- United States

- /

- Software

- /

- NasdaqGS:SNPS

Exploring 3 High Growth Tech Stocks In The US Market

Reviewed by Simply Wall St

The United States market has experienced a notable uplift, climbing by 5.8% over the past week and showing a 4.8% increase over the last year, with earnings projected to grow by 14% annually in the coming years. In this environment, identifying high-growth tech stocks involves looking for companies that demonstrate strong innovation and adaptability to capitalize on these favorable market trends.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.44% | 29.79% | ★★★★★★ |

| Arcutis Biotherapeutics | 25.76% | 58.17% | ★★★★★★ |

| TG Therapeutics | 26.03% | 37.60% | ★★★★★★ |

| Alkami Technology | 20.46% | 85.16% | ★★★★★★ |

| Travere Therapeutics | 28.65% | 65.75% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.74% | 58.77% | ★★★★★★ |

| TKO Group Holdings | 22.48% | 25.17% | ★★★★★★ |

| AVITA Medical | 28.22% | 55.77% | ★★★★★★ |

| Lumentum Holdings | 21.61% | 120.49% | ★★★★★★ |

| Ascendis Pharma | 32.36% | 59.79% | ★★★★★★ |

Click here to see the full list of 232 stocks from our US High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Synopsys (NasdaqGS:SNPS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Synopsys, Inc. is a company specializing in electronic design automation software for integrated circuits, with a market capitalization of $65.13 billion.

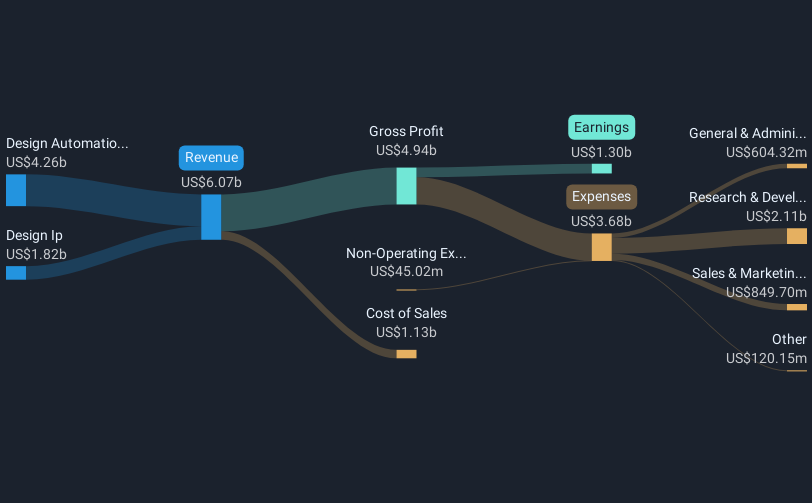

Operations: The company generates revenue primarily from its Design IP and Design Automation segments, with the latter contributing $4.26 billion. It focuses on providing software products for designing and testing integrated circuits.

Synopsys, a leader in electronic design automation, is leveraging its recent collaborations and technological advancements to stay competitive in the high-growth tech sector. Notably, their partnership with NVIDIA aims to accelerate chip design significantly, promising up to a 30x speed improvement using the NVIDIA Grace Blackwell platform. This initiative not only enhances Synopsys' computational lithography capabilities but also positions it well for future growth by integrating advanced AI technologies into its offerings. Furthermore, the company's commitment to innovation is reflected in its substantial R&D expenditure which has consistently been above industry average, ensuring Synopsys remains at the forefront of technological advancements in semiconductor design.

- Dive into the specifics of Synopsys here with our thorough health report.

Evaluate Synopsys' historical performance by accessing our past performance report.

Vertex Pharmaceuticals (NasdaqGS:VRTX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Vertex Pharmaceuticals Incorporated is a biotechnology company focused on developing and commercializing therapies for cystic fibrosis, with a market capitalization of $124.34 billion.

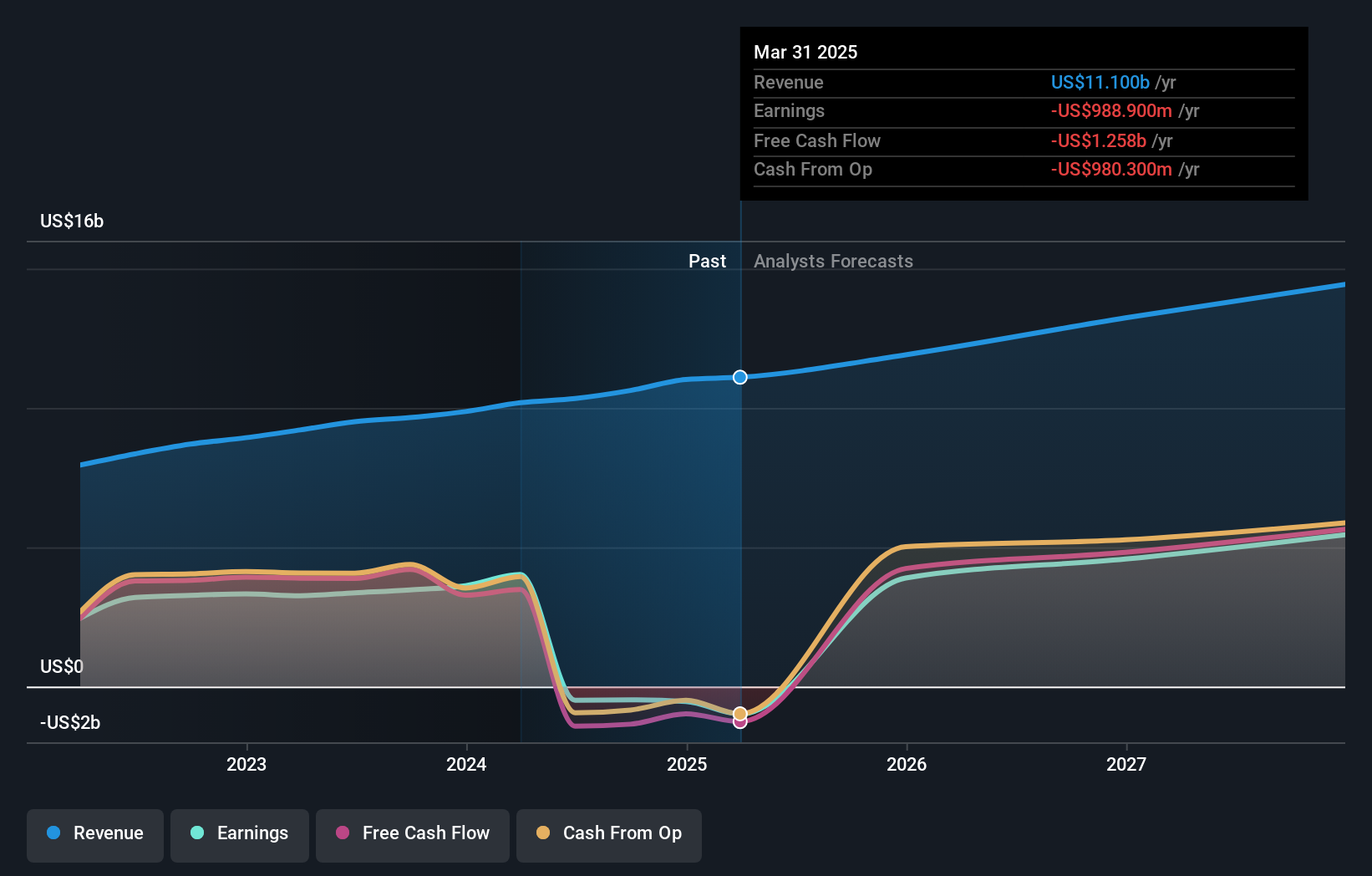

Operations: Vertex Pharmaceuticals generates revenue primarily from its pharmaceutical segment, amounting to $11.02 billion. The company specializes in therapies for cystic fibrosis, leveraging its biotechnology expertise to develop and commercialize these treatments.

Vertex Pharmaceuticals, despite its current unprofitability, is poised for significant growth with expected earnings to surge by 29.2% annually. The company's strategic focus on cystic fibrosis treatments and type 1 diabetes therapies underscores its commitment to addressing complex medical challenges. Recent regulatory approvals in Europe for KAFTRIO® and the ongoing Phase 3 trials of Zimislecel highlight Vertex's robust pipeline and potential market expansion. Moreover, a substantial R&D investment aligns with its innovative drive, supporting long-term growth in a competitive biotech landscape.

Corning (NYSE:GLW)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Corning Incorporated operates in the optical communications, display technologies, environmental technologies, specialty materials, and life sciences sectors both in the United States and internationally, with a market capitalization of approximately $35.35 billion.

