- United States

- /

- Oil and Gas

- /

- NYSE:GPOR

3 US Stocks Possibly Trading Below Estimated Value In December 2024

Reviewed by Simply Wall St

As the U.S. stock market faces a year-end slump, with major indices like the S&P 500 on track for their worst month since April, investors are keenly observing potential opportunities amidst the downturn. In such volatile conditions, identifying stocks that may be trading below their estimated value can provide an intriguing prospect for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Clear Secure (NYSE:YOU) | $27.07 | $53.24 | 49.2% |

| ConnectOne Bancorp (NasdaqGS:CNOB) | $22.70 | $43.79 | 48.2% |

| Oddity Tech (NasdaqGM:ODD) | $42.88 | $84.59 | 49.3% |

| Western Alliance Bancorporation (NYSE:WAL) | $83.57 | $164.32 | 49.1% |

| Lamb Weston Holdings (NYSE:LW) | $64.97 | $125.18 | 48.1% |

| HealthEquity (NasdaqGS:HQY) | $96.84 | $189.22 | 48.8% |

| WEX (NYSE:WEX) | $170.68 | $334.24 | 48.9% |

| LifeMD (NasdaqGM:LFMD) | $5.12 | $9.78 | 47.7% |

| Progress Software (NasdaqGS:PRGS) | $65.05 | $129.48 | 49.8% |

| South Atlantic Bancshares (OTCPK:SABK) | $15.40 | $29.97 | 48.6% |

Here we highlight a subset of our preferred stocks from the screener.

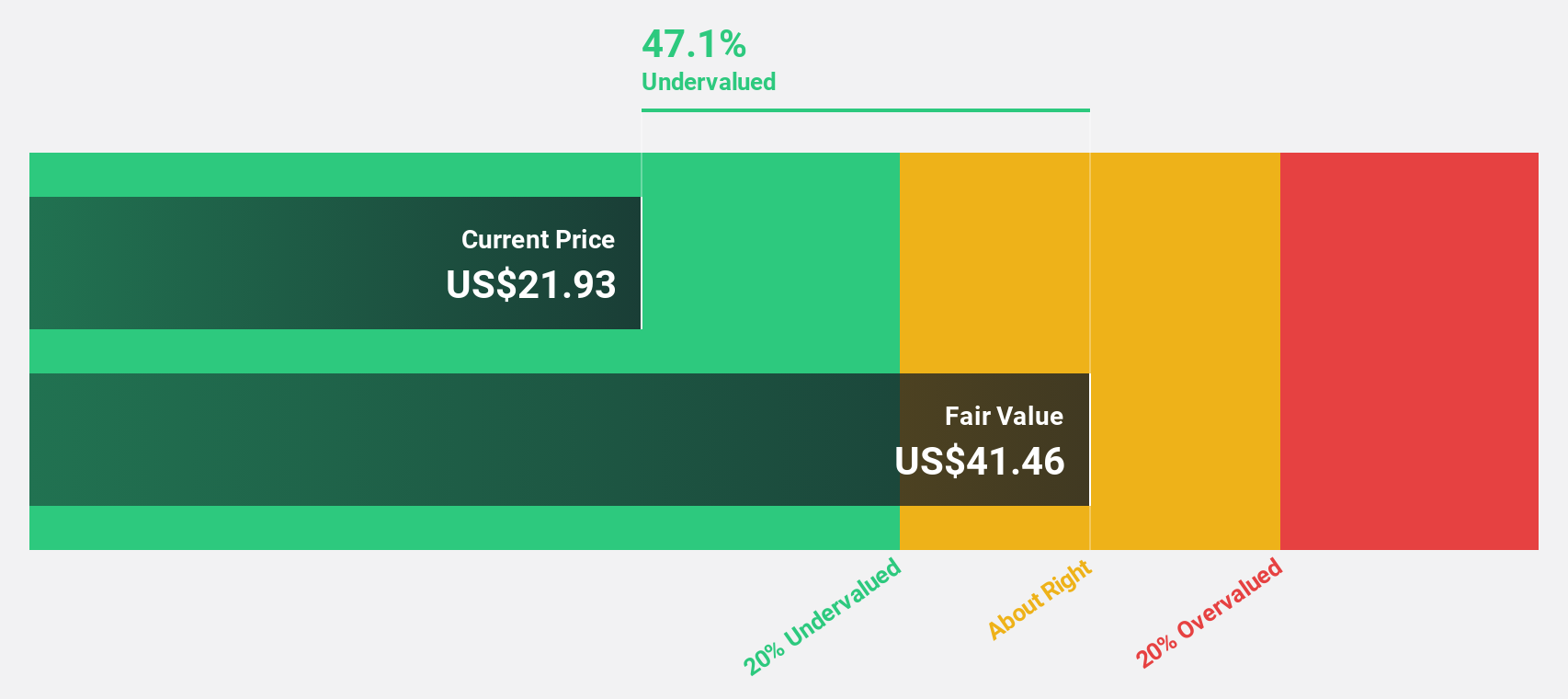

Hesai Group (NasdaqGS:HSAI)

Overview: Hesai Group develops, manufactures, and sells three-dimensional LiDAR solutions across Mainland China, Europe, North America, and internationally with a market cap of $1.72 billion.

Operations: Revenue Segments (in millions of CN¥):

Estimated Discount To Fair Value: 10.1%

Hesai Group is trading at US$14.7, slightly below its fair value estimate of US$16.35, indicating potential undervaluation based on cash flows. The company forecasts strong revenue growth of 30.1% annually, outpacing the US market average and expects to become profitable within three years. Recent partnerships with Changan Automobile and Leapmotor highlight its expanding role in automotive lidar technology, potentially boosting future cash flows despite a volatile share price history and current net losses reducing year-over-year.

- Our earnings growth report unveils the potential for significant increases in Hesai Group's future results.

- Unlock comprehensive insights into our analysis of Hesai Group stock in this financial health report.

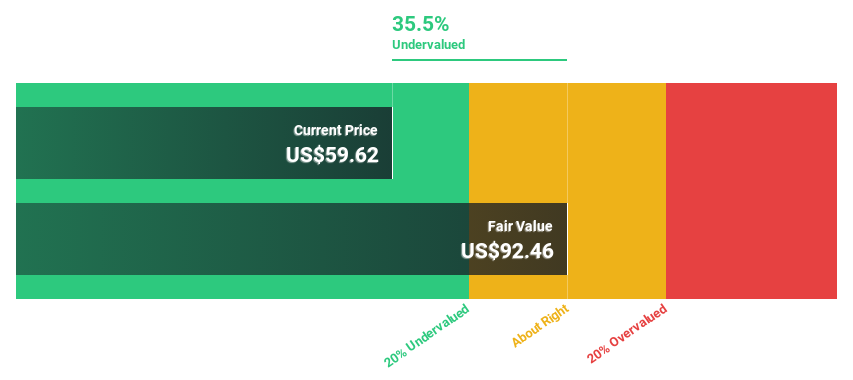

Crane NXT (NYSE:CXT)

Overview: Crane NXT, Co. is an industrial technology company that offers technology solutions for securing, detecting, and authenticating important assets, with a market cap of approximately $3.32 billion.

Operations: The company's revenue is primarily derived from Crane Payment Innovations, which contributes $873.40 million, and Security and Authentication Technologies, accounting for $571.20 million.

Estimated Discount To Fair Value: 37%

Crane NXT is trading at US$58.15, significantly below its fair value estimate of US$92.3, highlighting potential undervaluation based on cash flows. Earnings are projected to grow 23.27% annually, surpassing the broader US market's growth rate. Despite a high debt level, Crane NXT's strategic acquisitions in authentication technologies and updated guidance for increased sales growth demonstrate a commitment to enhancing revenue streams and diversifying operations amidst evolving market conditions.

- According our earnings growth report, there's an indication that Crane NXT might be ready to expand.

- Click here to discover the nuances of Crane NXT with our detailed financial health report.

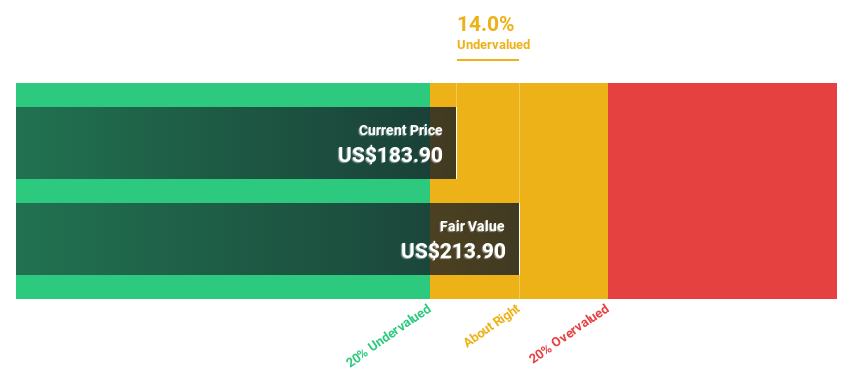

Gulfport Energy (NYSE:GPOR)

Overview: Gulfport Energy Corporation is involved in the acquisition, exploration, development, and production of natural gas, crude oil, and natural gas liquids in the United States with a market cap of approximately $3.02 billion.

Operations: The company's revenue primarily stems from its oil and gas exploration and production segment, generating approximately $886.64 million.

Estimated Discount To Fair Value: 14.7%

Gulfport Energy is trading at US$181.5, slightly below its fair value estimate of US$212.89, suggesting some undervaluation based on cash flows. Despite recent declines in revenue and net income, earnings are forecast to grow significantly at 46.39% annually, outpacing the US market average. The company has been actively repurchasing shares, enhancing shareholder value with an increased buyback plan authorization of $1 billion through December 2025.

- The analysis detailed in our Gulfport Energy growth report hints at robust future financial performance.

- Navigate through the intricacies of Gulfport Energy with our comprehensive financial health report here.

Summing It All Up

- Reveal the 179 hidden gems among our Undervalued US Stocks Based On Cash Flows screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GPOR

Gulfport Energy

Engages in the acquisition, exploration, and production of natural gas, crude oil, and natural gas liquids in the United States.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives