- United States

- /

- Tech Hardware

- /

- NYSE:CMPO

CompoSecure (CMPO): Evaluating Valuation After Arculus Wallet Expansion Through N.exchange Partnership

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 8.9% Overvalued

According to the most widely followed narrative, CompoSecure is currently considered overvalued by almost 9% based on forecasted growth, profitability improvements, and ongoing business risks. The consensus price target is only marginally above the recent share price, signaling limited expected upside.

The penetration of metal cards remains less than 1% of the global payment card market. Issuer and consumer demand for premium products continues to increase, positioning CompoSecure to capture significant market share and drive long-term revenue growth. Recent and ongoing investments in operational efficiency (via the CompoSecure Operating System) are contributing to improved gross margins and EBITDA. Management indicates there are further opportunities for cost efficiencies, supporting sustainable margin expansion and higher earnings.

What’s really fueling this narrative? There is a bold bet on rapid revenue and earnings growth, plus margin expansion that only a few companies ever achieve. Want the numbers behind this sky-high forecast and the key events these analysts say could change everything for CompoSecure in years to come? Keep reading to see exactly which assumptions drive the fair value and why this story has the market’s full attention.

Result: Fair Value of $19 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, future success is far from certain. Rising digital wallet adoption or the loss of major clients could dramatically shift CompoSecure’s growth outlook.

Find out about the key risks to this CompoSecure narrative.Another View: Our DCF Model Tells a Different Story

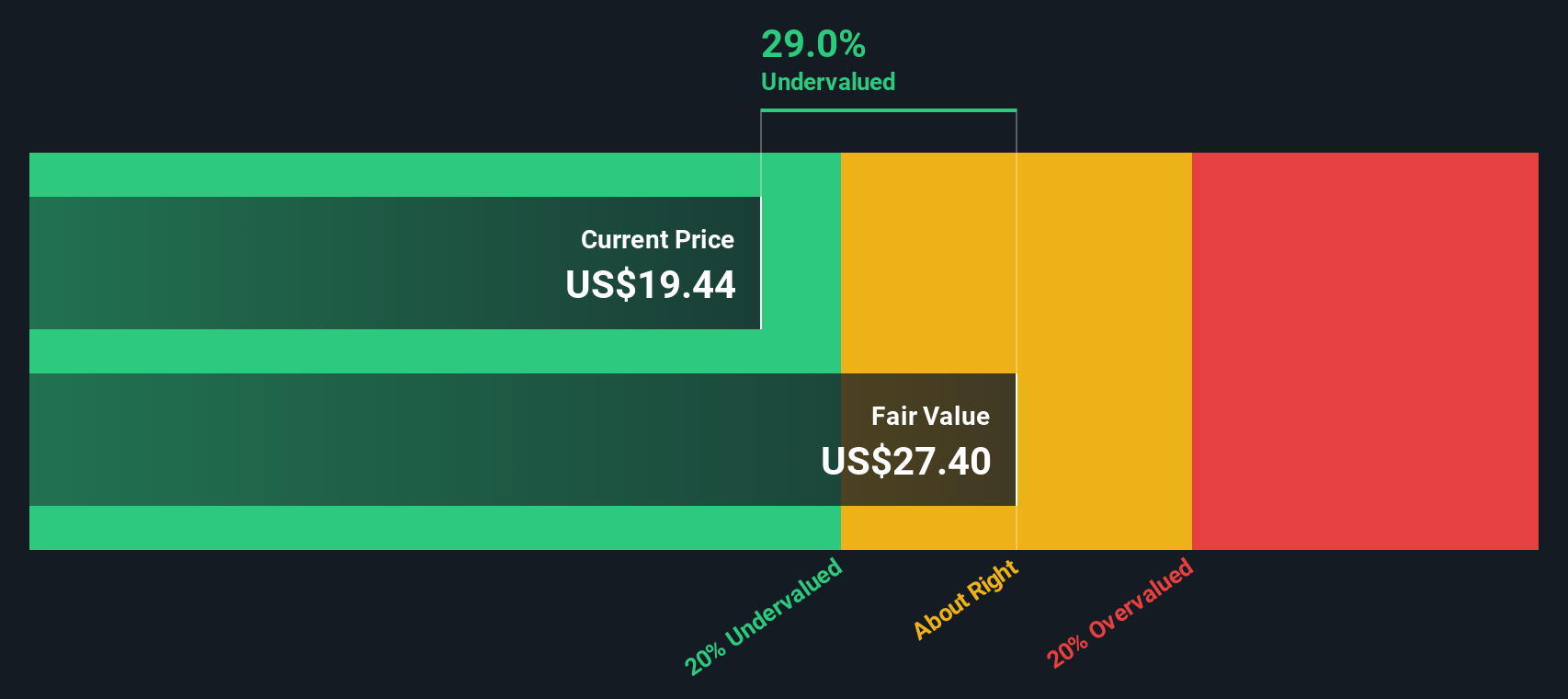

While analyst price targets suggest CompoSecure may be overvalued, our SWS DCF model points in the opposite direction. It hints at undervaluation based on projected future cash flows. Could these divergent views mean the market is missing something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CompoSecure for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CompoSecure Narrative

If the narrative above does not align with your perspective, or you would rather dive deeper into the data yourself, you can shape your own view of CompoSecure in just a few minutes. Do it your way

A great starting point for your CompoSecure research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Seize your chance to spot the next big winner before the crowd. Take control of your portfolio and move ahead of the market with these hand-picked opportunities:

- Target profit potential by zeroing in on AI innovators. Jump into a world of disruptive businesses with AI penny stocks that are changing what’s possible.

- Secure consistent income streams by checking out dividend stocks with yields > 3% featuring stocks with impressive yields and resilient cash flows, perfect for strengthening your passive earnings.

- Uncover bargains hiding in plain sight. Use undervalued stocks based on cash flows to spot companies the market has overlooked, and put undervalued stocks on your radar before prices catch up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMPO

CompoSecure

Manufactures and designs metal, composite, and proprietary financial transaction cards in the United States and internationally.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives