- United States

- /

- Semiconductors

- /

- NasdaqGS:MU

3 US Stocks That May Be Trading Below Their Estimated Intrinsic Values

Reviewed by Simply Wall St

As investors respond to recent developments surrounding tariffs and a wave of corporate earnings reports, U.S. stock markets have shown resilience, with indices like the S&P 500 and Nasdaq Composite experiencing gains. In this environment, identifying stocks that may be trading below their estimated intrinsic values can offer potential opportunities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| First National (NasdaqCM:FXNC) | $25.12 | $48.75 | 48.5% |

| KBR (NYSE:KBR) | $53.10 | $104.10 | 49% |

| Northwest Bancshares (NasdaqGS:NWBI) | $13.17 | $26.31 | 49.9% |

| Midland States Bancorp (NasdaqGS:MSBI) | $19.23 | $37.84 | 49.2% |

| Array Technologies (NasdaqGM:ARRY) | $7.30 | $14.40 | 49.3% |

| Advanced Energy Industries (NasdaqGS:AEIS) | $111.41 | $217.76 | 48.8% |

| Coastal Financial (NasdaqGS:CCB) | $86.74 | $172.68 | 49.8% |

| BeiGene (NasdaqGS:ONC) | $222.91 | $441.43 | 49.5% |

| Equifax (NYSE:EFX) | $266.77 | $531.78 | 49.8% |

| Gold Royalty (NYSEAM:GROY) | $1.35 | $2.64 | 48.8% |

Let's dive into some prime choices out of the screener.

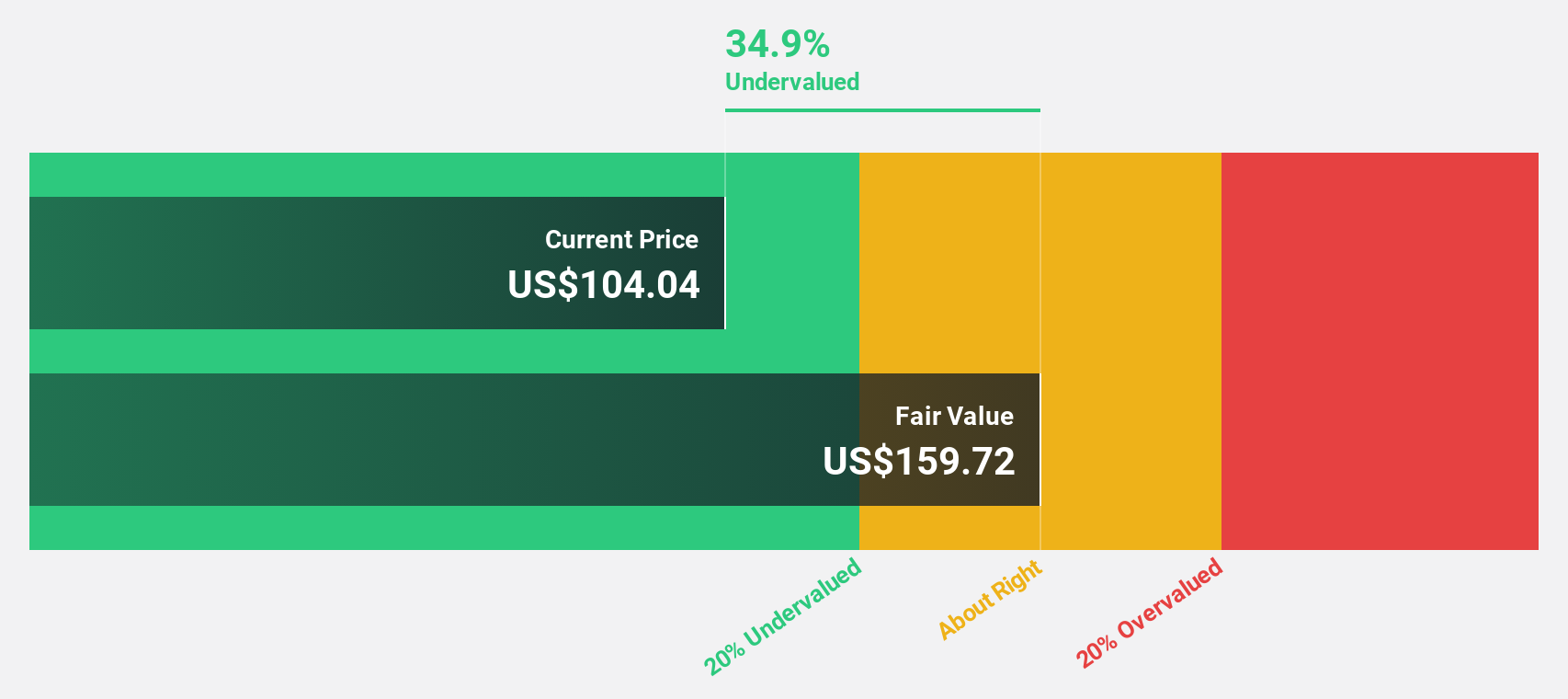

Micron Technology (NasdaqGS:MU)

Overview: Micron Technology, Inc. designs, develops, manufactures, and sells memory and storage products globally with a market capitalization of approximately $100.19 billion.

