- United States

- /

- Communications

- /

- NYSE:ANET

Arista Networks (NYSE:ANET) Climbs 15% Over Last Week

Reviewed by Simply Wall St

Arista Networks (NYSE:ANET) experienced a notable shift in its stock price with a 15% rise last week, amidst a period of mixed market performance marked by declines in major indexes like the Dow Jones and Nasdaq. This suggests that the company's stock movements could have been buoyed by internal factors or sector-specific developments, rather than broader market trends. With the market broadly higher over the last week, any recent industry-specific news or internal events at Arista Networks could have potentially provided additional influence, although such specifics were not immediately available based on provided data for analysis.

Be aware that Arista Networks is showing 1 risk in our investment analysis.

The recent news about Arista Networks' substantial 15% surge in stock price amidst a mixed market environment highlights the potential influence of internal developments or sector-specific trends. This movement may energize the company narrative, which emphasizes AI networking and CloudVision as growth drivers. The growth initiatives outlined suggest possible future revenues of US$10 billion, leveraging proprietary software to enhance margins. Meanwhile, the longer-term total shareholder return of very large over the past five years underscores strong historical performance.

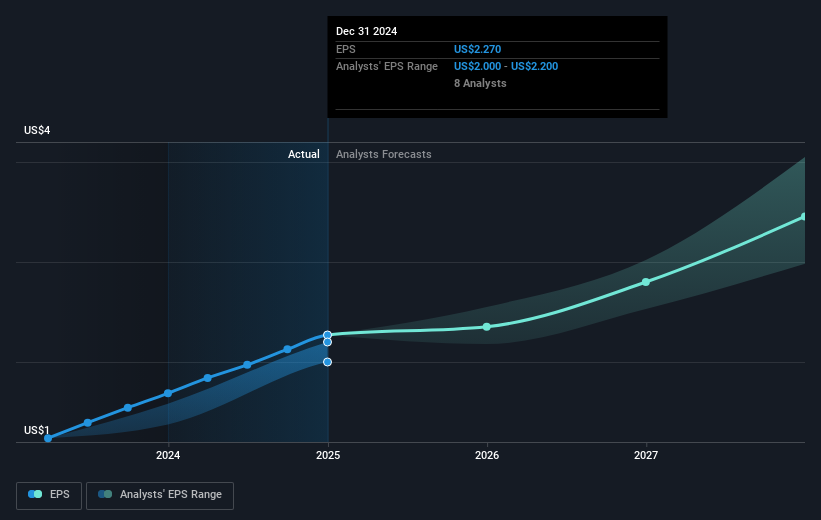

Considering Arista Networks' past year, it underperformed the US Communications industry which returned 22.5%. Yet, over the last year, it outstripped the US market, which posted a 7.5% increase, showing resilience in challenging market conditions. The current jump in share price could potentially influence revenue and earnings projections, aligning them closer to analyst expectations. With optimistic analyst projections valuing shares at US$104.46, Arista's current price movement can be viewed as a step towards reaching the consensus target, with room to grow based on the bullish target of US$145.00.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Arista Networks, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ANET

Arista Networks

Engages in the development, marketing, and sale of data-driven, client to cloud networking solutions for AI, data center, campus, and routing environments in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives