- United States

- /

- Semiconductors

- /

- NasdaqGS:AMD

3 US Stocks Estimated To Be Trading At Up To 33.9% Below Intrinsic Value

Reviewed by Simply Wall St

As the U.S. stock market reaches new heights with the S&P 500 and Nasdaq closing at record levels, driven by a surge in technology stocks, investors are increasingly focused on uncovering opportunities that may be undervalued amidst this bullish environment. In such a landscape, identifying stocks trading below their intrinsic value can offer potential for growth and diversification, making them attractive considerations for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| UMB Financial (NasdaqGS:UMBF) | $124.72 | $243.53 | 48.8% |

| First Solar (NasdaqGS:FSLR) | $207.92 | $399.87 | 48% |

| West Bancorporation (NasdaqGS:WTBA) | $23.84 | $46.82 | 49.1% |

| Five Star Bancorp (NasdaqGS:FSBC) | $32.98 | $63.88 | 48.4% |

| Privia Health Group (NasdaqGS:PRVA) | $22.31 | $43.17 | 48.3% |

| First Advantage (NasdaqGS:FA) | $19.37 | $38.63 | 49.9% |

| South Atlantic Bancshares (OTCPK:SABK) | $15.408 | $30.26 | 49.1% |

| AeroVironment (NasdaqGS:AVAV) | $203.19 | $404.34 | 49.7% |

| Progress Software (NasdaqGS:PRGS) | $68.31 | $132.04 | 48.3% |

| Intuitive Machines (NasdaqGM:LUNR) | $14.56 | $28.63 | 49.1% |

Let's explore several standout options from the results in the screener.

Advanced Micro Devices (NasdaqGS:AMD)

Overview: Advanced Micro Devices, Inc. is a global semiconductor company with a market capitalization of approximately $222.61 billion.

Operations: The company's revenue segments include Client at $6.20 billion, Gaming at $3.40 billion, Embedded at $3.69 billion, and Data Center at $11.00 billion.

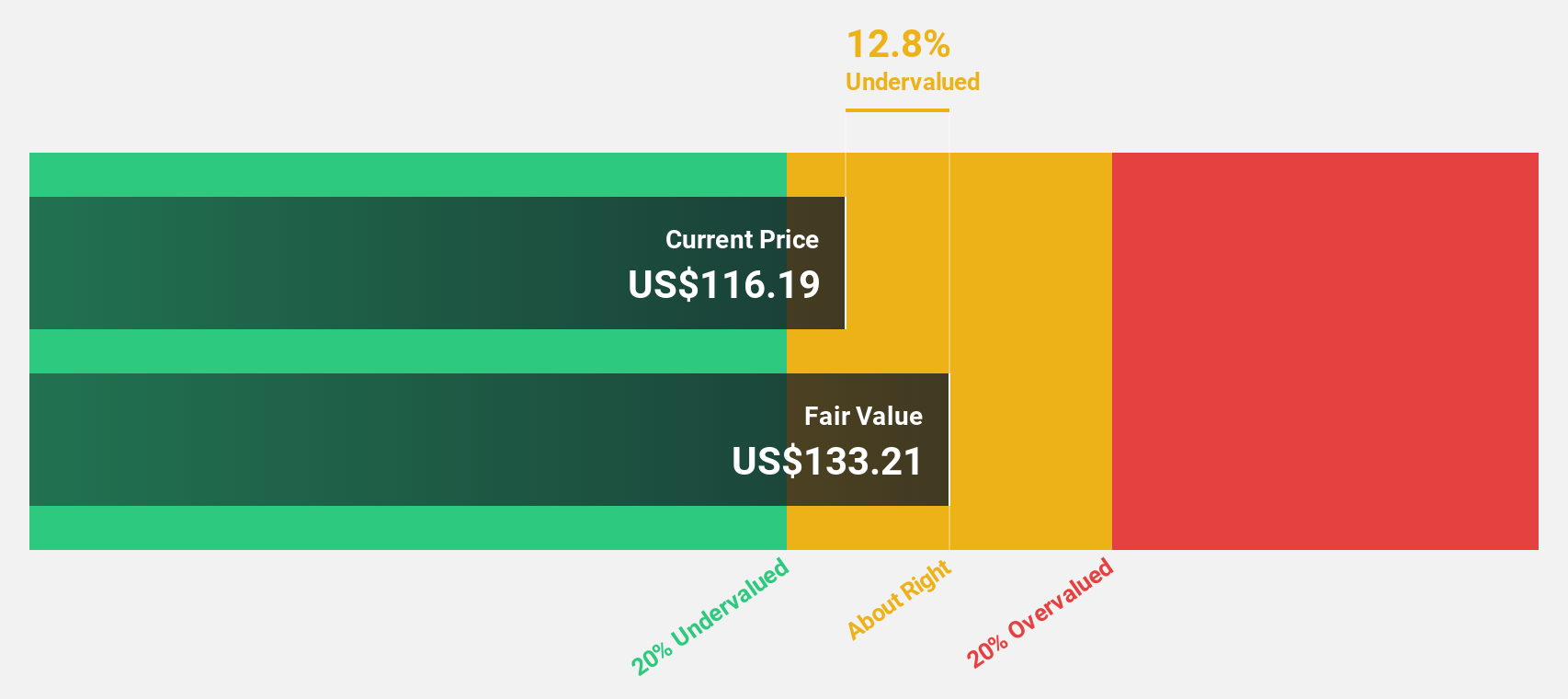

Estimated Discount To Fair Value: 33.9%

Advanced Micro Devices (AMD) appears undervalued based on cash flows, trading at US$142.06 against an estimated fair value of US$214.81. Recent earnings growth is substantial, with net income increasing to US$771 million from US$299 million year-over-year. Despite executive changes, AMD's leadership in high-performance computing and AI solutions continues to drive revenue growth forecasts of 19% annually, outpacing the broader U.S. market's expected growth rate of 8.9%.

- Our growth report here indicates Advanced Micro Devices may be poised for an improving outlook.

- Dive into the specifics of Advanced Micro Devices here with our thorough financial health report.

Atlassian (NasdaqGS:TEAM)

Overview: Atlassian Corporation, with a market cap of approximately $68.65 billion, designs, develops, licenses, and maintains various software products globally through its subsidiaries.

Operations: The company generates revenue from its Software & Programming segment, amounting to $4.57 billion.

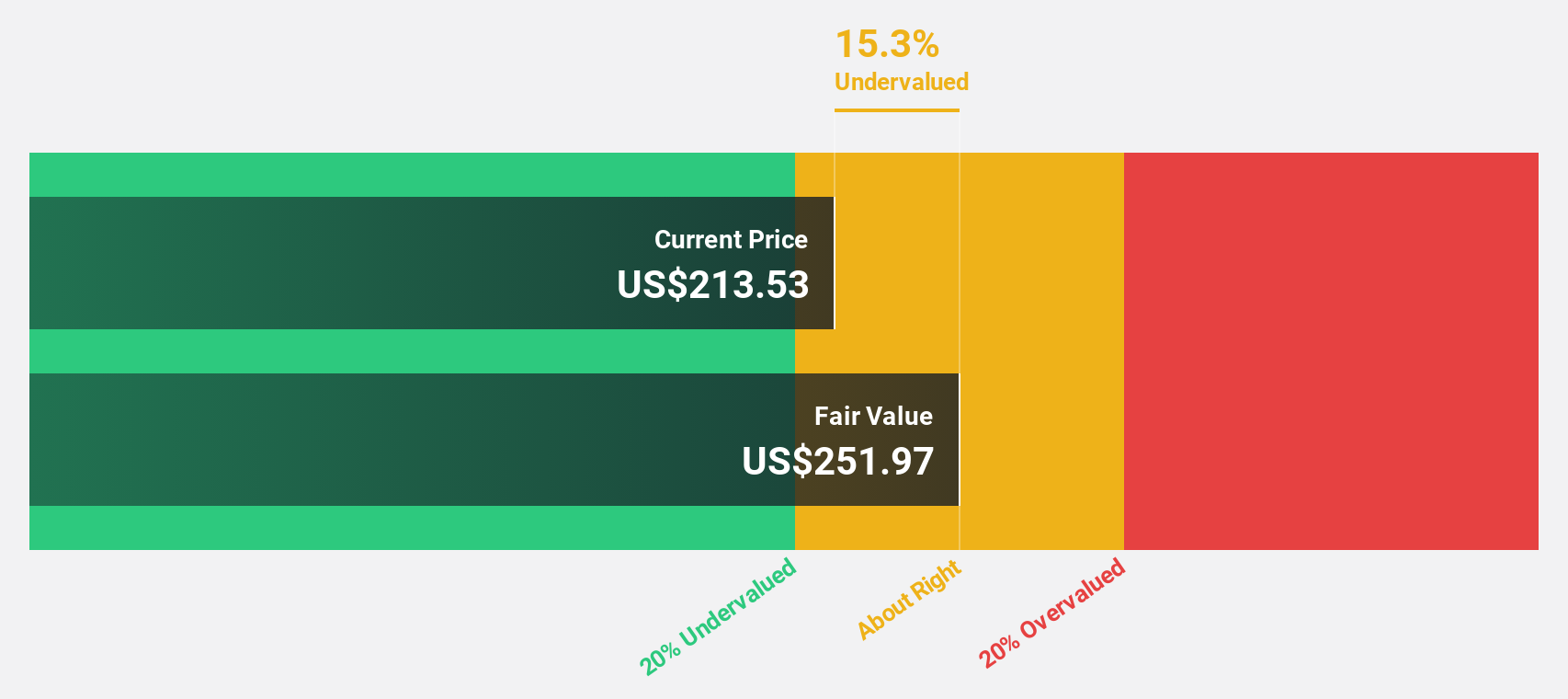

Estimated Discount To Fair Value: 30.9%

Atlassian is trading at US$265.88, significantly below its estimated fair value of US$384.75, highlighting its undervaluation based on cash flows. Despite a net loss increase to US$123.77 million year-over-year, revenue grew to US$1.19 billion from US$977.78 million, with future growth expected above market rates at 15.2% annually. The company has completed significant share buybacks and announced a new program worth up to $1.5 billion, indicating strong capital management focus amidst leadership changes.

- Our comprehensive growth report raises the possibility that Atlassian is poised for substantial financial growth.

- Navigate through the intricacies of Atlassian with our comprehensive financial health report here.

Corning (NYSE:GLW)

Overview: Corning Incorporated operates in the display technologies, optical communications, environmental technologies, specialty materials, and life sciences sectors globally with a market cap of approximately $41.67 billion.

Operations: The company's revenue segments include Optical Communications at $4.19 billion, Display Technologies at $3.77 billion, Specialty Materials at $1.98 billion, Environmental Technologies at $1.70 billion, and Life Sciences at $971 million.

Estimated Discount To Fair Value: 26.5%

Corning is trading at US$49.24, notably below its estimated fair value of US$66.98, suggesting undervaluation based on cash flows. Despite a net loss in recent earnings, revenue increased to US$3.39 billion from the previous year’s US$3.17 billion. Earnings are forecast to grow significantly above market rates at 41.9% annually, although profit margins have declined and debt levels remain high amidst ongoing share buybacks totaling over $1.83 billion since 2019.

- The growth report we've compiled suggests that Corning's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Corning.

Turning Ideas Into Actions

- Embark on your investment journey to our 186 Undervalued US Stocks Based On Cash Flows selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMD

Flawless balance sheet with reasonable growth potential.