- United States

- /

- Software

- /

- NasdaqGS:ADSK

Exploring High Growth Tech Stocks In The US Market

Reviewed by Simply Wall St

As the U.S. stock market navigates a landscape marked by record highs and mixed trading sessions, investor optimism is fueled by strong corporate earnings and resilient economic indicators, despite ongoing concerns about tariffs. In this environment, high growth tech stocks can be particularly appealing due to their potential for innovation and expansion, making them a focal point for investors seeking opportunities in the dynamic U.S. market.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 25.17% | 38.20% | ★★★★★★ |

| Circle Internet Group | 30.80% | 60.64% | ★★★★★★ |

| Ardelyx | 21.16% | 61.61% | ★★★★★★ |

| TG Therapeutics | 26.05% | 39.12% | ★★★★★★ |

| AVITA Medical | 27.39% | 61.05% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.97% | 59.13% | ★★★★★★ |

| Alkami Technology | 20.53% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 34.90% | 59.91% | ★★★★★★ |

| Caris Life Sciences | 24.80% | 72.64% | ★★★★★★ |

| Lumentum Holdings | 21.33% | 105.07% | ★★★★★★ |

Click here to see the full list of 224 stocks from our US High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Autodesk (ADSK)

Simply Wall St Growth Rating: ★★★★☆☆

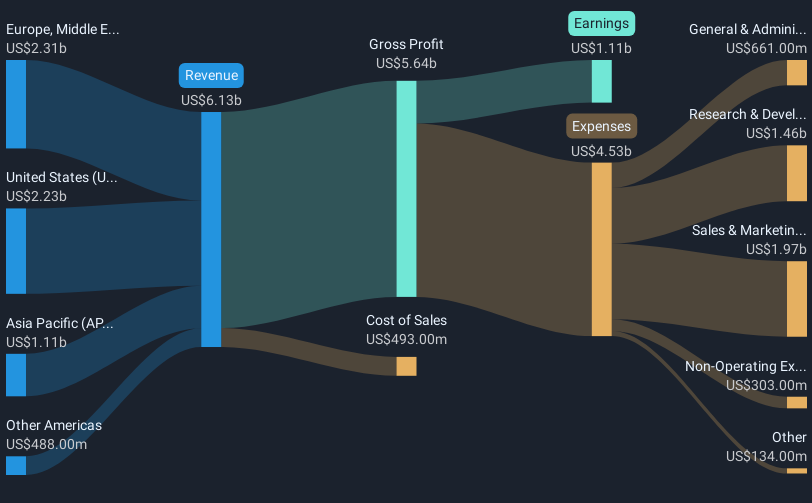

Overview: Autodesk, Inc. is a global provider of 3D design, engineering, and entertainment technology solutions with a market cap of approximately $61.93 billion.

Operations: Autodesk generates revenue primarily from its CAD/CAM software segment, which accounts for $6.35 billion.

Autodesk, a key player in the engineering software sector, is actively exploring growth through potential acquisitions, notably considering a significant deal with PTC Inc. This strategic move could enhance its market position and product offerings, signaling robust future prospects. Despite facing industry-wide challenges such as a slower earnings growth rate of 1.5% compared to the software industry's 18.9%, Autodesk maintains a strong innovation trajectory with substantial investments in R&D amounting to $1.2 billion annually, representing about 11% of its revenue. This commitment supports sustained advancements and competitiveness in evolving tech landscapes. Additionally, recent executive board enhancements aim to bolster governance and strategic oversight, potentially driving improved operational efficiencies and market responsiveness.

- Dive into the specifics of Autodesk here with our thorough health report.

Gain insights into Autodesk's historical performance by reviewing our past performance report.

Datadog (DDOG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Datadog, Inc. provides an observability and security platform for cloud applications globally, with a market cap of $48.13 billion.

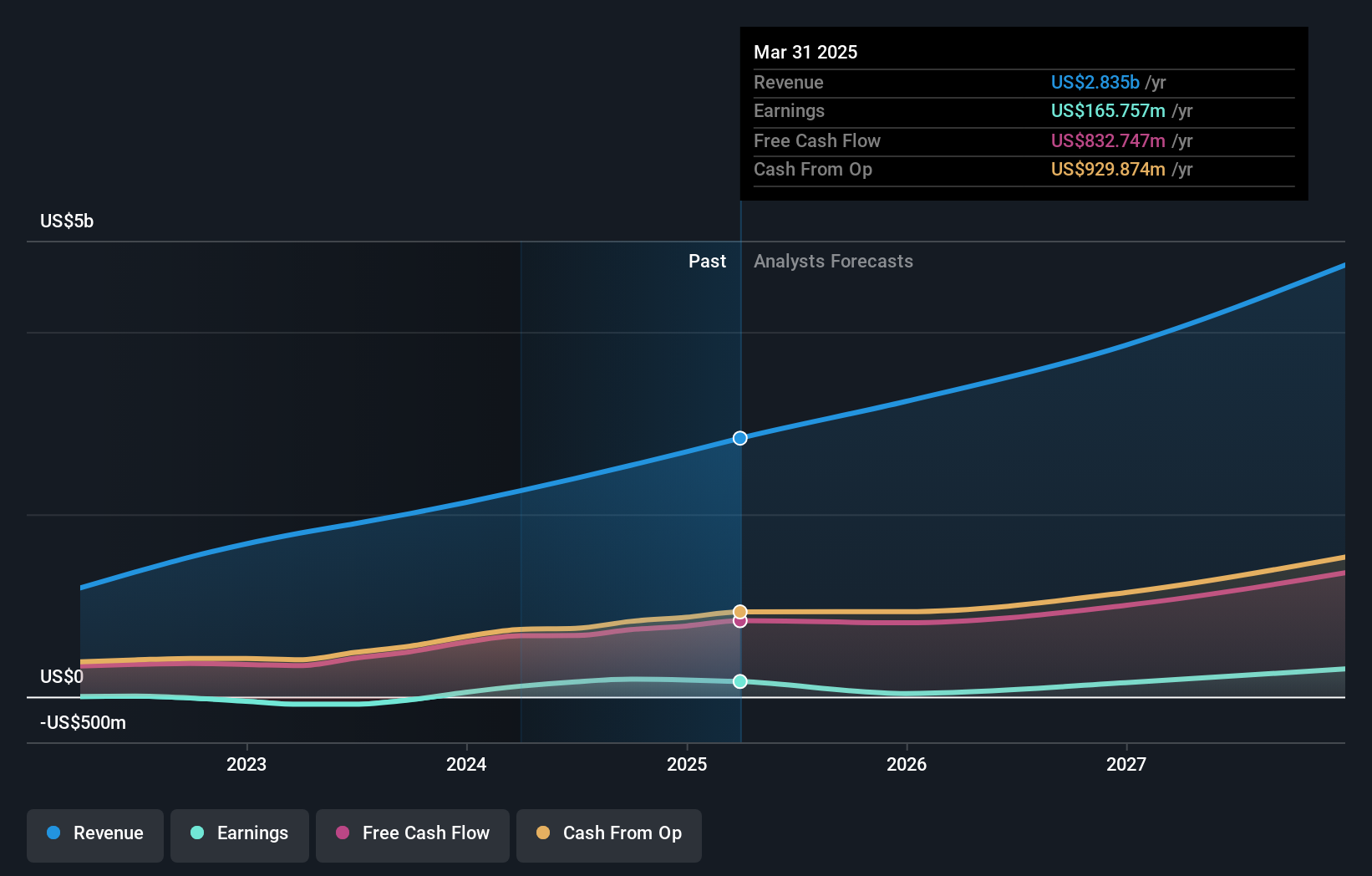

Operations: The company generates revenue primarily from its IT Infrastructure segment, amounting to $2.83 billion.

Datadog has recently demonstrated robust growth and strategic expansions, evidenced by its inclusion in multiple S&P indices and a promising partnership with Reflectiz. This collaboration enhances Datadog's security offerings, integrating advanced threat detection into its cloud-based platform, which is crucial as enterprises increasingly rely on digital infrastructures. Financially, the company forecasts a significant revenue jump to between $3.215 billion and $3.235 billion for the year, up from last quarter's $761.55 million, underlining strong market demand for its services. Moreover, Datadog's earnings growth outpaces the software industry average at 43.8% over the past year compared to 18.9%, signaling superior operational efficiency and innovation in high-growth tech sectors.

Corning (GLW)

Simply Wall St Growth Rating: ★★★★★☆

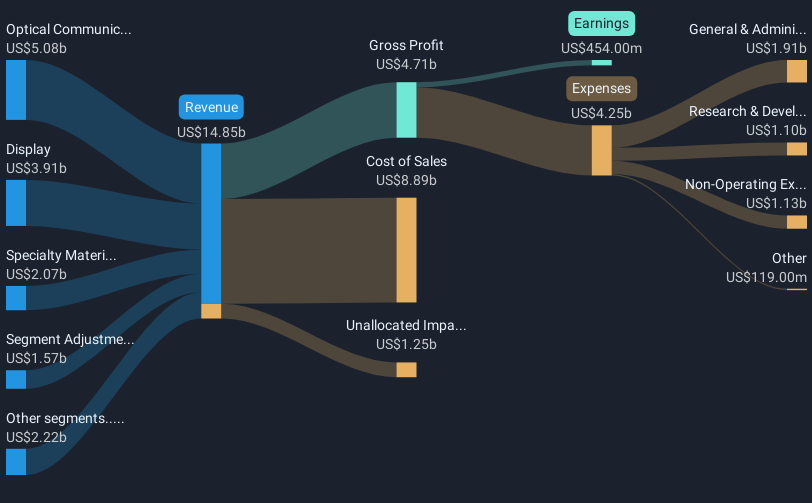

Overview: Corning Incorporated is a company that engages in the optical communications, display technologies, environmental technologies, specialty materials, and life sciences sectors with a market capitalization of approximately $45.37 billion.

Operations: The company generates revenue primarily from optical communications ($5.08 billion) and display technologies ($3.91 billion), with additional contributions from specialty materials and life sciences. The business model includes diverse operations across multiple sectors, allowing for a broad revenue base.

Corning's recent strategic moves, including its collaboration with Broadcom on co-packaged optics infrastructure, underscore its commitment to advancing data center technologies. This partnership is poised to enhance AI capabilities by optimizing networking and processing bandwidth, which is critical as demand for faster and more efficient data processing grows. Despite a drop from the Russell 1000 indices, Corning remains innovative; it repurchased shares worth $100.02 million in Q1 2025, reflecting confidence in its financial strategy. Furthermore, the introduction of Gorilla® Glass Ceramic 21 in Samsung’s new Galaxy model highlights Corning’s ongoing influence in high-tech materials development, combining durability with cutting-edge design to meet evolving consumer electronics standards.

- Click here to discover the nuances of Corning with our detailed analytical health report.

Evaluate Corning's historical performance by accessing our past performance report.

Summing It All Up

- Embark on your investment journey to our 224 US High Growth Tech and AI Stocks selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADSK

Autodesk

Provides 3D design, engineering, and entertainment technology solutions worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives