Assessing Amphenol (APH) Valuation After Sector Rotation From High-Flying AI and Electronics Stocks

Reviewed by Simply Wall St

Amphenol (APH) slid 6.6% after investors bailed on high-flying AI and electronics names when Oracle and Broadcom delivered underwhelming earnings, a reminder that the market is now demanding clearer proof of returns.

See our latest analysis for Amphenol.

That sharp swing comes after a powerful run, with the share price up strongly on a year to date basis and supported by a very robust multi year total shareholder return. This suggests momentum is cooling, but the long term story remains intact.

If this kind of rotation in tech has your attention, it could be a good moment to explore other high growth names through high growth tech and AI stocks.

With the shares still up sharply over one and three years and trading only modestly below analyst targets, the real question now is whether this pullback marks a fresh buying opportunity or if the market has already priced in future growth.

Most Popular Narrative Narrative: 12.3% Undervalued

With Amphenol last closing at $129.90 against a narrative fair value near $148, the current dip sits against a backdrop of ambitious growth assumptions.

Accelerating global deployment of AI driven data centers and adoption of next generation IT architecture is driving strong, sustained demand for Amphenol's high speed, high value interconnect solutions, as evidenced by exceptional growth in IT datacom revenue and continued multi quarter customer engagement; this is expected to support further top line growth and maintain higher incremental margins.

Want to see what powers that confidence? Revenue lines marching higher, margins drifting up, and a future earnings multiple that assumes serious execution. Curious which assumptions really drive that fair value call? Dive in to unpack the full narrative behind the numbers.

Result: Fair Value of $148.15 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained AI and datacenter demand is not guaranteed, and any slowdown or “pulled forward” orders could expose how much growth is already priced in.

Find out about the key risks to this Amphenol narrative.

Another Angle on Valuation

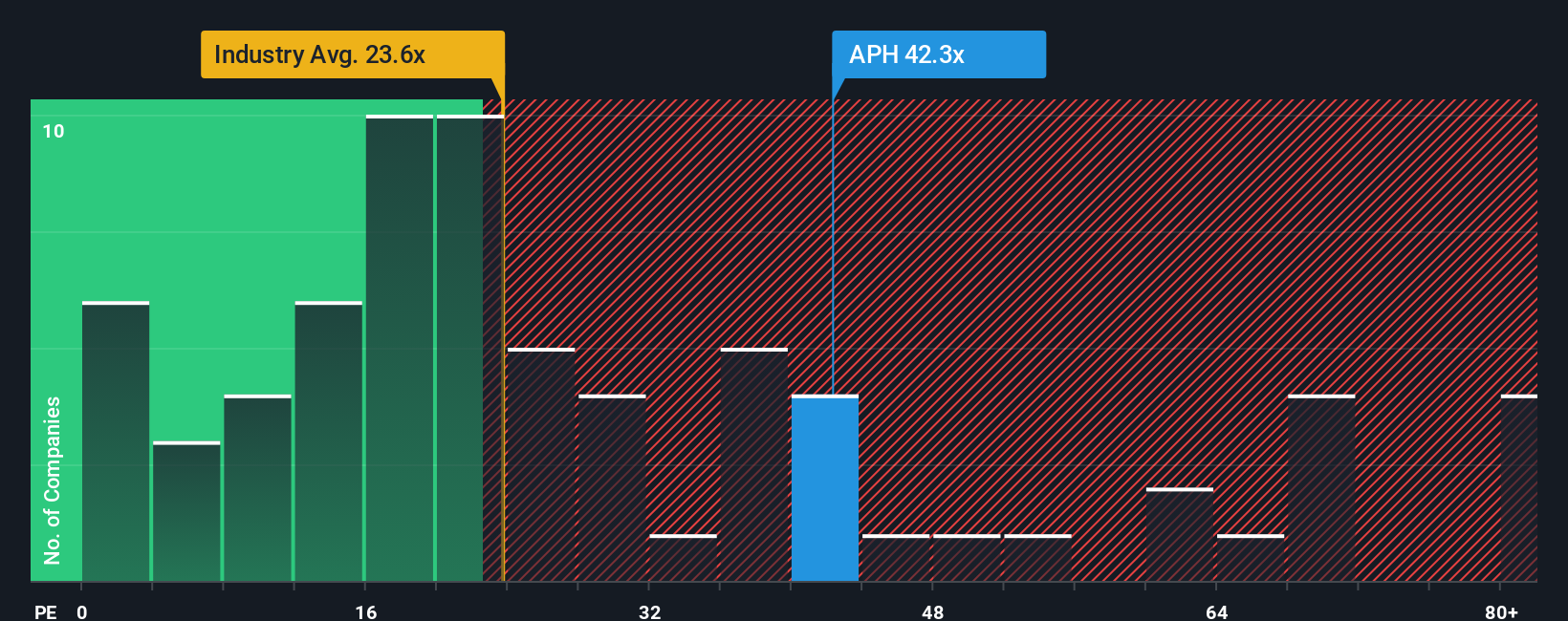

On earnings, the picture is far less forgiving. Amphenol trades at 41.6 times earnings versus a fair ratio of 34.9 times, and 24.8 times for the wider US Electronic industry, leaving little margin for error if growth or AI demand slows.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Amphenol Narrative

If you see the story differently or just want to stress test the assumptions yourself, build a fresh view in minutes with Do it your way.

A great starting point for your Amphenol research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for your next investing edge?

Put Simply Wall Street's Screener to work for you today, or risk watching others seize opportunities first while you stay on the sidelines.

- Capitalize on discounted businesses by targeting quality companies trading below intrinsic value through these 908 undervalued stocks based on cash flows.

- Ride the next wave of intelligent innovation by zeroing in on market leaders and upstarts powered by these 26 AI penny stocks.

- Lock in reliable income streams by focusing on established companies offering meaningful yields using these 13 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APH

Amphenol

Designs, manufactures, and markets electrical, electronic, and fiber optic connectors in the United States, China, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)