- United States

- /

- Media

- /

- NasdaqGM:TTD

3 High Growth Tech Stocks Leading The US Market

Reviewed by Simply Wall St

Over the last 7 days, the United States market has dropped by 1.1%, but in the longer term, it has risen by 5.9% over the past year with earnings expected to grow by 13% per annum in the coming years. In this environment, identifying high growth tech stocks that demonstrate strong potential and resilience can be crucial for investors seeking opportunities amidst fluctuating market conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.29% | 29.79% | ★★★★★★ |

| Arcutis Biotherapeutics | 25.76% | 58.17% | ★★★★★★ |

| TG Therapeutics | 26.03% | 37.60% | ★★★★★★ |

| Travere Therapeutics | 28.65% | 66.06% | ★★★★★★ |

| Alkami Technology | 20.46% | 85.16% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.96% | 58.81% | ★★★★★★ |

| TKO Group Holdings | 22.48% | 25.17% | ★★★★★★ |

| AVITA Medical | 27.81% | 55.17% | ★★★★★★ |

| Lumentum Holdings | 21.35% | 120.49% | ★★★★★★ |

| Ascendis Pharma | 32.85% | 59.73% | ★★★★★★ |

Click here to see the full list of 234 stocks from our US High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Trade Desk (NasdaqGM:TTD)

Simply Wall St Growth Rating: ★★★★★☆

Overview: The Trade Desk, Inc. is a technology company that provides a global advertising platform, with a market capitalization of approximately $24.71 billion.

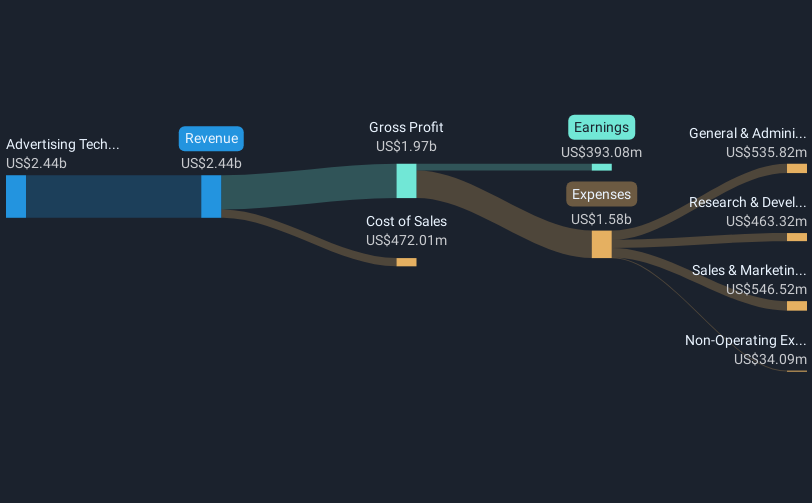

Operations: Trade Desk generates revenue primarily through its advertising technology platform, which contributed $2.44 billion. The company focuses on providing a comprehensive platform for digital advertising across various channels and formats.

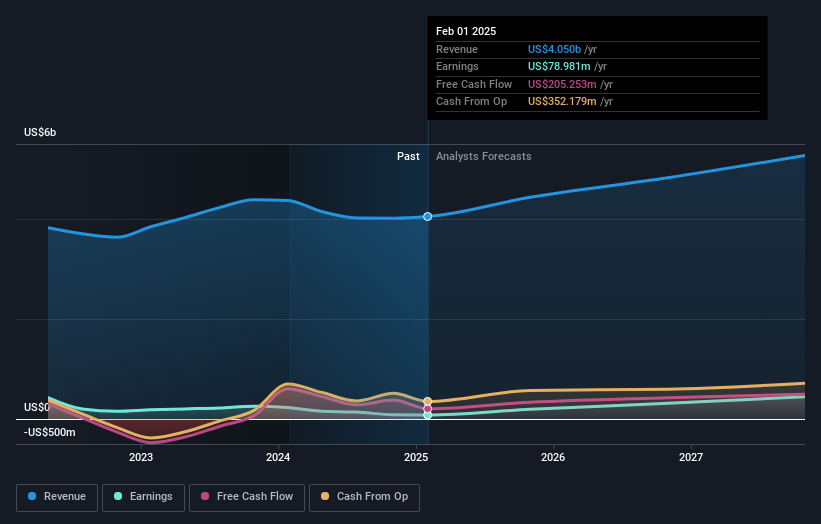

The Trade Desk, a key player in the ad-tech industry, has demonstrated robust financial and strategic growth. With a revenue increase of 15.7% annually and earnings surging by 21.9%, the company's commitment to innovation is evident in its R&D investments, which have been pivotal for developments like Kokai—a generative AI tool enhancing ad-buying efficiency. Recent executive appointments and strategic partnerships underscore its proactive approach in adapting to market demands and fostering significant client relationships, positioning it well amidst evolving digital advertising landscapes.

- Delve into the full analysis health report here for a deeper understanding of Trade Desk.

Understand Trade Desk's track record by examining our Past report.

Ciena (NYSE:CIEN)

Simply Wall St Growth Rating: ★★★★☆☆

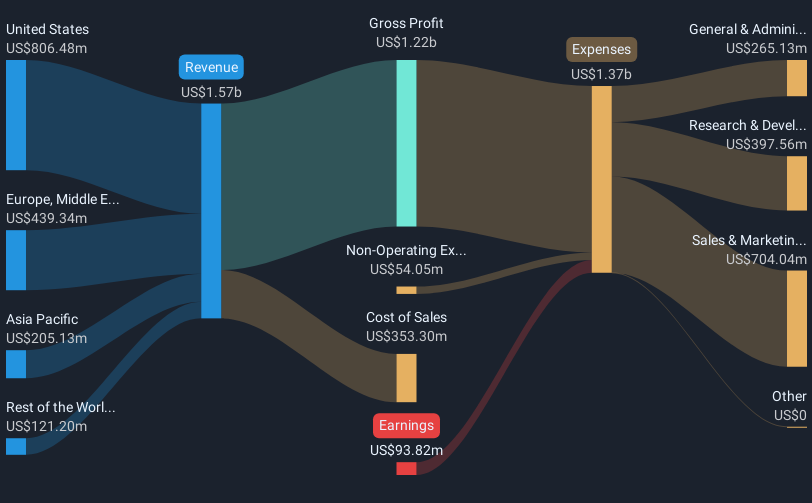

Overview: Ciena Corporation is a network technology company that offers hardware, software, and services to network operators globally across regions such as the Americas, Europe, the Middle East, Africa, Asia Pacific, Japan, and India with a market capitalization of approximately $8.55 billion.

Operations: Ciena generates revenue primarily from its Networking Platforms segment, which accounts for approximately $3.06 billion, followed by Global Services at $540.45 million. The Platform Software and Services contribute $363.38 million, while Blue Planet Automation Software and Services add $89.71 million to the overall revenue stream.

Ciena's recent strategic alliances and product enhancements underscore its commitment to advancing high-speed connectivity solutions, crucial for AI-driven applications. The company's collaboration with Windstream Wholesale, leveraging Ciena’s Reconfigurable Line System for a network overbuild, enhances service capabilities significantly—supporting 400G and future 800G services. Additionally, a trial with Lumen Technologies demonstrated the potential of Ciena’s WaveLogic 6 Extreme technology across an ultra-long-haul network, setting new benchmarks in data transmission. These initiatives not only reflect Ciena's innovative edge but also its role in shaping next-generation digital infrastructure critical for cloud expansions and AI applications.

Cloudflare (NYSE:NET)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Cloudflare, Inc. is a cloud services provider offering various solutions to businesses globally, with a market cap of $37.21 billion.

Operations: The company generates revenue primarily through its Internet Telephone segment, which accounts for $1.67 billion.

Cloudflare's recent innovations, including the launch of Workers VPC and Workers VPC Private Link, highlight its commitment to enhancing secure, global cross-cloud applications. This development allows developers to bypass traditional cloud limitations by facilitating seamless connections between different computing environments. By addressing the substantial egress fees associated with legacy clouds, Cloudflare is not only optimizing operational flexibility but also reducing costs for businesses. Furthermore, their introduction of new AI agents accelerates the deployment of intelligent systems capable of autonomous decision-making and adaptation to dynamic environments. These strategic moves underscore Cloudflare's pivotal role in driving forward-thinking cloud solutions and AI integration across industries.

- Navigate through the intricacies of Cloudflare with our comprehensive health report here.

Review our historical performance report to gain insights into Cloudflare's's past performance.

Make It Happen

- Access the full spectrum of 234 US High Growth Tech and AI Stocks by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trade Desk might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TTD

Trade Desk

Operates as a technology company in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives