- United States

- /

- Tech Hardware

- /

- NYSE:HPE

Hewlett Packard Enterprise (NYSE:HPE) Empowers Lupin with Advanced Private Cloud Solution

Reviewed by Simply Wall St

Hewlett Packard Enterprise (NYSE:HPE) recently announced a new partnership with Lupin Limited aimed at enhancing the pharmaceutical giant's cloud infrastructure. This development may have added weight to HPE's 3.16% price move last week, aligning with a broader market surge led by significant earnings reports. The tech sector, buoyed by strong performances from major players and hopes surrounding potential tariff reductions, experienced a positive trend. The collaboration with Lupin underscores HPE's positon in cloud solutions, contributing to the company's favorable position within the tech rally.

Be aware that Hewlett Packard Enterprise is showing 1 weakness in our investment analysis.

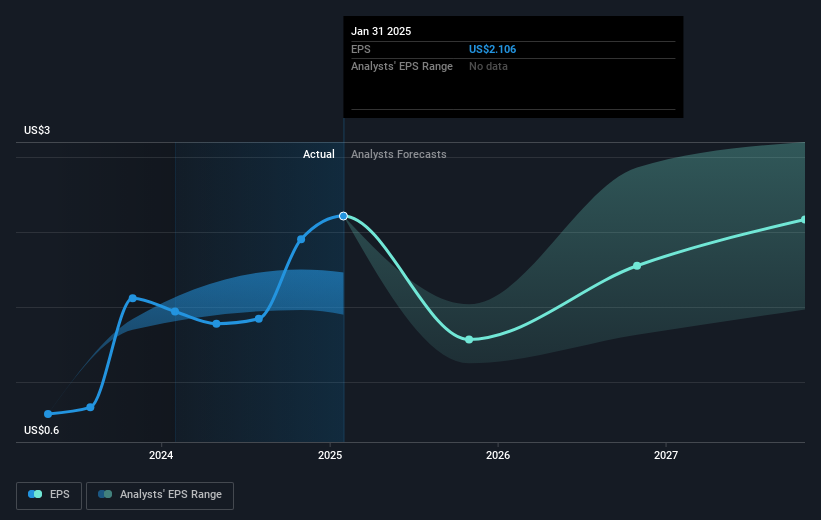

The recently announced partnership between Hewlett Packard Enterprise (HPE) and Lupin Limited could bolster HPE's cloud infrastructure capabilities, underpinning the company's attempts to capture AI workloads through its GreenLake strategy. This collaboration may positively influence revenue and earnings forecasts, particularly with HPE's focus on high-margin offerings and AI systems. However, regulatory and competitive challenges cloud the optimism. The DOJ lawsuit over the Juniper Networks acquisition, if resolved unfavorably, could negate anticipated synergies of US$450 million, affecting future forecasts significantly.

Over the past five years, HPE's total shareholder return, including dividends, reached 75.10%. This indicates a positive performance over a longer-term horizon, despite underperformance relative to the US Tech industry last year, which returned 17.8%. Such long-term gains should be considered against a backdrop of a challenging market environment marked by intense competition and evolving product lines.

HPE’s current share price stands at US$15.15, reflecting a discount of approximately 23.6% to the consensus analyst price target of US$18.98. This market price suggests that analysts remain optimistic about the company's potential near-term growth and synergies despite the existing challenges. The collaboration with Lupin could add positive momentum, but the share price's alignment with analysts’ expectations largely hinges on the successful integration of AI strategies and potential regulatory setbacks. It's crucial to continuously assess the impact of these developments on HPE's financial health and market positioning.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Hewlett Packard Enterprise, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hewlett Packard Enterprise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HPE

Hewlett Packard Enterprise

Provides solutions that allow customers to capture, analyze, and act upon data seamlessly in the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives