- United States

- /

- Tech Hardware

- /

- NYSE:DELL

Dell Technologies (DELL) Declares Quarterly Dividend of US$0.53 Per Share

Reviewed by Simply Wall St

Dell Technologies (DELL) recently affirmed its commitment to shareholder value through increased quarterly dividends and a notable 18% rise in annual cash dividends. Over the last quarter, the company's stock experienced an 11.36% increase, aligning with its strong financial performance, as evidenced by growth in revenue and net income in its latest earnings report. Key factors possibly reinforcing market sentiment include the company's strategic participation in the NIST NCCoE project and executive changes, such as the appointment of Richard Troy Sharp as Chief Accounting Officer. Amidst a broader market characterized by record highs, Dell's initiatives added weight to its stock performance.

The recent affirmation of Dell Technologies' commitment to shareholder value, highlighted by increased dividends and strategic appointments, bolsters the narrative of enhanced revenue visibility and margin prospects. The participation in the NIST NCCoE project, alongside executive changes, positions the company to leverage rising enterprise AI demand. Over the past five years, Dell's shares have delivered a very large total return of 315.92%, reflecting strong investor confidence and performance relative to its peers. Over the past year, Dell has exceeded the US Tech industry, which returned 8.7%.

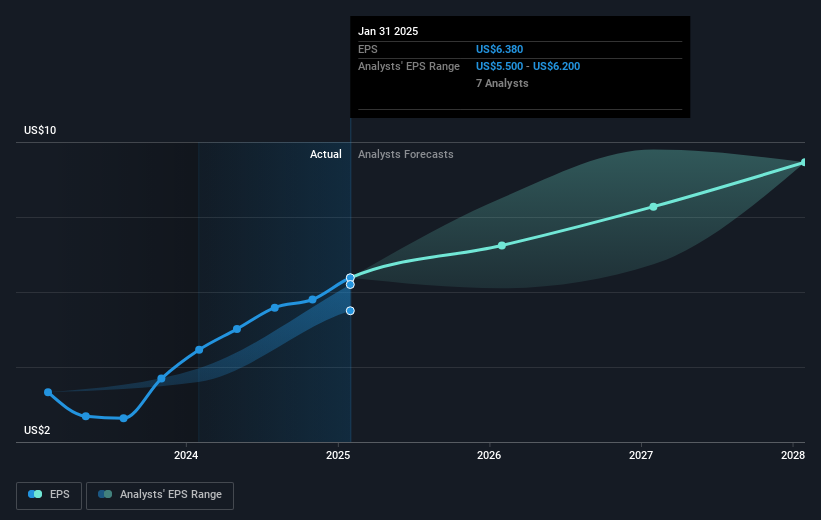

The company's share price appreciation aligns with optimistic revenue and earnings forecasts. Analysts anticipate annual revenue growth of 6.4% and earnings expansion from US$4.84 billion to US$7.4 billion by 2028, supported by the company's modernization efforts and capital allocation strategy. However, margin pressures remain due to hardware commoditization and cyclical dependencies. With a current share price of US$126.67, the stock trades at a discount of approximately 16% to the consensus analyst price target of US$146.43, suggesting potential upside if forecasts are met. The current financial initiatives and strategic projects may further amplify long-term revenue and earnings growth, aligning with analyst expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DELL

Dell Technologies

Designs, develops, manufactures, markets, sells, and supports various comprehensive and integrated solutions, products, and services in the Americas, Europe, the Middle East, Asia, and internationally.

Very undervalued with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)