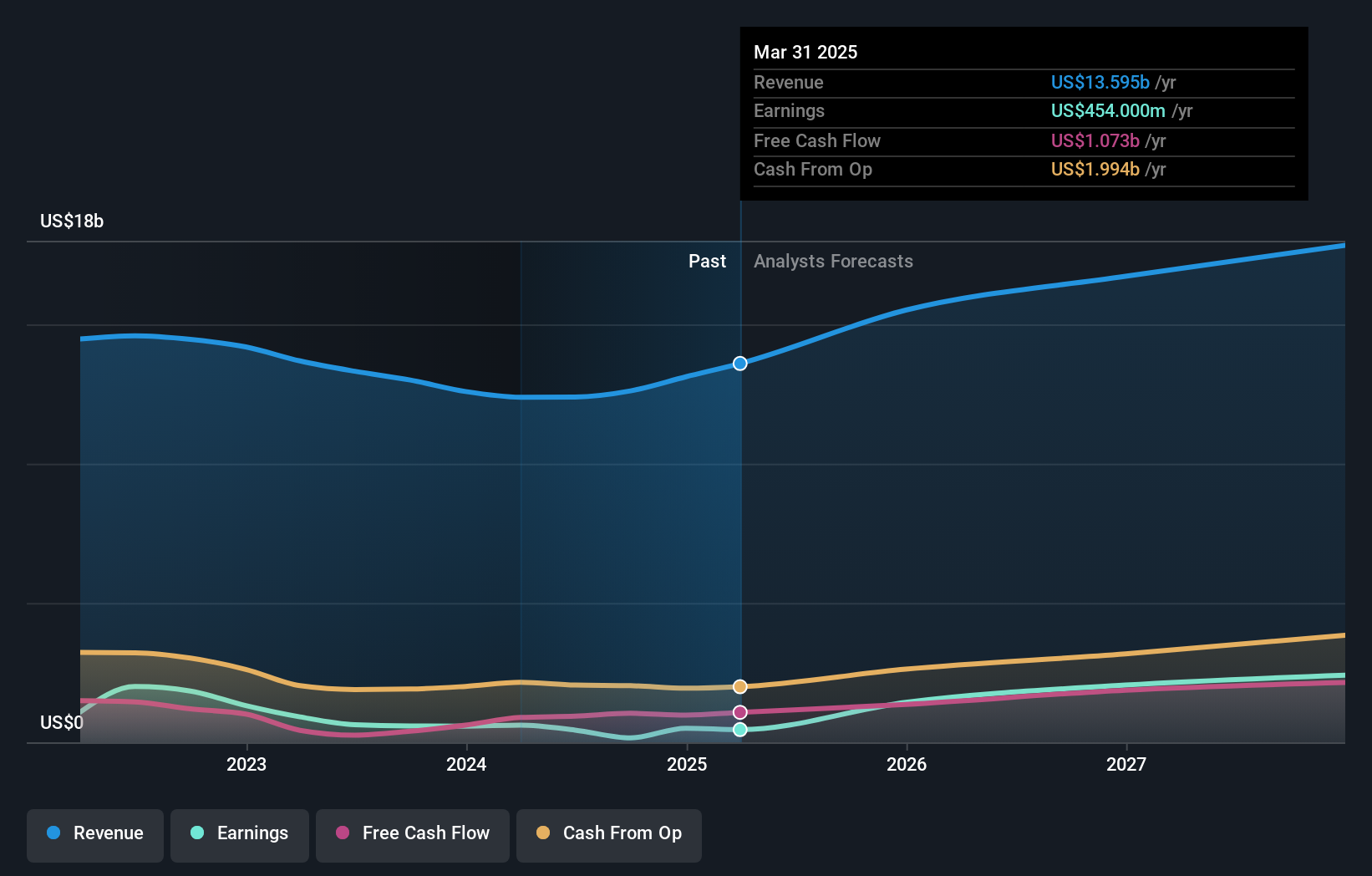

Operations: The company generates revenue through its primary segments: optical communications ($4.66 billion), display technologies ($3.87 billion), specialty materials ($2.02 billion), environmental technologies ($1.67 billion), and life sciences ($979 million). The optical communications segment is the largest contributor to revenue, followed by display technologies and specialty materials.

Corning's recent strategic initiatives and product launches underscore its adaptability and forward-thinking in the high-tech sector, particularly within AI and mobile technology markets. With a robust annual earnings growth of 23.9% and a solid revenue increase of 9.7%, Corning is effectively leveraging its R&D investments, which recently accounted for significant financial commitments, to pioneer innovations like the Gorilla® Glass Ceramic and advanced fiber solutions for AI data centers. These developments not only enhance Corning's product portfolio but also meet the escalating demands of modern technological infrastructures, positioning it well amidst evolving industry dynamics.

- Delve into the full analysis health report here for a deeper understanding of Corning.

Explore historical data to track Corning's performance over time in our Past section.

Summing It All Up

- Take a closer look at our US High Growth Tech and AI Stocks list of 232 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SNPS

Synopsys

Provides electronic design automation software products used to design and test integrated circuits.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives