- United States

- /

- Software

- /

- NasdaqGS:CYBR

Exploring 3 High Growth Tech Stocks in the United States

Reviewed by Simply Wall St

The United States market has shown robust performance, rising 2.3% over the last week and climbing 35% in the past year, with earnings projected to grow by 15% annually in the coming years. In this favorable environment, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation and adaptability to capitalize on these positive trends.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Sarepta Therapeutics | 23.80% | 44.01% | ★★★★★★ |

| Invivyd | 47.87% | 67.72% | ★★★★★★ |

| Amicus Therapeutics | 20.10% | 62.00% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.41% | 70.53% | ★★★★★★ |

| Blueprint Medicines | 25.26% | 68.92% | ★★★★★★ |

| Travere Therapeutics | 31.20% | 72.26% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 236 stocks from our US High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

CyberArk Software (NasdaqGS:CYBR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CyberArk Software Ltd. develops, markets, and sells identity security solutions and services globally, with a market cap of $12.11 billion.

Operations: The company generates revenue primarily from its Security Software & Services segment, totaling $860.60 million. It operates across the United States, Europe, the Middle East, Africa, and other international markets.

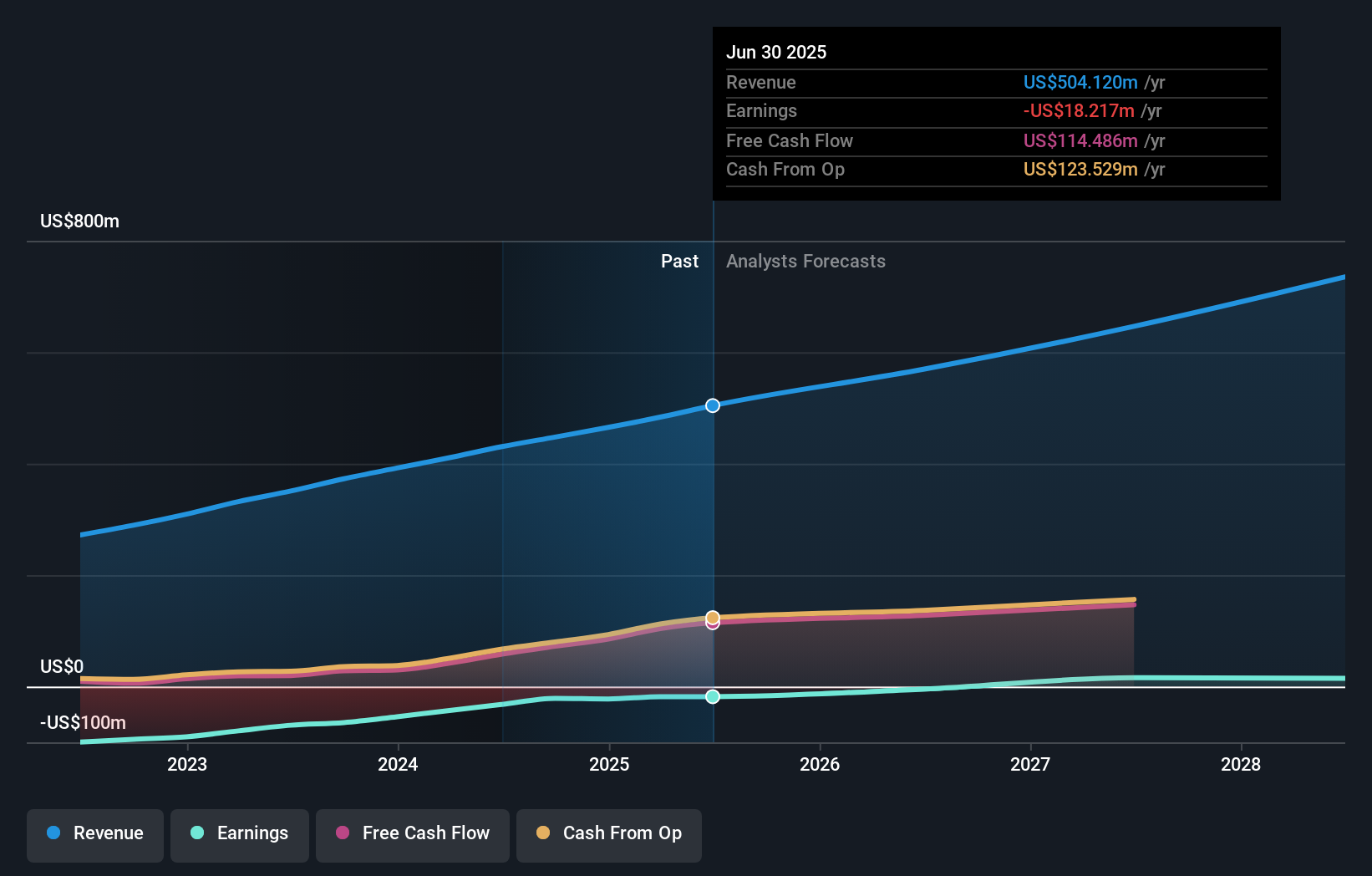

CyberArk Software, amid a challenging landscape for unprofitable tech entities, is demonstrating robust potential with expected revenue growth at 26.9% annually, outpacing the US market prediction of 8.8%. This growth trajectory is complemented by an aggressive R&D investment strategy, crucial for maintaining technological leadership and innovation in cybersecurity solutions. Recent strategic client acquisitions like RBL Finserve and SAP Enterprise Cloud Services underscore CyberArk's pivotal role in advancing identity security solutions tailored for complex cloud environments. These partnerships not only enhance its market position but also validate its product efficacy in high-stakes industries, setting a solid foundation for future profitability forecasted to surge by 113.6% annually.

Intapp (NasdaqGS:INTA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Intapp, Inc., through its subsidiary Integration Appliance, Inc., offers AI-powered solutions across various regions including the United States and the United Kingdom, with a market cap of approximately $3.88 billion.

Operations: Intapp generates revenue primarily from its Software & Programming segment, amounting to $447.75 million. The company focuses on delivering AI-powered solutions internationally, leveraging technological advancements to cater to diverse markets.

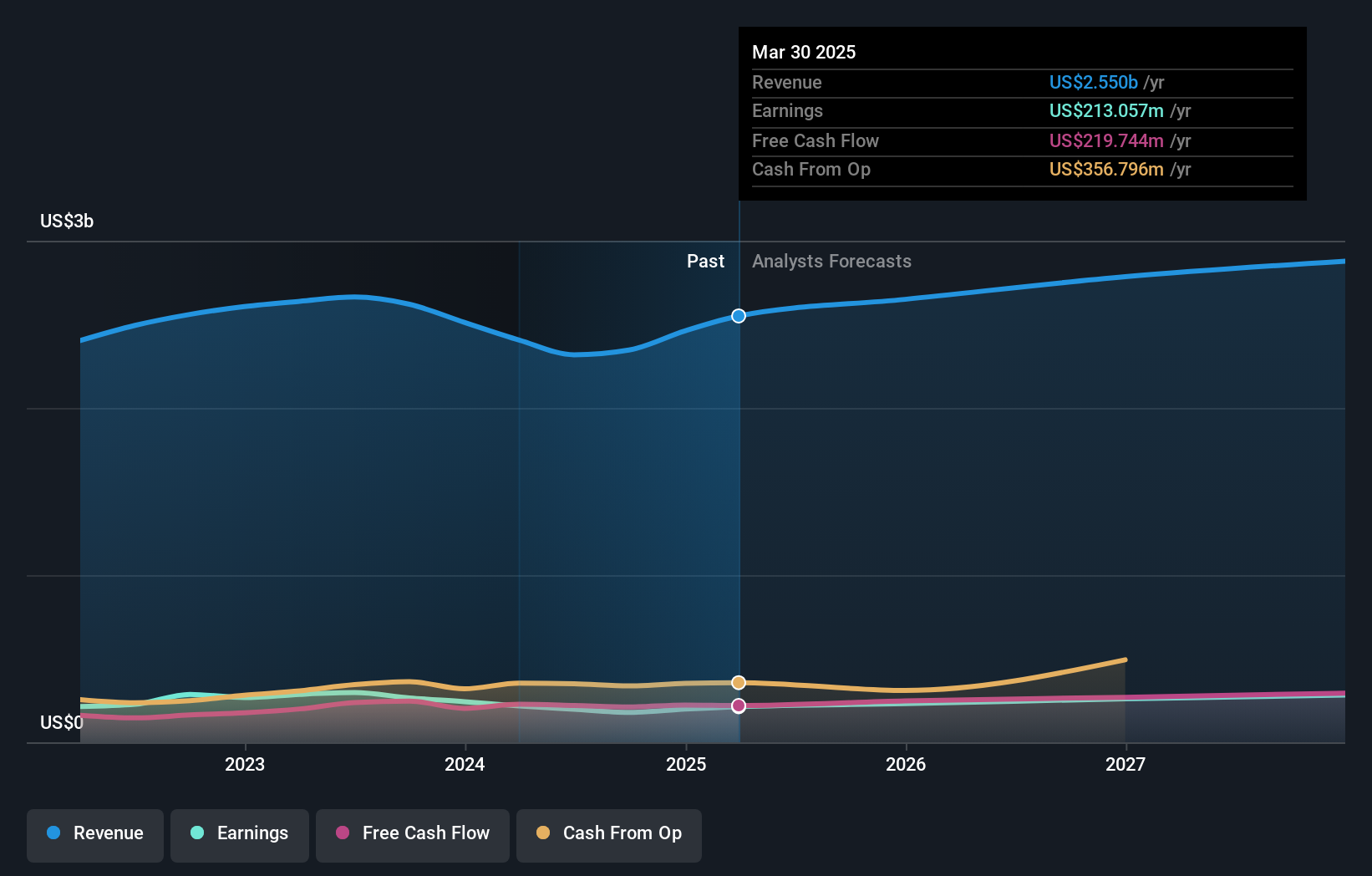

Amidst a transformative landscape in tech, Intapp has made notable strides, particularly with its recent earnings rebound. In Q1 2025, revenue surged to $118.81 million from $101.58 million year-over-year, reflecting a robust uptick in demand for its specialized software solutions like DealCloud and Intapp Conflicts. This growth is underpinned by significant R&D investments which constituted 13.5% of its revenue last year, fostering innovation and enhancing product offerings crucial for client engagements such as those with Alvarez & Marsal and Crete Professionals Alliance. Looking ahead, the firm forecasts revenues between $495.5 million to $499.5 million for FY2025, signaling confidence in continued growth driven by both organic strategies and potential new market expansions.

- Take a closer look at Intapp's potential here in our health report.

Gain insights into Intapp's past trends and performance with our Past report.

Belden (NYSE:BDC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Belden Inc. is a company that designs, manufactures, and markets signal transmission solutions for mission-critical applications globally, with a market capitalization of approximately $4.78 billion.

Operations: Belden's revenue is primarily derived from two segments: Automation Solutions, generating approximately $1.27 billion, and Smart Infrastructure Solutions, contributing about $1.08 billion. The company operates across various regions including the Americas, Europe, the Middle East, Africa, and Asia-Pacific.

Belden is navigating a challenging economic landscape with strategic agility, as evidenced by its recent focus on tuck-in acquisitions and share repurchases, signaling a proactive approach to capitalizing on growth opportunities. Despite a downturn in net income from $72.35 million to $53.69 million in the third quarter of 2024, Belden's commitment to innovation remains robust, particularly through its investment in new safety-oriented product lines like the LioN-Safety I/O Modules. These efforts are part of Belden’s broader strategy to enhance data transmission security and efficiency across industrial operations, aligning with emerging market demands for integrated safety solutions. With an expected revenue forecast between $645 million and $660 million for Q4 2024 and R&D expenses reflecting a deep commitment to technological advancement, Belden is poised to meet future industry requirements effectively.

Seize The Opportunity

- Get an in-depth perspective on all 236 US High Growth Tech and AI Stocks by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CYBR

CyberArk Software

Develops, markets, and sells software-based identity security solutions and services in the United States, Israel, the United Kingdom, Europe, the Middle East, Africa, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives