- United States

- /

- Tech Hardware

- /

- NYSE:HPE

Hewlett Packard Enterprise (HPE) Launches US$2.9 Billion Notes Offering

Reviewed by Simply Wall St

Hewlett Packard Enterprise (HPE) recently launched an offering of $900 million in notes, a move indicative of strategic financial management. This decision came amid a robust market environment, with major U.S. stock indexes hitting record highs driven by favorable inflation data and expectations of rate cuts by the Federal Reserve. HPE's share price rose by 35% in the last quarter, a performance that aligns with the overall market uptrend. The company's debt financing and dividend declarations might have bolstered investor confidence, although broader market trends likely played a more significant role in this gain.

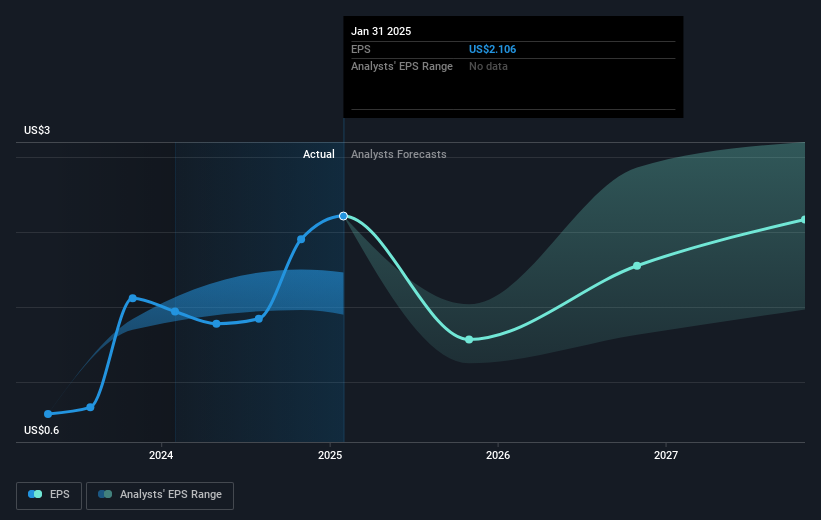

The recent offering of $900 million in notes by Hewlett Packard Enterprise (HPE) could have several implications for its revenue and earnings forecasts. The capital raised may enhance its capacity to execute strategic initiatives in AI, networking, and cloud services, aligning with its ongoing transition to high-margin segments. Such financial bolstering may also support improvements in operational efficiencies and free cash flow, potentially accelerating earnings growth. However, this debt increase may elevate financial risk if not managed alongside robust cash flow generation.

Over a five-year period, HPE has achieved a substantial total shareholder return of 198.79%. This impressive increase reflects both share price appreciation and dividend payments. Over the past year, HPE's returns surpassed the broader market, exceeding the US market's 19.1% return. This relative outperformance underscores HPE's current position as a competitive player in the tech industry.

With analysts setting a price target of US$25.51, the current share price of US$24.44 represents a slight discount of approximately 4.39%. This minimal difference may suggest that analysts believe HPE's current valuation aligns closely with its fair value, assuming the company meets earnings and revenue expectations moving forward. Investors should consider how the note offering impacts future growth and profitability as they evaluate this near-term price target.

Learn about Hewlett Packard Enterprise's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hewlett Packard Enterprise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HPE

Hewlett Packard Enterprise

Provides solutions that allow customers to capture, analyze, and act upon data seamlessly.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)