Badger Meter (BMI): Revisiting Valuation After a Recent Share Price Rebound

Reviewed by Simply Wall St

Badger Meter (BMI) has quietly bounced back over the past month, climbing about 5% even though the stock is still down sharply this year. This move has drawn fresh attention to its long term growth story.

See our latest analysis for Badger Meter.

Even after the recent bounce, the share price is still well below where it started the year. Yet a strong five year total shareholder return above 100% suggests longer term momentum has not completely broken.

If Badger Meter’s move has you rethinking what steady compounders can do, it might be worth widening the lens and exploring fast growing stocks with high insider ownership.

With growth still solid and the share price well below recent highs, the key question now is whether Badger Meter is trading at an attractive discount or if the market has already priced in its next leg of growth.

Most Popular Narrative Narrative: 16% Undervalued

With Badger Meter last closing at $184.80 against a narrative fair value of about $219.50, the valuation framework leans clearly toward upside and sets the scene for some ambitious assumptions.

The rapid expansion and integration of IoT enabled products and real time analytics, as seen in the rollout of BEACON and new machine learning enabled products like Cobalt, are accelerating customer adoption of recurring, higher margin software and data solutions contributing to improved revenue visibility and ongoing net margin enhancement.

Want to see how steady demand, rising margins, and a richer earnings multiple all come together in one story? The key drivers behind this fair value hinge on compounding revenue, expanding profitability, and a future valuation usually reserved for market darlings. Curious which specific growth and margin assumptions have to line up to support that upside case? Read on to uncover the full narrative behind those numbers.

Result: Fair Value of $219.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained project delays or funding pullbacks for municipal water infrastructure could quickly pressure Badger Meter’s growth trajectory and challenge today’s upside narrative.

Find out about the key risks to this Badger Meter narrative.

Another Angle: Expensive on Earnings

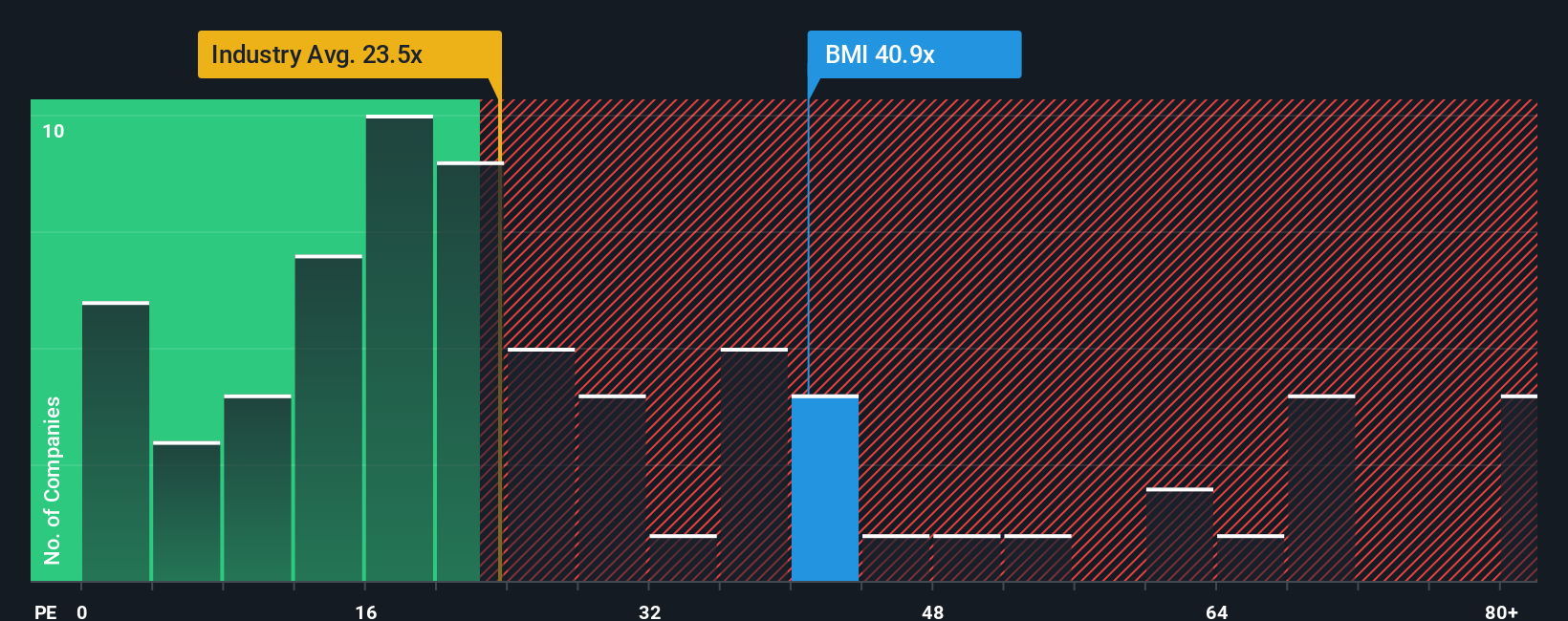

While the narrative fair value and analyst targets point to upside, the current valuation looks stretched when you compare earnings. Badger Meter trades on a 39.2x P/E, versus 24.8x for the US Electronic industry, 34.9x for peers, and a fair ratio of just 22.9x. That gap suggests investors may already be paying up for much of the story, so what happens if growth or sentiment cools?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Badger Meter Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a custom narrative in just minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Badger Meter.

Ready for your next investing edge?

Smart investors never stop scouting for the next great opportunity, so do not let fresh ideas pass you by when the Simply Wall St screener can guide you.

- Capture potential mispricings by acting early on these 908 undervalued stocks based on cash flows that strong cash flow analysis suggests the market is overlooking.

- Ride powerful technological shifts by targeting these 26 AI penny stocks positioned at the front line of artificial intelligence adoption and innovation.

- Lock in dependable income streams with these 13 dividend stocks with yields > 3% that offer yields above 3% without losing sight of quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Badger Meter might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BMI

Badger Meter

Manufactures and markets flow measurement, quality, control, and communication solutions worldwide.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)