Operations: Micron Technology's revenue is primarily derived from its Compute and Networking Business Unit ($12.17 billion), Mobile Business Unit ($6.59 billion), Storage Business Unit ($5.67 billion), and Embedded Business Unit ($4.63 billion).

Estimated Discount To Fair Value: 18.3%

Micron Technology appears undervalued based on discounted cash flow analysis, trading at US$90.66 against an estimated fair value of US$111.02. Despite recent legal challenges and market demand fluctuations, the company has shown resilience by becoming profitable this year with significant earnings growth forecasted at 29.11% annually over the next three years, outpacing the broader U.S. market expectations. Recent debt financing and strategic expansions further bolster its financial position and operational capabilities.

- Our comprehensive growth report raises the possibility that Micron Technology is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Micron Technology stock in this financial health report.

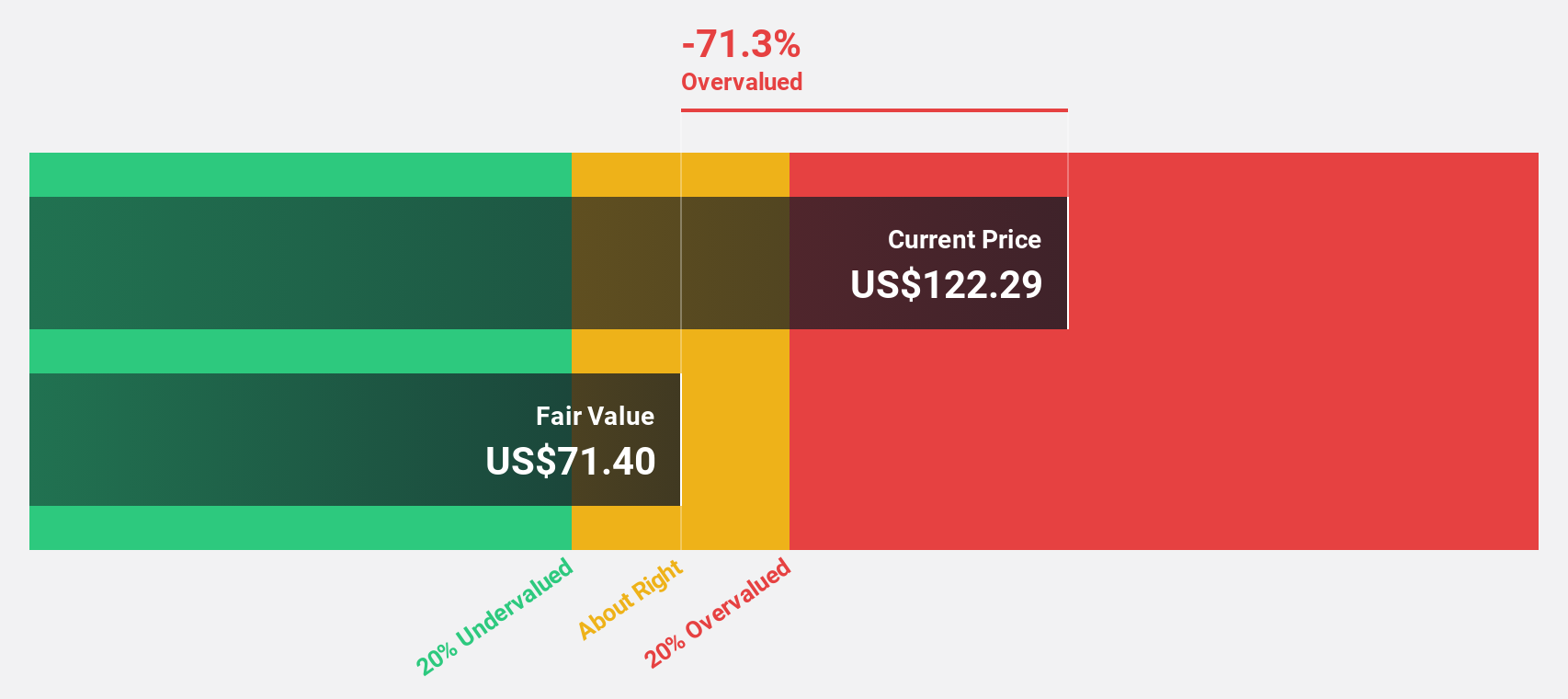

Coherent (NYSE:COHR)

Overview: Coherent Corp. is engaged in the development, manufacturing, and marketing of engineered materials, optoelectronic components and devices, as well as optical and laser systems for various global markets including industrial, communications, electronics, and instrumentation sectors; it has a market cap of $13.53 billion.

Operations: The company's revenue segments consist of Lasers generating $1.41 billion, Materials contributing $1.51 billion, and Networking bringing in $2.63 billion.

Estimated Discount To Fair Value: 40.9%

Coherent, trading at US$87.74, is undervalued based on discounted cash flow analysis with an estimated fair value of US$148.56. The company is expected to become profitable within three years, with earnings projected to grow significantly each year. Recent product launches in optics and thermal management signal strategic growth in high-demand sectors like additive manufacturing and medical diagnostics, potentially enhancing revenue streams faster than the U.S. market average growth rate of 8.7% per year.

- According our earnings growth report, there's an indication that Coherent might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Coherent.

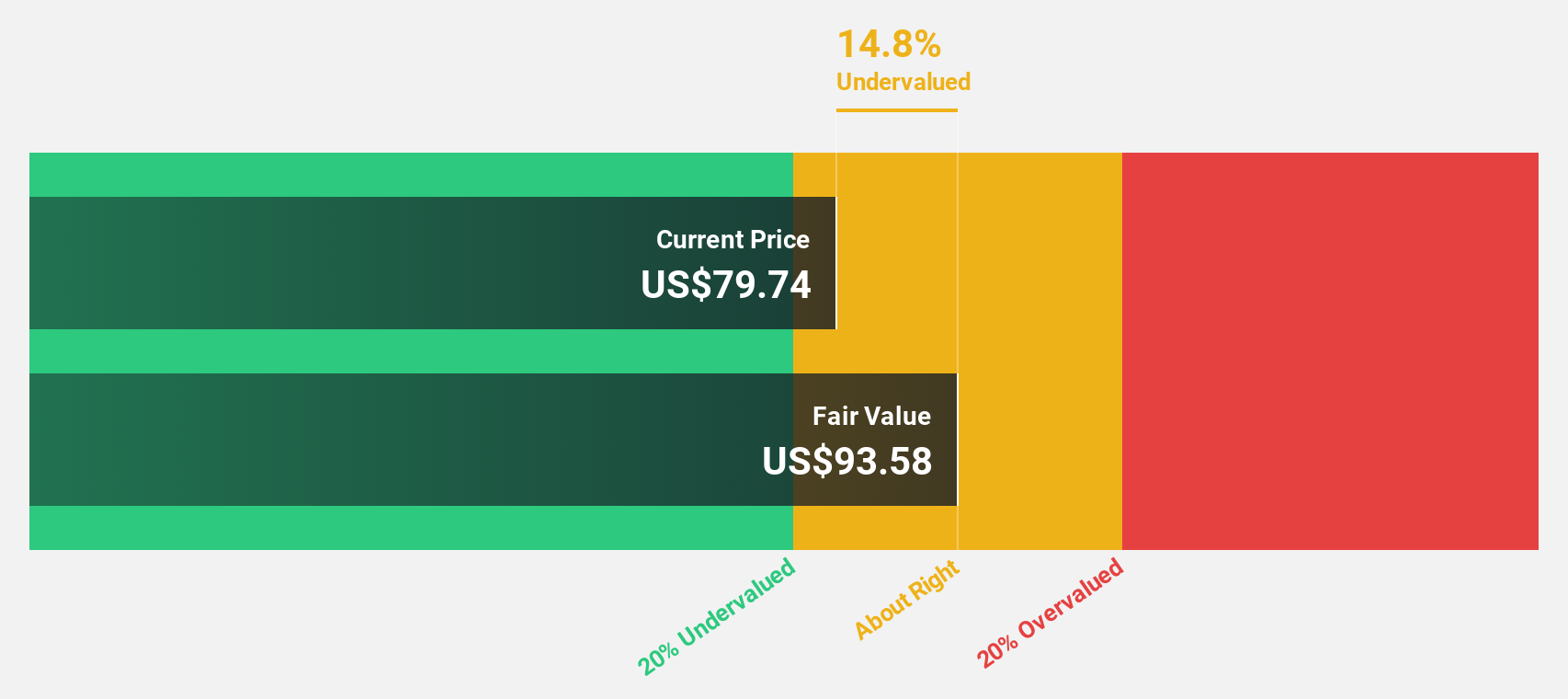

Onto Innovation (NYSE:ONTO)

Overview: Onto Innovation Inc. specializes in designing, developing, manufacturing, and supporting process control tools for optical metrology, with a market cap of approximately $9.84 billion.

Operations: The company's revenue primarily comes from its Semiconductor Equipment and Services segment, totaling $942.24 million.

Estimated Discount To Fair Value: 26%

Onto Innovation, priced at US$200.55, is undervalued by over 20% based on discounted cash flow analysis with a fair value of US$270.94. Earnings are forecast to grow significantly at 27.6% annually, outpacing the U.S. market's growth rate of 14.8%. Recent advancements in its product suite for high bandwidth memory and advanced logic applications could drive future revenue growth faster than the market average, enhancing its valuation prospects further.

- Our expertly prepared growth report on Onto Innovation implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Onto Innovation.

Taking Advantage

- Unlock more gems! Our Undervalued US Stocks Based On Cash Flows screener has unearthed 177 more companies for you to explore.Click here to unveil our expertly curated list of 180 Undervalued US Stocks Based On Cash Flows.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MU

Micron Technology

Designs, develops, manufactures, and sells memory and storage products in the United States, Taiwan, Mainland China, rest of the Asia Pacific, Hong Kong, Japan, Europe, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives