Corning (GLW) Powers U.S. Solar Supply Chain with T1 Energy Partnership

Reviewed by Simply Wall St

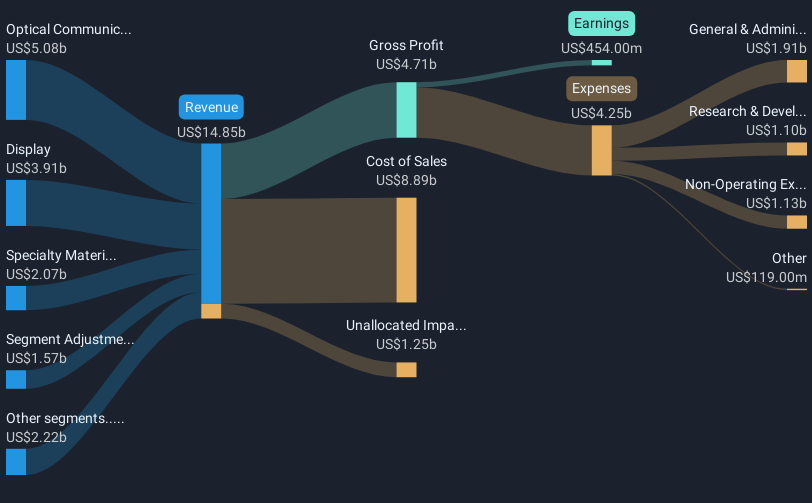

Corning (GLW) recently announced a strategic commercial agreement with T1 Energy, focusing on the U.S. solar supply chain, which is aligned with national interests in energy self-sufficiency. Over the past quarter, Corning's stock price has risen by 36%, a move that likely benefited from multiple positive developments. The partnership with T1 Energy is significant, but other contributing events include the major expansion of Corning's partnership with Apple and their positive Q2 earnings results, demonstrating strong sales and net income growth. These events likely augmented the broader market momentum, which saw the Dow hit record highs while S&P 500 and Nasdaq slipped marginally.

We've identified 3 weaknesses for Corning that you should be aware of.

The recent strategic commercial agreement between Corning and T1 Energy strengthens Corning's position within the U.S. solar supply chain, potentially enhancing revenue and earnings growth. This aligns with the company's narrative of leveraging trends in Optical Communications and Solar sectors. The longer-term perspective shows Corning's shares achieving a total return of 138.02% over five years, emphasizing their resilience and appeal to investors. Over the past year, Corning outperformed the U.S. market, which saw a return of 17.4%, as well as the Electronic industry, which returned 33.9%.

The recent deal with T1 Energy could drive further revenue gains, supporting forecasts that anticipate Corning's revenue growth at 11% per year. Similarly, earning forecasts expect growth of 20.7% annually, supported by ongoing share buybacks and manufacturing efficiencies. With a current share price of $65.76 and an analyst consensus price target of $68.25, the price movement appears modest, suggesting the stock is near its perceived fair value based on projected earnings and market conditions. Investors may weigh these factors when assessing Corning’s trajectory in the coming years.

Assess Corning's future earnings estimates with our detailed growth reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GLW

Corning

Operates in optical communications, display technologies, environmental technologies, specialty materials, and life sciences businesses.

High growth potential with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion