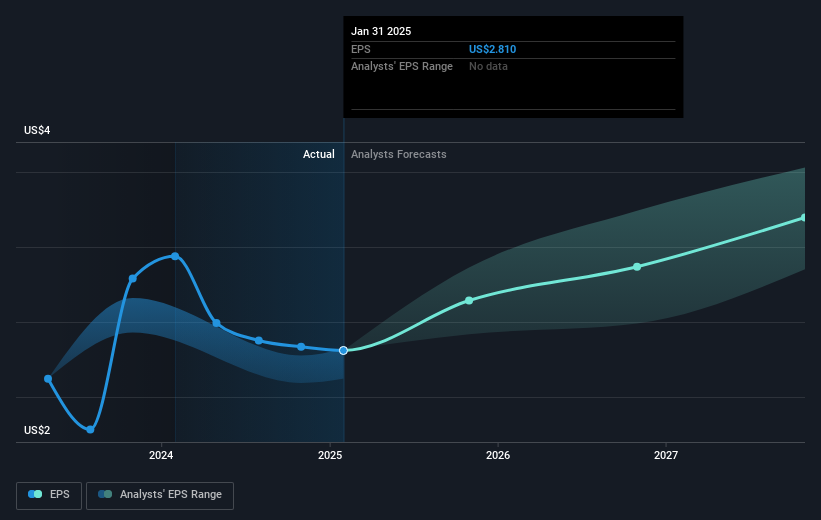

Despite these advances, HP underperformed the broader US Tech industry over the past year. This gap highlights challenges, including a 1% decline in net profit margins recently. However, its valuation, with a Price-To-Earnings Ratio markedly below both fair estimates and industry averages, suggests investor interest remains. Analyst consensus also indicates optimism, with targets projecting a 24.9% price increase.

Learn about HP's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HPQ

HP

Provides personal computing, printing, 3D printing, hybrid work, gaming, and other related technologies in the United States and internationally.

Very undervalued average dividend payer.