Coherent (NYSE:COHR) Sees 13% Price Dip Despite Positive Q2 Earnings Report

Reviewed by Simply Wall St

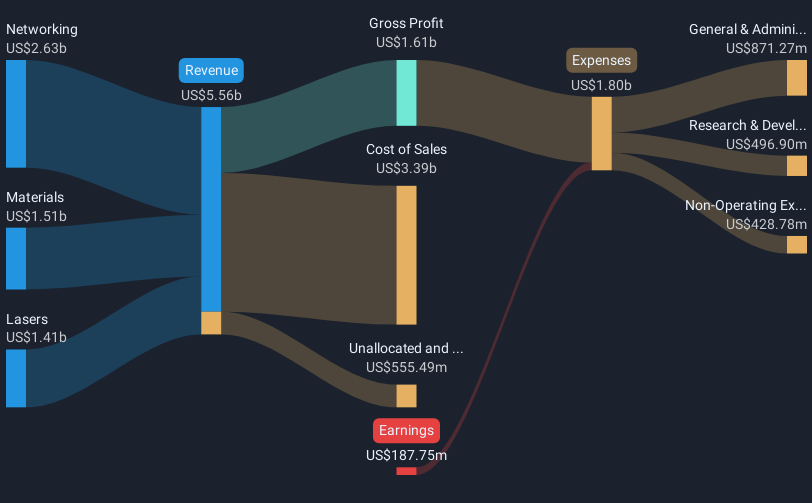

Coherent (NYSE:COHR) recently announced impressive second-quarter earnings with a notable rise in sales, net income, and earnings per share compared to the same period last year. Despite these positive financial developments, the company's stock experienced a 13% decline over the past week. This drop aligns with broader market trends as major indexes like the Dow Jones and S&P 500 recorded their worst week in two years, influenced by tariff concerns and fears about an economic slowdown. The market's general downturn affected many large-cap technology stocks, leading to significant declines across the sector, which Coherent is part of. Even amidst Coherent's positive earnings report, the prevailing bearish market sentiment likely weighed heavily on its stock price, reflecting external macroeconomic factors rather than the company's operational performance.

Get an in-depth perspective on Coherent's performance by reading our analysis here.

Over the last five years, Coherent (NYSE:COHR) shares achieved a total return of 207.52%, including dividends. This exceptional performance occurred amidst several developments worth exploring. Coherent's substantial investment, US$33 million, to upgrade its manufacturing capabilities for InP devices in Texas in December 2024, aimed at enhancing production capacity. Earlier in 2024, the company expanded its leadership team, appointing Jim Anderson as CEO and Sherri R. Luther as CFO, fueling confidence among investors.

The company also pursued growth opportunities through innovative product launches. In January 2025, Coherent introduced products for various markets, including the CT-Series Thermoelectric Coolers and high-power F-theta lenses, both expanding market potential. Despite a recent short-term decline, Coherent outpaced long-term market averages, though it underperformed the US market and Electronic industry over the past year, which returned 11.1% and 2.3% respectively. Analysts remain optimistic about its potential recovery, anticipating a price rise.

- Analyze Coherent's fair value against its market price in our detailed valuation report—access it here.

- Understand the uncertainties surrounding Coherent's market positioning with our detailed risk analysis report.

- Got skin in the game with Coherent? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COHR

Coherent

Develops, manufactures, and markets engineered materials, optoelectronic components and devices, and optical and laser systems and subsystems for the use in the industrial, communications, electronics, and instrumentation markets worldwide.

Undervalued with reasonable growth potential.