Shareholder Activism Hits Amphenol (NYSE:APH) As Shares Drop 8%

Reviewed by Simply Wall St

Amphenol (NYSE:APH) has recently been in the spotlight due to investor activism with shareholder proposals from John Chevedden targeting special meeting processes, and a product launch in collaboration with Semtech Corporation on the 1.6T OSFP Active Copper Cable. Concurrently, the company is navigating a patent infringement complaint from Credo Technology. Amid these developments, Amphenol's stock move appears steady over the past month. However, broader market conditions saw substantial declines due to escalating trade tensions and tariff uncertainties led by the Trump administration, overshadowing the company's efforts and impacting the technology sector more broadly.

Buy, Hold or Sell Amphenol? View our complete analysis and fair value estimate and you decide.

Find companies with promising cash flow potential yet trading below their fair value.

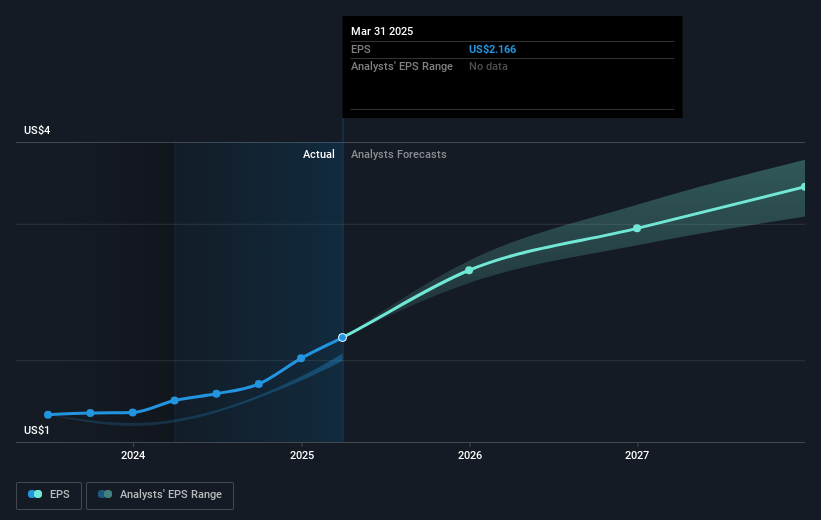

Amphenol has delivered a substantial total return of 221.13% over the last five years. This impressive performance reflects several key developments. The company's acquisition of Andrew businesses from CommScope, anticipated to finalize soon, is expected to strengthen Amphenol’s communication market standing. Additionally, Amphenol's ongoing investment in AI-driven data centers supports this expansion, aligning with market trends. Collaborations like the recent launch of a 1.6T OSFP Active Copper Cable with Semtech target the burgeoning AI/ML sectors.

Amphenol has consistently exceeded market benchmarks, significantly outperforming the US Electronic industry’s one-year return of 2.6%. Despite some challenges, including an ongoing patent infringement lawsuit and potential integration difficulties from acquisitions, the company's solid financial foundation remains clear. Amphenol also implemented substantial share repurchases totaling $514.4 million, demonstrating a commitment to increasing shareholder value. As of the latest earnings report for 2024, sales increased to $15.22 billion, further reflecting the company’s growth trajectory.

Click to explore a detailed breakdown of our findings in Amphenol's financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APH

Amphenol

Designs, manufactures, and markets electrical, electronic, and fiber optic connectors in the United States, China, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives